COVID Relief Lifted Personal Income to Record Levels

Of the $5.9 trillion ($5.2 trillion net) of enacted COVID relief, we estimate $3.6 trillion was committed or disbursed over the one-year period beginning last April. New data from the Bureau of Economic Analysis shows that COVID relief directly increased personal income by $1.6 trillion over the course of the year. Incorporating the economic impact of COVID relief, it’s likely income was boosted by over $2.5 trillion.

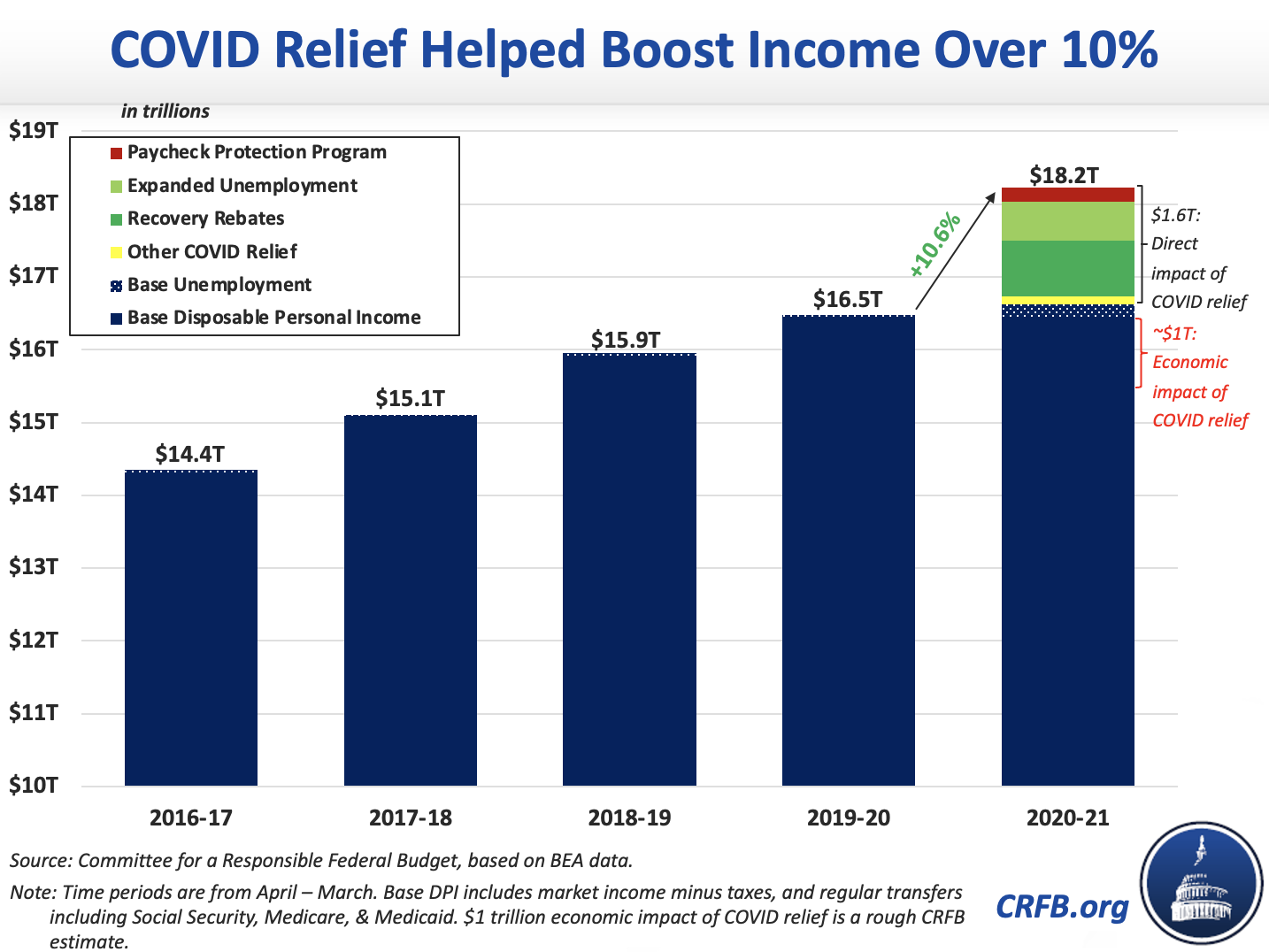

All told, nominal disposable personal income (DPI) grew 10.6 percent, or $1.8 trillion from the 12 months before April 2020 to the 12 months through last month. By comparison, income grew by an average of 5 percent per year over the prior three years — despite those years having much stronger overall economic growth.

This massive income growth is almost entirely attributable to COVID relief and prior law unemployment benefits. Absent those factors and their economic effects, we estimate personal income would have fallen by about 5 percent or nearly $1 trillion over the past year. Thanks to prior law unemployment benefits and the economic boost from COVID legislation, normal market and transfer income (net of taxes) grew by about 1 percent, or $155 billion.

The effects of COVID relief itself on income was even more impactful — contributing at least $1.6 trillion or 9 percent to personal income. This boost includes $760 billion from three rounds of recovery rebates, $540 billion from expanded unemployment benefits (including the FEMA lost wages program), $190 billion from the Paycheck Protection Program, and $110 billion from other spending and relief. It does not include additional income or savings resulting from tax relief, low-interest loans, aid to state and local governments (some which was then transferred to individuals), or COVID relief that was or will be paid after March 31, 2021.

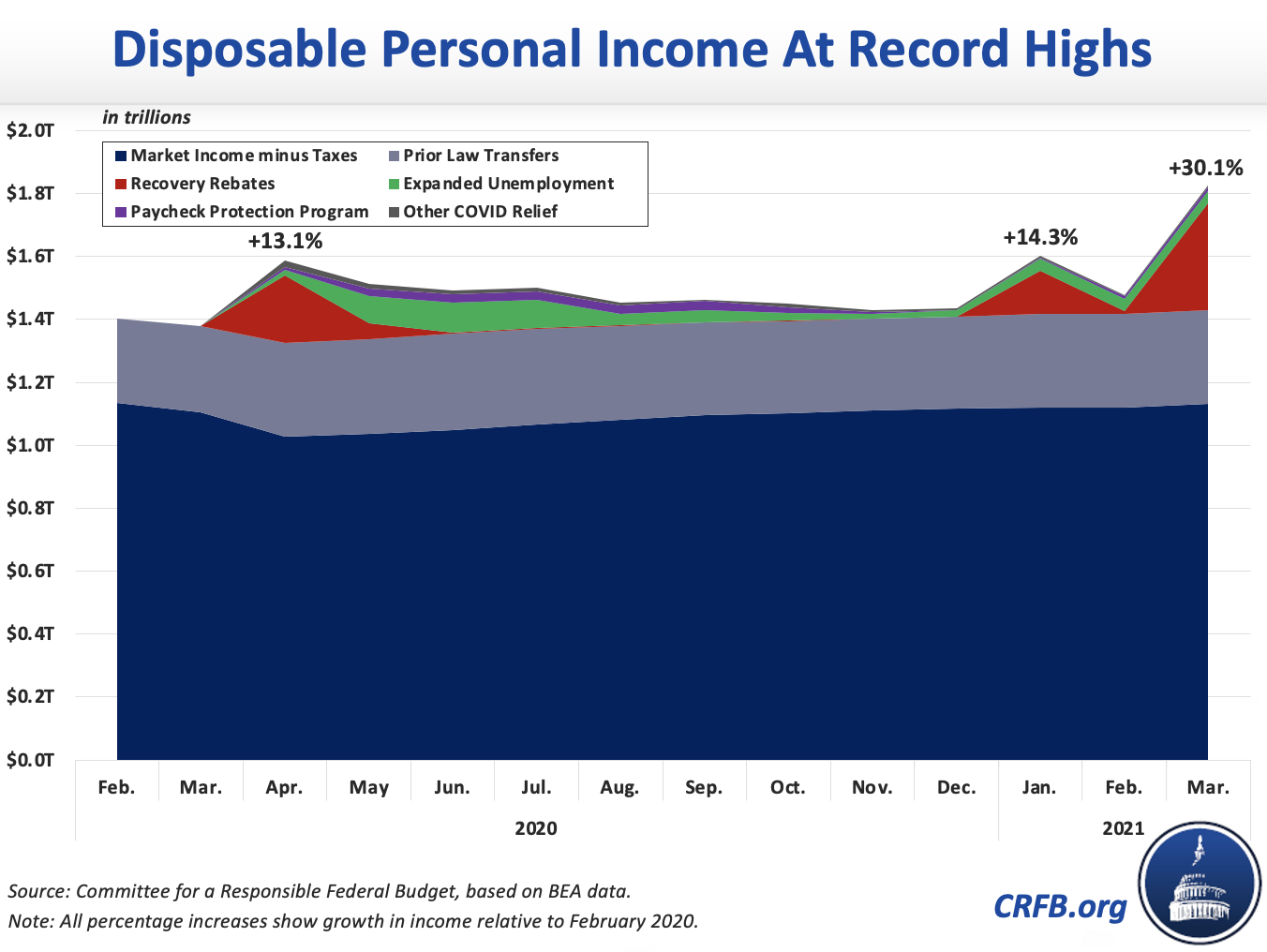

On a month-to-month basis, COVID relief has helped temporarily boost income to new records, amidst a pandemic. Disposable income in March is 30 percent higher than in February of last year. Total March income of $1.8 trillion ($21.9 trillion annualized) included $335 billion in recovery rebates, $40 billion from expanded unemployment benefits, $12 billion in personal income from the Paycheck Protection Program (most PPP spending did not directly affect income), and $5 billion from other COVID-relief measures. Another $5 billion in base unemployment benefits was enough to bring base income (excluding direct COVID relief but not its economic impact) to roughly pre-pandemic levels (and 4 percent above the average over the prior year).

Last month’s income spike, like the ones before it in April 2020 and January 2021, is largely driven by large temporary recovery rebate payments to households. But even if the 2021 rebates were hypothetically paid out over 12 months, March income would still be over 6 percent above pre-pandemic levels.

While further COVID relief is scheduled to be disbursed in the coming months, the recent income boost will wane. Most rebates have already been paid (though expanded child tax credit payments haven’t begun), expanded unemployment benefits expire on September 6, and other COVID relief will mostly expire by year’s end. We thus expect total income to fall modestly in the 12 months following our analysis.

Yet as income from COVID relief fades, market income from wages and business income are expected to grow. Hopefully a strong and robust economic recovery will help most Americans maintain or improve their standards of living going forward.

This blog post is a product of the COVID Money Tracker, an initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.