The Fed’s Latest Economic Projections Show Higher Inflation, Lower Growth

The Federal Open Market Committee (FOMC) of the Federal Reserve released updated economic projections at its meeting last month. Along with the FOMC’s decision to raise interest rates by 75 basis points (0.75 percentage points), the economic projections show the Fed’s worsening outlook for both economic growth and inflation.

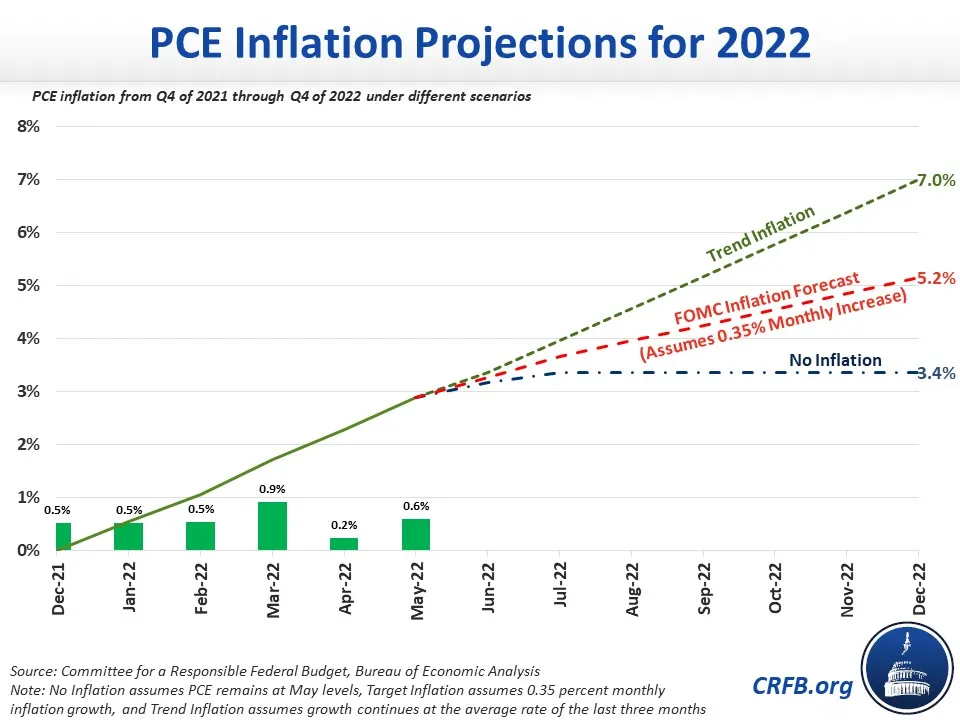

Inflation has remained high over the past few months despite escalating interest rate hikes. The FOMC has raised interest rates by 150 basis points already this year and is likely to increase them by another 50 to 75 basis points this month. The personal consumption expenditures (PCE) price index in May grew 0.6 percent over April and is now up 6.3 percent over a year ago; consumer price index (CPI) grew 1.0 percent in May and is now up 8.6 percent over a year ago. Both indices remain far above the Fed’s 2.0 percent and 2.3 percent targets, respectively.

The FOMC’s projections indicate that they expect PCE inflation to moderate at 5.2 percent this year, 2.6 percent next year, and 2.2 percent by 2024. This is nearly 1 percentage point higher than their March projections and reaching this estimate would require inflation to slow to 4.2 percent on an annualized basis. If inflation continues at its current growth trend, PCE inflation will hit 7.0 percent in 2022.

In order to make this progress, the FOMC now estimates a federal funds rate that is about 165 basis points above the current rate by the end of the year (150 basis points above the Fed’s March projection). This would require an average increase of about 50 basis points per meeting over the FOMC’s four remaining meetings this year. By the end of 2023, the Fed anticipates the federal funds rate to be 3.8 percent; for comparison, it estimates the neutral rate of interest to be roughly 2.5 percent.

The projections also show a bleaker employment situation and slower real Gross Domestic Product (GDP) growth. Specifically, the Fed projects unemployment to rise to 3.7 percent by the end of 2022, 3.9 percent in 2023, 4.1 percent in 2024 (up from 3.5 percent, 3.5 percent, and 3.6 percent, respectively, projected in March). Real GDP growth for 2022 was revised down from 2.8 percent growth in the March projections to 1.7 percent in 2022, 1.7 percent in 2023, and 1.9 percent in 2024.

| FOMC Variable | 2022 | 2023 | 2024 |

|---|---|---|---|

| Unemployment | |||

| Fed Projections (March 2022) | 3.5% | 3.5% | 3.6% |

| Fed Projections (June 2022) | 3.7% | 3.9% | 4.1% |

| OMB (March 2022) | 3.9% | 3.6% | 3.7% |

| CBO (May 2022) | 3.7% | 3.6% | 3.8% |

| Change in Real GDP | |||

| Fed Projections (March 2022) | 2.8% | 2.2% | 2.0% |

| Fed Projections (June 2022) | 1.7% | 1.7% | 1.9% |

| OMB (March 2022) | 3.8% | 2.5% | 2.1% |

| CBO (May 2022) | 3.1% | 2.2% | 1.5% |

| PCE Inflation | |||

| Fed Projections (March 2022) | 4.3% | 2.7% | 2.3% |

| Fed Projections (June 2022) | 5.2% | 2.6% | 2.2% |

| CBO (May 2022) | 4.0% | 2.3% | 2.1% |

Source: Federal Reserve, Office of Management and Budget, Congressional Budget Office.

Federal Reserve Chair Jerome Powell announced the Fed will continue using tools to control inflation and navigate a “soft landing” though it will now depend more heavily on factors the Fed cannot control such as oil price spikes from Russia’s invasion of Ukraine. Congress and the President should help, rather than harm, inflation by reducing deficits, lowering drug prices, and enacting policies that would offset costly legislation. Taking these steps could help reduce the economic damage done by blunt interest rate increases and avoid a recession.