The Drivers: Health Care Cost Growth and Population Aging

In our recent analysis of CBO's Long-Term Budget Outlook, we elaborated on how the overall federal debt is on an unsustainable path. Just twelve years from now, under CBO’s Alternative Fiscal Scenario (AFS), debt will surpass 100 percent of GDP, and by 2038, it will exceed 200 percent. Driving this debt growth are the increasing costs of Social Security and especially Medicare and Medicaid. Even under the lower costs of the Extended Baseline scenario, from 2012 to 2037, Social Security spending will rise from 5 to 6 percent of GDP while total federal health care spending will rise from 5 to 10 percent of GDP. What drives the growth of these programs? Two main dynamics are at work.

First, the aging of the U.S. population expands the rolls of Social Security and Medicare (and Medicaid for long-term care) and increases beneficiaries’ average age, with all the increases in costs related to age. Second, health care cost growth raises costs per beneficiary, and those increases in health care costs have grown on an average of 1.6 percent faster than the overall economy on average over the last 25 years according to CBO -- a phenomenon known as “excess cost growth.” CBO assumes that health care cost growth will slow down over time, but excess growth will remain.

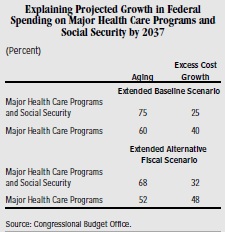

Through 2037, aging will be the dominant force in spending increases not only on Social Security and health care programs, but also in the overall non-interest budget. In its Extended Baseline Scenario, where Medicare provider payments are cut by 27 percent next January, CBO projects that aging will account for 75 percent of the growth from 2012 to 2037 in the combined spending on Social Security and health care programs. In CBO’s Alternative Fiscal Scenario, with continued "doc fixes" maintaining Medicare physician reimbursements and various health care cost-controls being overridden after 2022, aging accounts for 68 percent of combined growth on Social Security and health care programs.

Surprisingly, even when you look at just the major health care programs, aging accounts for the majority of the spending growth through 2037 in both scenarios.

After 2037, declining numbers of Baby Boomers will stabilize the age distribution, while health care costs are projected to continue growing faster than the economy. Over the longer term, then, excess cost growth in health care will eventually account for the majority of spending growth for Social Security and federal health care spending.

The fact that aging and health care play such a central role in the growth of Social Security and the health care programs -- which would actually decline in their absence -- suggests that these factors need to be taken seriously. This is especially true given that both factors will also reduce federal revenue -- by reducing the proportion of the population in the labor force and by increasing the amount of tax-exempt compensation received in the form of health insurance -- and could slow economic growth.

As policymakers work toward replacing the fiscal cliff with more targeted deficit reduction measures in the year ahead, they should pay special attention to those measures which can slow health care cost growth or mitigate the effects of population aging. As CBO said:

The aging of the U.S. population and the rising costs for health care mean that the combination of budget policies that worked in the past cannot be maintained in the future.