How Might CBO Estimate the President's Budget?

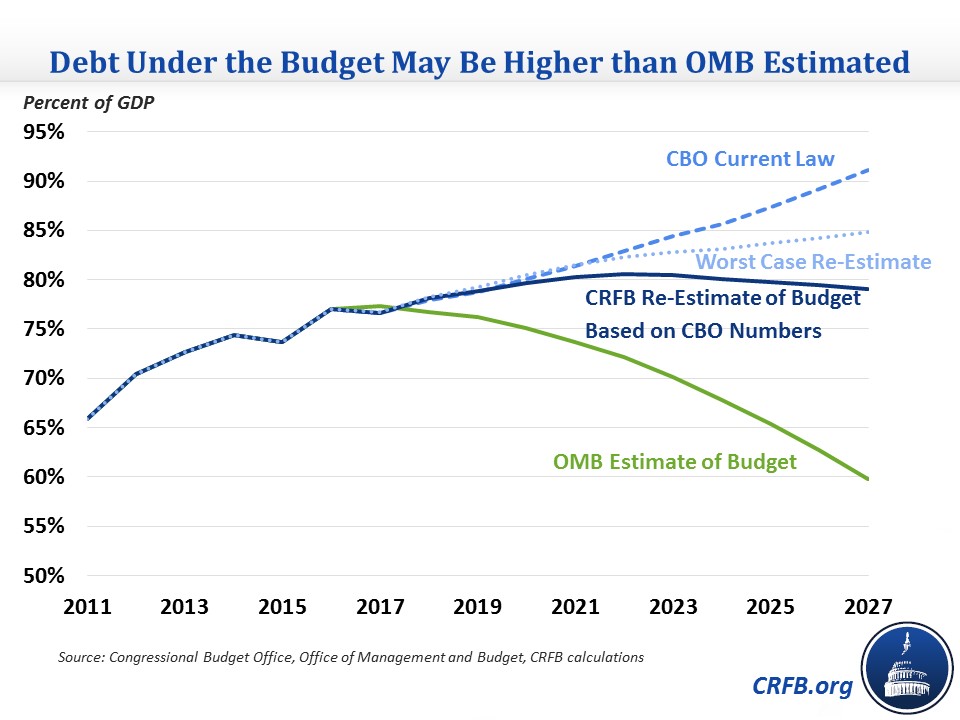

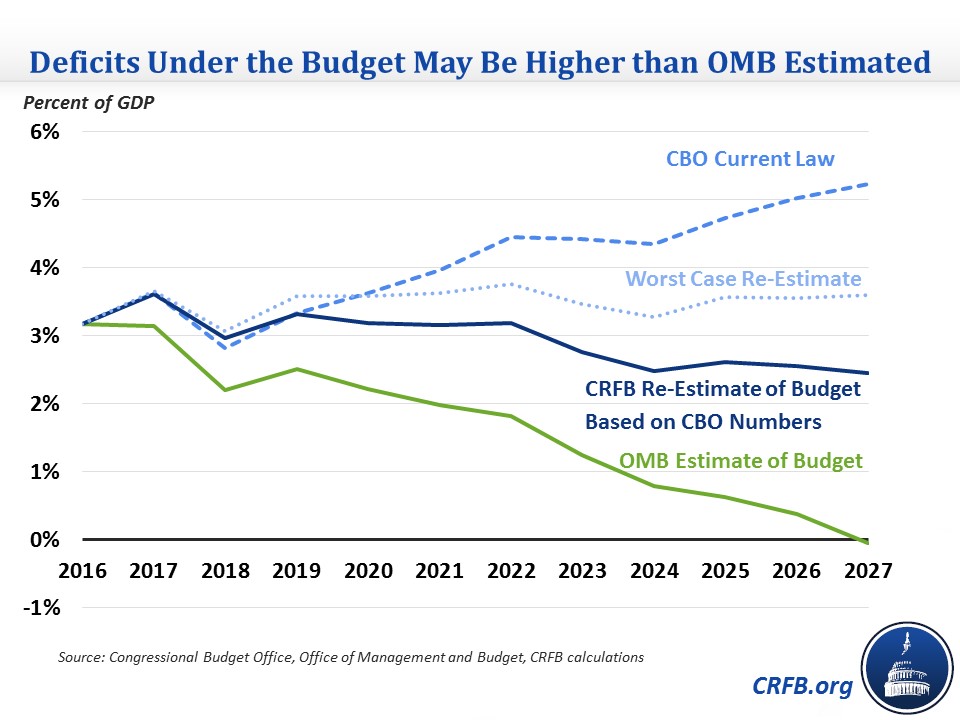

When the President released his budget in May, the Administration estimated it would reach balance after a decade and reduce the debt-to-GDP ratio from 77 percent today to 60 percent by 2027. The Congressional Budget Office (CBO) is due to release their own estimate of the President's budget on July 13, which is likely to show a very different fiscal picture.

Though we have no way of knowing precisely what CBO's estimate will look like in advance, we predict – based on our own modeling – that CBO will project a deficit of $685 billion (2.4 percent of GDP) in 2027 and a debt to GDP ratio of roughly 80 percent – a full 20 percent of GDP higher than what the Trump Administration projects. Even these estimates assume the implementation of deep unspecified discretionary spending cuts, a costless tax reform, and double-counted Medicaid savings.

There are a few reasons we believe CBO will estimate much higher deficits and debt than the budget presented.

The largest difference between CBO and the Office of Management and Budget (OMB) is that CBO will evaluate the budget using its own economic assumptions, which project a reasonable 1.8 percent real economic growth per year rather than the 2.9 percent annual growth rate assumed by OMB. OMB's rapid growth projections, which are far outside of the mainstream and extremely unlikely to materialize, result in an economy 11 percent larger than CBO's projection by 2027. These faster growth projections mean both more revenue and a lower debt-to-GDP ratio (due to higher GDP). We previously estimated that this change alone would result in debt reaching 76 percent of GDP in 2027 (rather than OMB's 60 percent) and deficits reaching $625 billion (rather than OMB's $16 billion surplus).

CBO will also estimate the effect of each policy on its own, which in many cases will yield different results. We expect somewhat different scores for student loan reform, postal reform, PBGC premiums, and discretionary spending changes, among other policies.

More significantly, the agency is likely to ignore claimed savings with no savings-generating policy behind them. We predict CBO will score no savings for reducing improper payments and reducing SSDI and SSI costs through return-to-work pilots, even though OMB scored the two as saving a combined $190 billion. CBO may also determine there is too little detail for them to credit the Administration's policies related to Affordable Care Act (ACA) repeal and replacement, further Medicaid reductions, financial reform, and undistributed non-defense discretionary cuts – though our estimate assumes CBO will score these policies.*

Finally, CBO uses different interest assumptions than OMB, and so the debt service impact of the President's policies will differ.

Using our best guess of CBO estimates, we predict CBO will find substantially higher deficits and debt than what OMB reported. Instead of falling continuously from 77 percent of GDP in 2017 to 60 percent by 2027, we believe CBO will find debt rising to a high of 81 percent of GDP by 2022 before falling to 79 percent by 2027. In nominal dollars, debt held by the public will reach $22.1 trillion in 2027 instead of $18.6 trillion.

At the same time, instead of deficits falling from $603 billion this year until the budget reaches a small surplus in 2027, we predict CBO will find deficits remaining in in the $600 to $700 billion range each year for the next decade, reaching $685 billion in 2027. As a share of GDP, deficits would remain just above 3 percent of GDP for the next 5 years then fall to 2.4 percent of GDP by 2027.

Note that our predictions are very uncertain. They require predicting not only how CBO will score each policy but also what policies they will choose to score. For example, the budget contains $610 billion of largely unspecified Medicaid cuts beyond what is already included in ACA repeal and replacement. We anticipate that CBO will count these savings even though Administration officials have said that at least some of these savings overlap with the ACA replacement and are therefore double-counted.

It is also important to note that a fraction of the difference between CBO and OMB is based on their scoring methodology. By convention, CBO scores the budget based on current law economic assumptions while OMB's economic assumptions assume the passage of policies in the budget. There is a strong case that the President's budget would increase growth. However, we expect the growth impact to result in an average growth rate of close to 2 percent, not almost 3 percent. Later this year, CBO will likely release its own macroeconomic estimate of the President's budget that will show what the budget would look like with that added growth.

CBO will ultimately have the final say on how the President's budget would affect deficits and debt, but we expect they will show a much less rosy picture than OMB showed in May (though an improvement over current law). If the agency does, it will show the need for the Administration to widen the scope of their deficit reduction to include Social Security and Medicare, or to include higher revenue if they are unwilling to do that. Otherwise, debt will remain too high and quite possibly still on an upward path over the long term.

*If we do not count the Medicaid, financial reform, and unspecified non-defense discretionary savings and use the final score of the American Health Care Act in place of the Administration's savings from ACA repeal and replacement, we estimate that the budget's deficit would reach $1 trillion in 2027, deficits as a share of GDP would range between 3 and 4 percent over the next ten years, and debt would rise to 85 percent of GDP by 2027.