COVID Relief Continues to Bolster Personal Income

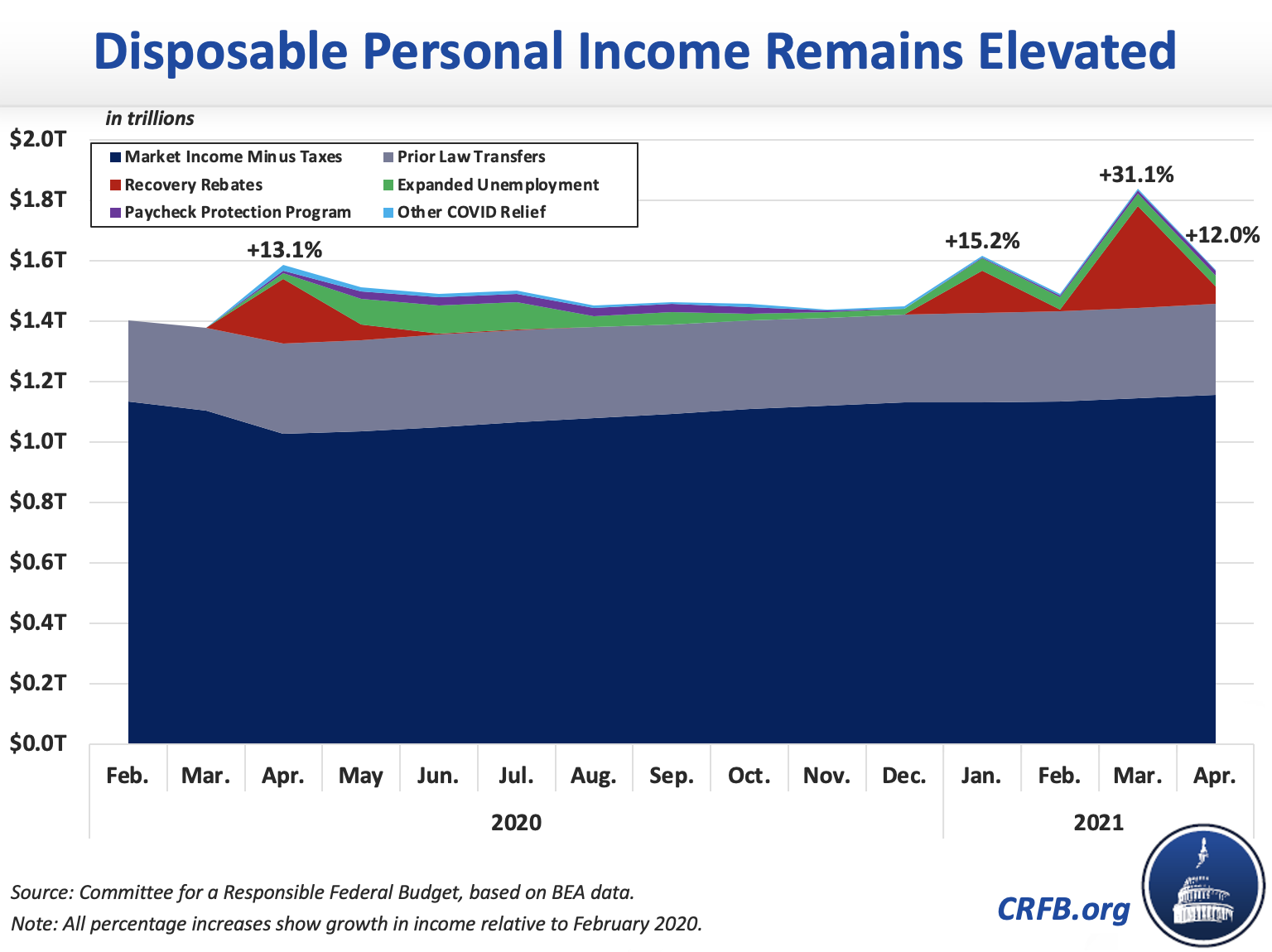

New data from the Bureau of Economic Analysis (BEA) for the month of April shows that disposable personal income (DPI) was 12.0 percent above pre-pandemic levels, or 3.8 percent above pre-pandemic levels excluding COVID relief. We have documented in a number of analyses how the $5.9 trillion ($5.2 trillion net) of enacted COVID relief to date has propelled personal income to record levels.

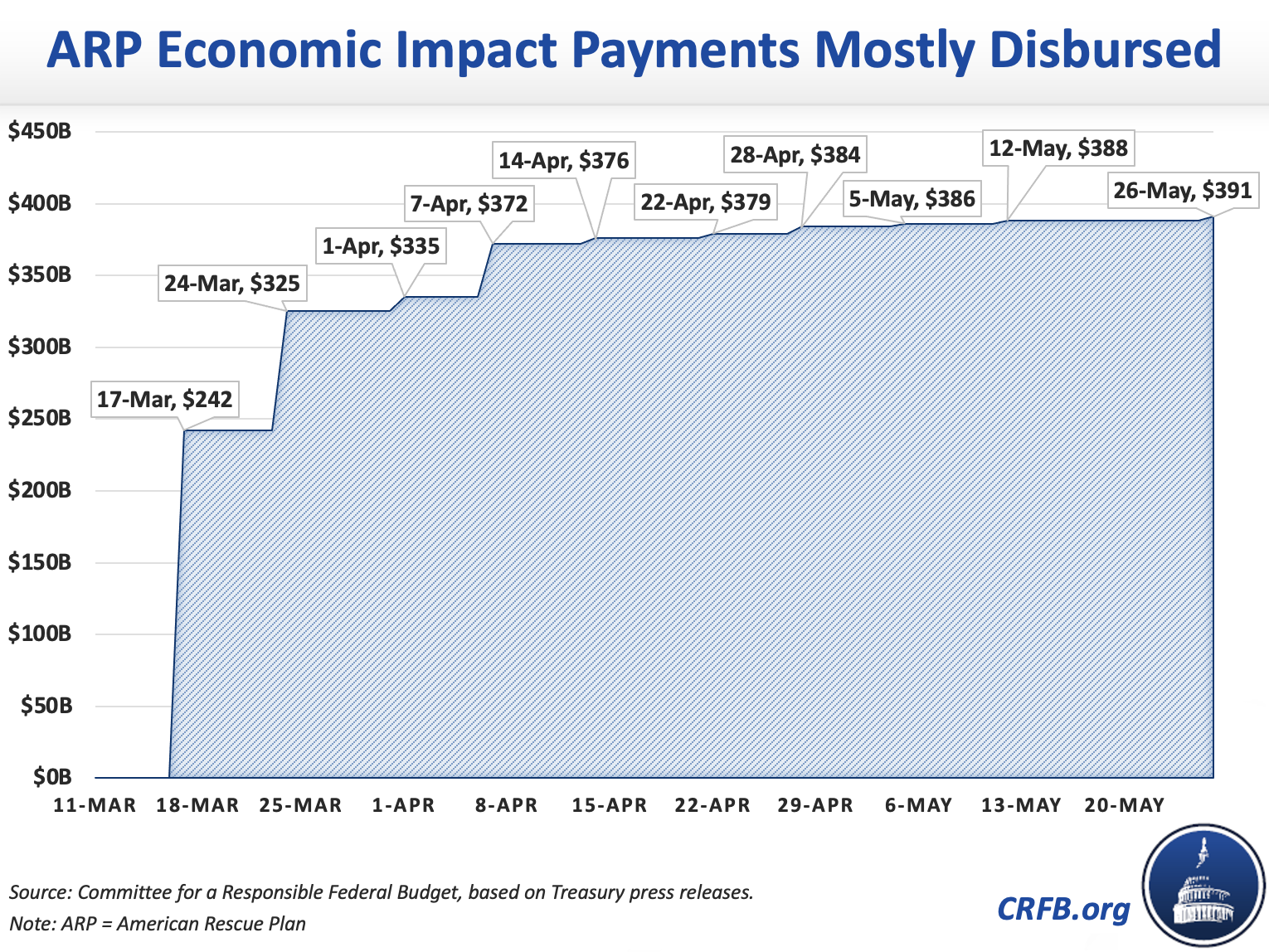

In March, personal income was 31 percent above pre-pandemic levels. The 19 percentage point fall from March to April is due to the one-time Economic Impact Payments (EIPs) from the American Rescue Plan made mostly in March. These payments were responsible for about $335 billion of income in March, compared to only $55 billion in April (April payments went largely to non-filer Social Security, Supplemental Security Income (SSI), and VA beneficiaries; other filers who recently filed a return for whom the Internal Revenue Service (IRS) did not previously have information to process their payment; and those receiving “plus up” payments).

As more Americans have returned to work, unemployment benefits have also been shrinking over the course of 2021, from $47 billion in January to $41 billion in April. Other parts of income have grown, including wages and salaries, which are over 2 percent higher in April than in January of this year and 3 percent higher than pre-pandemic levels.

In fact, income including prior law transfers but excluding COVID relief is now 3.8 percent above pre-COVID levels (in line with trend growth) and market income excluding COVID relief is 1.8 percent higher (in line with inflation).

As the economy continues to recover, we expect market income to continue to grow – supplemented by further government spending such as the monthly advance child tax credit payments that will begin next month to roughly 40 million households. At the same time, other COVID relief will begin to disappear – especially expanded unemployment benefits which will partially or fully discontinue in 25 states over the next two months and the remaining states by Labor Day.

While it is hard to predict where personal income will land once the crisis is behind us, it is clear it has been bolstered over the last 13 months through April. We recently estimated that, absent COVID relief, income would have fallen by 5 percent ($1 trillion) from the year before the pandemic started to the year after; instead, income grew by 10.6 percent ($1.8 trillion).

We estimate around $4.2 trillion has either been committed or disbursed from the $5.9 trillion ($5.2 trillion net) of enacted COVID relief to date. This enormous fiscal response has more than preserved incomes over the course of the crisis and has helped to boost disposable income to record levels. As support from COVID relief wanes over the coming months, a strong and robust economic recovery will hopefully continue to boost personal income through growth in traditional income sources.

This blog post is a product of the COVID Money Tracker, an initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.