CBO: The Deficit Will Be About $45 Billion Lower This Year But $1.7 Trillion Higher over Ten Years

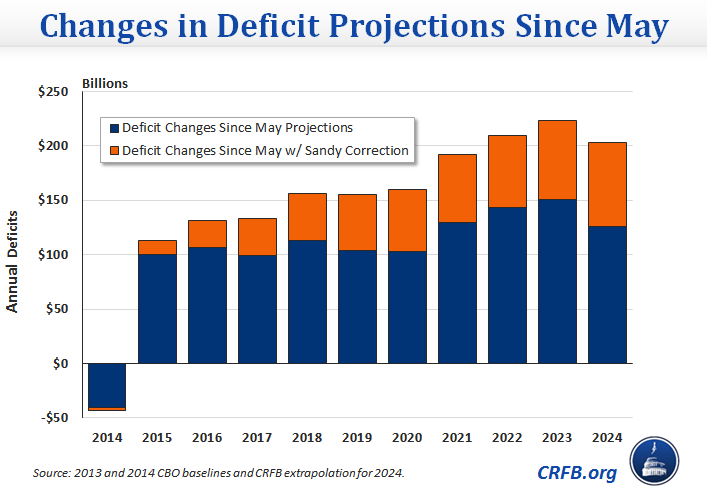

In May of last year, CBO expected the 2014 deficit to fall to $560 billion from 2013's total of $680 billion. Now, CBO is estimating a deficit of $514 billion this year, a reduction of $46 billion compared to May. By contrast, CBO revised its estimates of ten-year deficits up by about $1.4 trillion over the 2014-2023 period and nearly $1.7 trillion over the 2015-2024 period on an apples-to-apples basis that removes non-recurring disaster costs.*

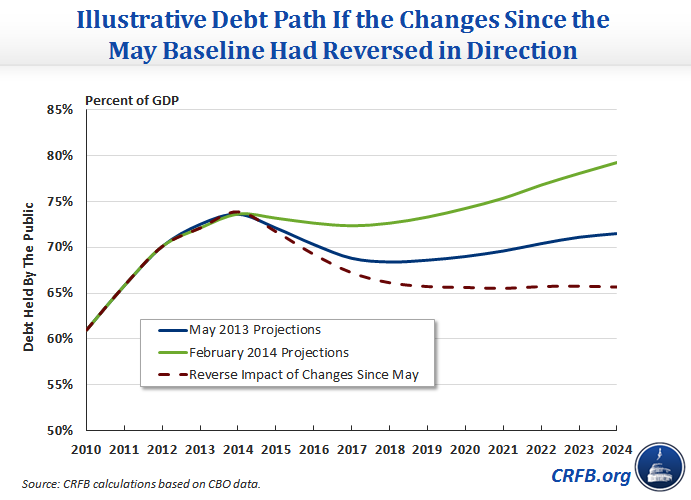

Ironically, most economists would have preferred exactly the opposite: somewhat higher deficits today, when the economy is weak, and lower deficits in future years to allow the debt to fall as a share of GDP. In fact, had the opposite occurred, it would have boosted GDP both this year and the end of the decade by about 0.35 percent, using CBO rules of thumb (Appendix D of the report).

Many articles (here and here and here) have reported the lower deficits that CBO now projects in the short term. Less attention, however, has focused on the far worse projections over the rest of the ten-year window (and likely beyond). As we explained in recent blog posts on CBO's new report, falling deficits in the near term are being driven by higher revenues and lower spending as a result of the economic recovery, along with payments to the Treasury from Fannie Mae and Freddie Mac, but higher deficits of about $1.7 trillion than previously thought over the decade are being driven by slower economic growth, a slower recovery of the labor market, and lower levels of labor participation.

Unfortunately, it would have been far better if CBO had said the opposite was occurring. Luckily, lawmakers can adopt measures to control long-term debt and improve the country's growth potential.

The Short Term

CBO's updated projections show slower economic growth over the next few years than previously thought – growth in 2016 only reaches 3.4 percent in 2016 instead of 4.4 percent – and a slower recovery in the labor market. Such information could prompt lawmakers and economists to call for additional temporary short-term investments to aid the recovery, should they deem it necessary. According to CBO, short-term relief in form of emergency unemployment benefits and/or additional sequester relief could boost near-term GDP growth and employment. Using rough rules of thumb from CBO, an additional $45 billion in deficits this year from aid for the jobless and/or additional sequester relief could boost 2014 inflation-adjusted GDP by between 0.30 and 0.35 percentage points (raising real growth from 2.7 percent to about 3.0 percent) and boost full-time equivalent employment by between 350,000 and 400,000.

Importantly, however, CBO also cautions that higher federal borrowing for short-term measures "would eventually reduce the nation's output and income slightly below what would occur." When presented with the option of providing additional relief to the economy in the near term while offsetting the costs over the long-term, CBO would say it would be a net positive for the economy (as would most economists), especially if the offsets continued to hold down deficits over the long term.

The Long Term

Higher expected deficits after 2015 will come at a time when population aging, health care costs, and rising interest payments will place even larger demands on the government to borrow. As CRFB and CBO continue to stress, increased federal borrowing when debt is already at elevated levels poses serious risks to economic growth, investment, budgetary flexibility, and financial stability.

In addition to the reasons cited for lower projected growth this decades, which include lower labor force participation and lower productivity growth, CBO cites higher levels of debt as a central component. As a result of higher debt levels than in previous projections, CBO now forecasts that the nation's capital stock (the cumulation of current and past investments in physical capital) will grow more slowly each year – 3.1 percent, down from an average of 3.4 percent.

Using CBO's rough rules of thumb over the longer term, an additional $1.5 trillion in primary deficit reduction (which is what would occur if CBO's deficit increases from the May baseline became downward revisions) could increase the size of the economy by between 0.35 and 0.40 percentage points by 2024 as a result of a larger capital stock. Greater deficit reduction, and particularly pro-growth tax and spending reforms, could produce additional economic gains.

Combining the Short Term and Long Term into One Strategy

A far better strategy than short-term austerity or elevated deficits in later years would be to reverse the trends simultaneously. Such a strategy could allow for slightly higher deficits in the near term, something than many economists have suggested, while at the same time paying for these measures over the ten-year window and undertaking far-reaching reforms to the tax code, entitlement programs, and other spending to put the debt on a downward path relative to the economy. The upfront measures could help encourage the recovery, while entitlement and tax reforms would put downward pressure on the debt over the long term, enhancing overall growth. Most economists would call that a win-win, plain and simple.

If the changes since the May baseline had been in the opposite direction – lowering ten-year deficits by about $1.7 trillion instead of increasing them – debt would have been on a roughly stable path later this decade instead of an upward path. Importantly, however, lawmakers would have to do far more in order to put the debt on a downward path – an outcome that should be the ultimate goal.

Many bipartisan deficit reduction plans have allowed for slightly higher near-term borrowing in exchange for much lower borrowing down the road. For example, the original Domenici-Rivlin plan coupled an upfront payroll tax holiday for both employees and employers along with trillions of dollars in health care reforms, tax reforms, spending reforms, and Social Security reform. In addition, the recent Simpson-Bowles proposal called for repealing a larger portion of the sequester than lawmakers were able to agree on and combine those near-term measures with more than $2.5 trillion in savings through 2023. President Obama's deficit reduction offer to Speaker Boehner in the fiscal cliff negotiations included $50 billion of immediate infrastructure investments coupled with $1.8 trillion in savings through 2023.

Let's hope that the FY2015 budget season focuses attention on CBO's worsened projections and produces proposals to improve the economy and guide the budget toward long-term sustainability.

*The $46 billion change in FY2014 deficits would change only slightly when correcting for the differences in Sandy aid between the baselines.