CBO Releases Interim Economic Projections

The Congressional Budget Office (CBO) has released a new set of economic projections for 2020 and 2021 showing a sharp economic contraction during the second quarter of 2020 and a slight resurgence toward the end of the year as the economy begins to recover from the COVID-19 public health emergency. These estimates are an update to CBO's April projections and are based on data available through May 12.

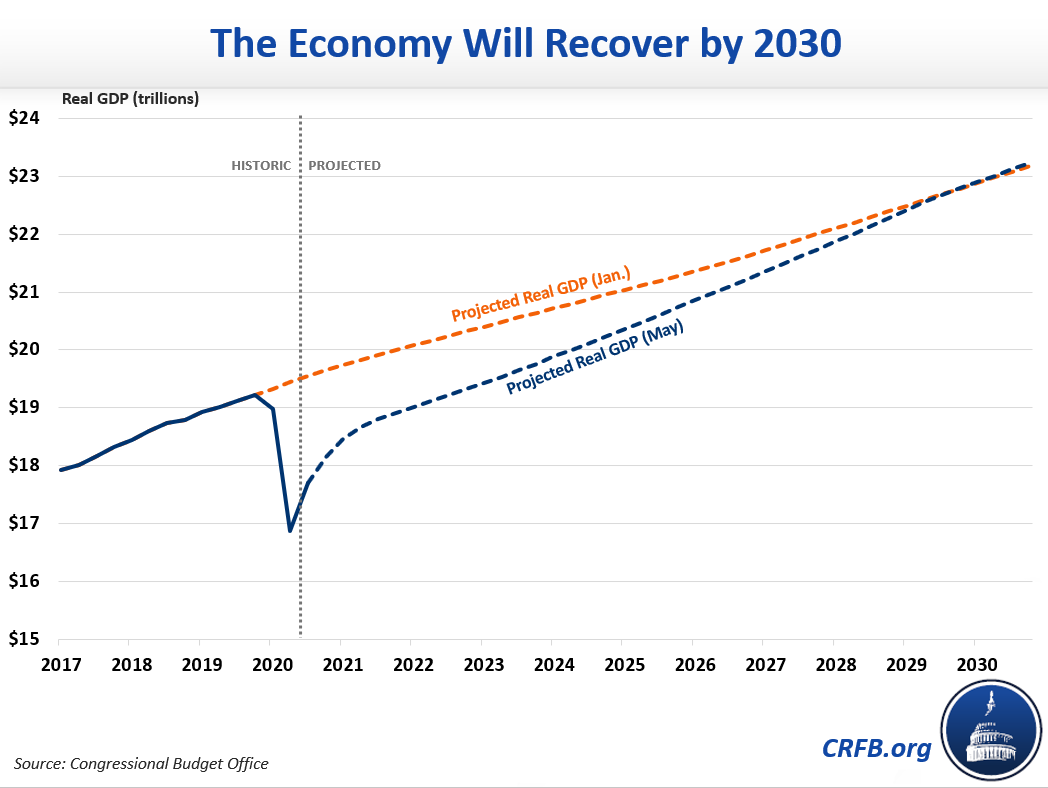

Real Gross Domestic Product (GDP) fell by 1.2 percent (4.8 percent on an annualized basis) during the first quarter of 2020 and is expected to fall by another 11.2 percent during the second quarter. After that, GDP is expected to rise in the third and fourth quarters of 2020, by 5.0 percent and 2.5 percent, respectively. On a fourth-quarter-to-fourth-quarter basis, real GDP is projected to fall by 5.6 percent in 2020 and grow by 4.2 percent in 2021.

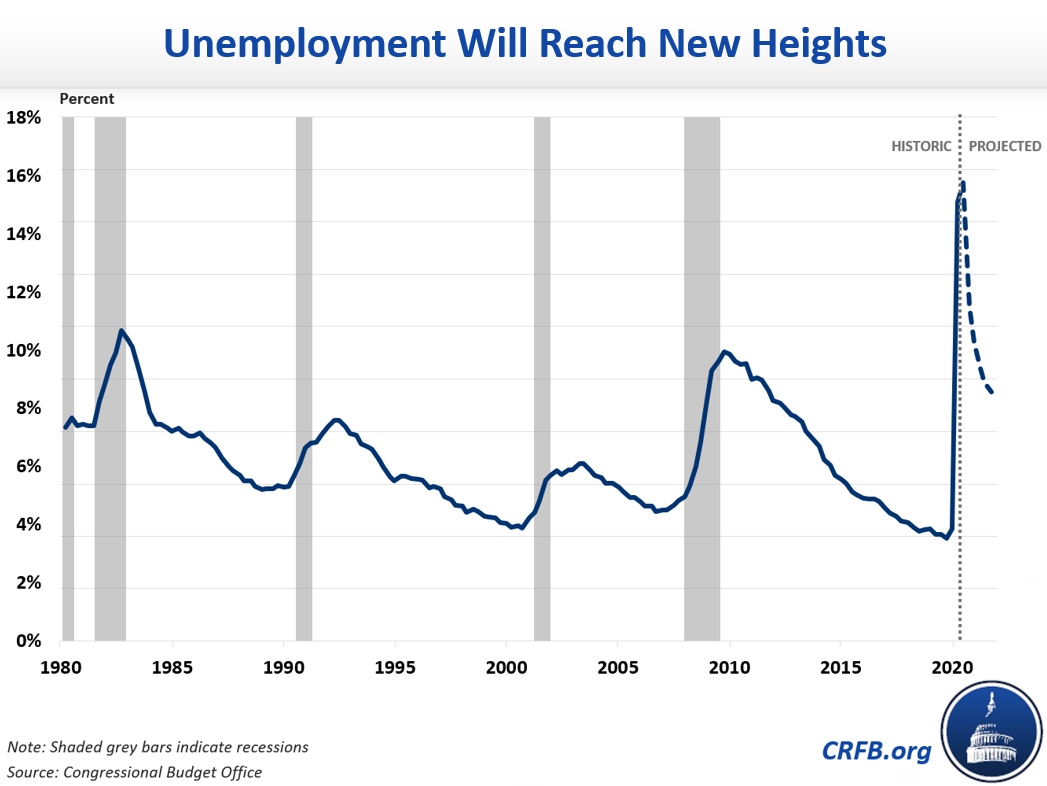

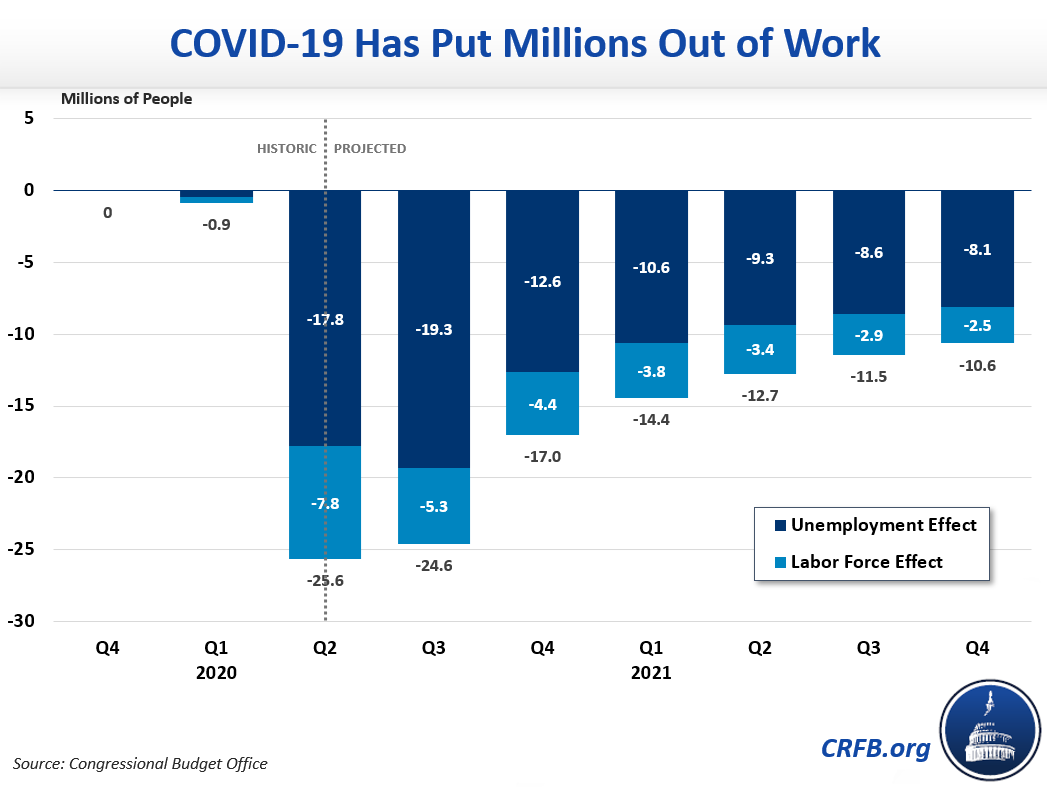

The unemployment rate is expected to nearly quadruple, going from 3.8 percent in the first quarter of 2020 to 15.1 percent during the second quarter, and is expected to peak at 15.8 percent during the third quarter of 2020. From there, the unemployment rate will begin to decline – although not as rapidly as it increased – falling to 11.5 percent during the fourth quarter. On an annual basis, CBO expects the unemployment rate to average 11.5 percent in 2020 and 9.3 percent in 2021. Labor market conditions are expected to gradually improve as stay-at-home orders are lifted, allowing businesses to reopen and increase the demand for workers.

CBO projects there will be nearly 26 million fewer employed workers in the second quarter of 2020 than during the fourth quarter of 2019, and that almost 8 million people will leave the labor force outright (i.e., stop looking for work).

Inflation is projected to decrease in the second quarter, then rise thereafter, although at a slower pace than previously expected. While COVID-19 has reduced the supply of goods and services available, it has caused an even greater drop in demand for those goods and services, thus reducing inflation. As a result, the price index for personal consumption expenditures (PCE) is projected to decline by 1.2 percent during the second quarter of 2020 but increase by 1.1 and 1.3 percent during the third and fourth quarters of 2020, respectively. On a fourth-quarter-to-fourth-quarter basis, the PCE is expected to grow by 0.6 percent in 2020 and 1.5 percent in 2021. Both rates are significantly below the Federal Reserve's goal of 2 percent.

Interest rates are expected to remain low for the next two years. CBO projects that the Federal Reserve will keep the federal funds rate near zero through 2021, so the interest rate on 3-month Treasury bills (which is closely linked to the federal funds rate) will remain at approximately 0.1 percent through 2021. CBO expects interest rates on ten-year Treasury notes to rise modestly from 0.7 percent currently to 1.0 percent in 2021, due to the deceleration of the Federal Reserve's long-term asset purchases and in expectation of future increases in short-term interest rates.

These projections are well within the consenus range of other forecasters. CBO's projections of real GDP growth, the unemployment rate, interest rates, and inflation are near or within the middle two-thirds of the range of Blue Chip forecasters for 2020 and 2021.

Importantly, CBO's projections assume the four pandemic-related laws enacted since March will partially mitigate the economic downturn brought on by the COVID-19 emergency. The agency assumes individual rebate checks and tax credits will boost overall demand for goods and services, federal assistance to state and local governments will pay for COVID-related costs, and loans and grants will allow businesses to stay afloat so that employees can go back to their old jobs after the economy picks back up. At the same time, CBO assumes that so long as some degree of social distancing measures remain in place, the economic boost from pandemic-related legislation will be smaller than it could be without social distancing.

CBO also released a limited set of economic projections through 2030, showing that the damage done to the economy by this pandemic will take nearly ten years to repair. Like CBO's estimates for 2020 and 2021, these projections are very rough and uncertain. Compared to CBO's pre-COVID projections, real GDP will be 6 percent lower in 2020 and 2021 and 5 percent lower in 2022 and 2023. While this reduction will gradually taper off, it will take until 2030 for GDP to fully recover to its pre-COVID projection.

The unemployment rate will gradually decline from 10.0 percent in 2021 to 7.5 percent in 2023 and 4.5 percent by 2030, close to CBO's January projection of 4.3 percent. Interest rates will steadily increase over the coming decade. The average rate on 3-month Treasuries will remain below 0.25 percent through 2027, but will increase to 1.0 percent by 2030. Meanwhile, interest rates on long-term Treasuries will gradually increase to 2.5 percent. However, by 2030, interest rates on both long- and short-term Treasuries will still be lower than CBO's January projection of 2.4 and 3.1 percent, respectively. Inflation is projected to average around 1.9 percent after 2022, in line with the Federal Reserve's target of 2 percent.

CBO's projections assume current laws remain in place and no additional emergency legislation is enacted. Again, the agency's projections are highly uncertain and will continue to change as the pandemic unfolds.