CBO Releases March 2024 Long-Term Budget Outlook

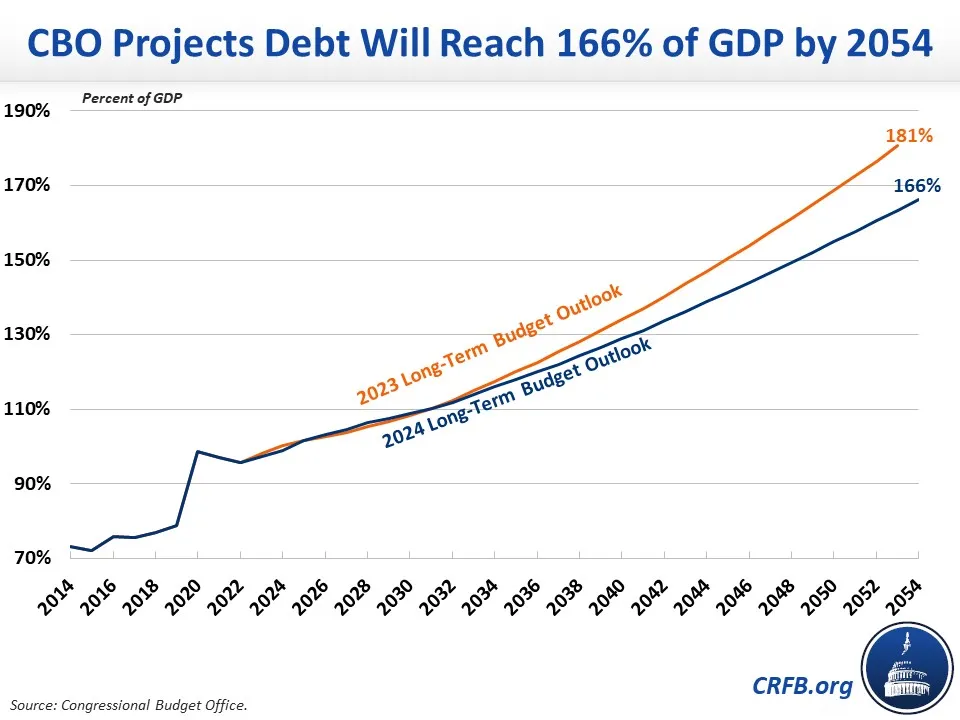

The Congressional Budget Office (CBO) just released its March 2024 Long-Term Budget Outlook that projects the nation's fiscal and economic future over the next three decades. CBO projects that federal debt held by the public will rise from 97 percent of Gross Domestic Product (GDP) at the end of Fiscal Year (FY) 2023 to 166 percent of GDP by the end of 2054. Although this would be slightly lower than in CBO's June 2023 Long-Term Budget Outlook, it would still be more than double pre-pandemic levels and about 3.4 times the 50-year historical average of 48 percent of GDP.

Under this outlook, which largely mimics current law, deficits would rise rapidly over time. Specifically, the budget deficit will rise from 5.6 percent of GDP ($1.6 trillion) in FY 2024 to 6.1 percent of GDP ($2.6 trillion) in 2034, to 7.3 percent of GDP ($4.4 trillion) in 2044, and to 8.5 percent of GDP ($7.3 trillion) in 2054. As a share of the economy, the 2054 deficit of 8.5 percent of GDP will be over two-times larger than the 50-year historical average of 3.7 percent of GDP.

The projected growth in debt and deficits over the next three decades is driven by a persistent gap between spending and revenue. CBO expects spending to grow rapidly over the long term and revenue to rise more gradually. Specifically, spending will rise from 23.1 percent of GDP in FY 2024 to 27.3 percent of GDP in 2054, while revenue will grow from 17.5 percent of GDP to 18.8 percent of GDP. The rapid rise in long-term spending is driven by rising Social Security, health care, and especially interest costs. CBO projects that spending on these three areas will grow from 13.8 percent of GDP in 2024 to 20.4 percent of GDP in 2054 – a 48 percent increase. Interest payments alone will more than double over the next three decades, and grow to become the largest item in the federal budget by 2051.

In addition, CBO projects that three major federal trust funds will exhaust their reserves and become insolvent over the next three decades. Under CBO's estimates, the Highway Trust Fund will exhaust its reserves by FY 2028, the Social Security Old-Age and Survivors (OASI) Insurance trust fund will run out by FY 2033, the Medicare Hospital Insurance (Part A) trust fund will become insolvent by FY 2035, and the Social Security Disability Insurance (SSDI) trust fund will remain solvent at least through FY 2054. On a theoretically combined basis, assuming dedicated revenue is reallocated in the years between OASI and SSDI insolvency, the Social Security trust funds will become insolvent by FY 2034.

Importantly, CBO's extended baseline reflects current law and assumes that various tax and spending provisions phase out or expire as scheduled and that discretionary spending is limited by the Fiscal Responsibility Act, then grows with inflation through FY 2034 and then with the economy thereafter. In the past, CBO has shown debt could grow much more rapidly under alternative scenarios.

As CBO mentions and we've explained before, rising debt poses a series of risks and threats to the budget and economy. Specifically, high debt levels slow income and wage growth, increase interest payments on the national debt, put upward pressure on interest rates, limit the amount of available fiscal space to respond to an economic recession or other emergency, place an undue burden on future generations, and increase the risk of a fiscal crisis.

The Committee for a Responsible Federal Budget will publish our full analysis of CBO's March 2024 Long-Term Budget Outlook later today. Read our press release on CBO's extended baseline here.