CBO Updates Economic and Budget Outlook

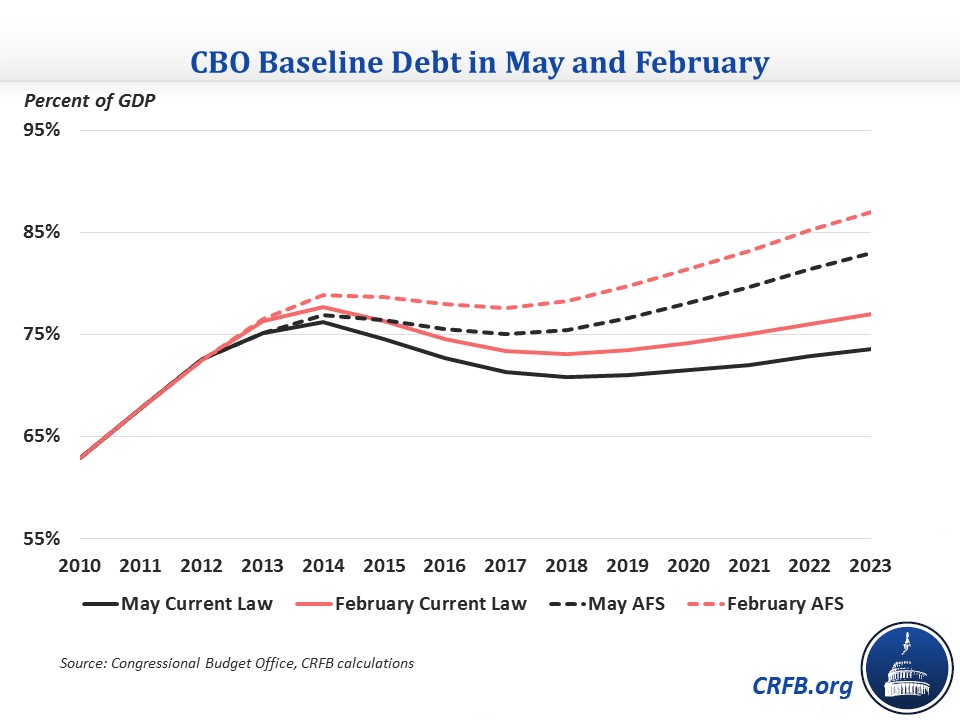

Today, the Congressional Budget Office has released an update to its budget outlook from February. With little legislative changes since February, the budget outlook after a few technical revisions shows slightly lower debt levels compared to the previous baseline. However, debt remains on a clear, upward trajectory near the end of the decade, similar to the path in February's baseline. While the short-term improvement is a welcomed sign, the new outlook still shows that more work needs to be done to put the budget on a sustainable path. Even assuming sequestration remains in place, more deficit reduction will be required to put debt on a downward path as a share of the economy - the necessary goal for lawmakers.

In all, ten-year deficits are $618 billion less, totaling $6.34 trillion compared to $6.96 trillion in the February estimate. Debt would fall from 71.5 percent of GDP in 2013 to 70.8 percent in 2018 before rising on an upward path to 73.6 percent under current law, while rising to 83 percent under CBO's alternative fiscal scenario (AFS), which represents the continuation of many current policies. The AFS baseline assumes the scheduled sequester for 2014-2021 is repealed, refundable tax credit expansions extended for five years in American Taxpayer Relief Act (ATRA) are extended permanently, a "doc fix" prevents a 25 percent cut to Medicare providers, and other expiring tax extenders are continued permanently without being offset. February's Budget and Economic Outlook projected debt to rise to 77 percent in 2023 under current law and 87 percent under AFS.

With no major budgetary legislation passed by Congress since February, the changes to the baseline are primarily due to technical revisions. CBO's new estimates have increased projected revenues by $95 billion from 2014 to 2023, attributed to larger than expected receipts for 2013 for individual and corporate taxpayers, as well as lower estimated tax subsidies for the health insurance exchanges and other smaller technical changes. CBO has decreased projected spending by $522 billion over ten years, largely due to new data that could suggest a slowdown of spending on Medicare and Medicaid, fewer individuals enrolled in the Social Security Disability Insurance Program, and increased payments from Fannie Mae and Freddie Mac. Overall projected deficits are $618 billion lower over ten years than what was projected in February.

Spending is projected to fall from 21.5 percent of GDP in 2013 to 21.3 percent by 2017 before rising to 22.6 percent by 2023. Revenue will continue to increase, largely due to the economic recovery and tax increases taking effect, from 17.5 percent of GDP in 2013 to 19.3 percent by 2015 and roughly stabilizing around 19 percent of GDP through 2023.

| CBO's May Current Law Projections (Percent of GDP) | |||||||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Ten-Year | |

| Revenues | 18.3 | 19.3 | 19.2 | 18.9 | 18.8 | 18.7 | 18.7 | 18.8 | 19.0 | 19.1 | 18.9 |

| Spending | 21.6 | 21.4 | 21.5 | 21.3 | 21.4 | 21.7 | 21.9 | 22.1 | 22.6 | 22.6 | 21.9 |

| Deficits | -3.4 | -2.1 | -2.3 | -2.4 | -2.6 | -3.0 | -3.2 | -3.3 | -3.6 | -3.5 | -3.0 |

| Debt | 76.2 | 74.6 | 72.7 | 71.3 | 70.8 | 71.0 | 71.5 | 72.0 | 72.9 | 73.6 | N/A |

Source: CBO

The short-term improvement is a good sign, but no reason to put the budget on the back burner. The longer we wait to solve our budget problem, the more savings will be needed to put debt on a clear downward path as a share of the economy. Waiting longer will leave beneficiaries and taxpayers will less time to adjust to policy changes, give lawmakers little fiscal flexibility to respond to a crisis, and slow economic growth. Projections are also subject to change -- if economic growth is slower or interest rates are higher than expected, debt as a share of the economy could be much higher than CBO expects. Much of the deficit reduction can be phased in to occur when the economy has had more time to recover, but delaying a comprehensive agreement that would include tax and entitlement reform would be a missed opportunity.

CBO will release its estimates of the President's budget this Friday, which CRFB will cover in a full analysis and an update of our CRFB Realistic Baseline here on The Bottom Line. But the story told by this new budget outlook is largely the same: lawmakers still have further to go to solve our budget problem.

Click here to read the full report from the Congressional Budget Office.