CBO Closes the Book on the 2009 Stimulus

CBO unofficially closed the books on the American Recovery and Reinvestment Act (ARRA, or the 2009 stimulus), putting out its final report on the economic and fiscal effects of the legislation. ARRA passed in February 2009 during what ended up being the deepest output and employment decline of the Great Recession; the economy had shrunk by 8 percent in the last quarter of 2008 and was in the process of shrinking another 5 percent in early 2009, while hundreds of thousands of people were losing their jobs each month. The legislation, originally scored as costing $787 billion, included a number of different provisions intended to stimulate the economy, including increased safety net spending, fiscal aid to states, infrastructure projects, and tax cuts for both individuals and businesses. CBO's latest report includes an updated score of ARRA ($836 billion) and adds economic effects for 2014 to the effects they already reported for previous years.

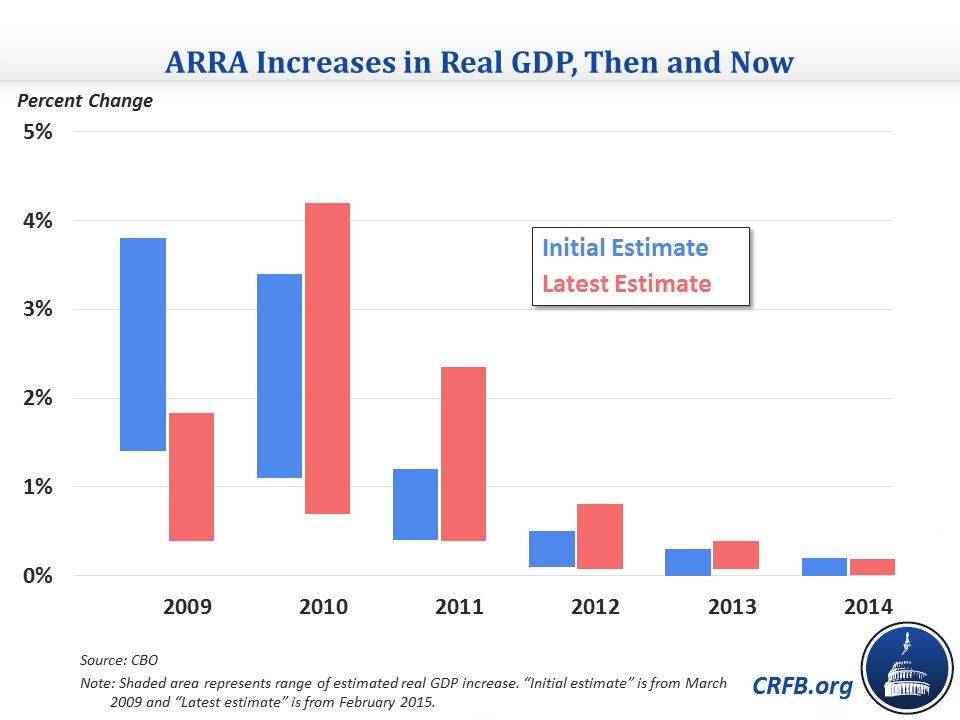

Not surprisingly, CBO finds that ARRA had limited effect on the economy in 2014 given that only 2 percent of the total deficit impact took place in that year. It boosted real GDP by between 0 and 0.2 percent in 2014 and lowered the unemployment by between 0 and 0.2 percentage points. The economic effect peaked in 2010, when nearly half of the deficit impact of the legislation took place, raising real GDP by between 0.7 and 4.1 percent and lowering the unemployment rate by between 0.4 and 1.8 percentage points. Compared to its projections at the time, CBO found much less of a boost to real GDP in 2009 but a greater boost in 2010 and 2011. It also found less of a reduction in unemployment in 2009 and 2010 but a greater effect in 2011 and 2012 than they thought at the time.

On the fiscal side, it is notable that ARRA ended up costing $49 billion more than CBO originally anticipated. This comes entirely from the spending side, which was $88 billion higher than expected; the tax cuts actually ended up being $39 billion less costly. As a result, the law ended up with a ratio of spending increases to tax cuts of 80/20 rather than the originally estimated 75/25.

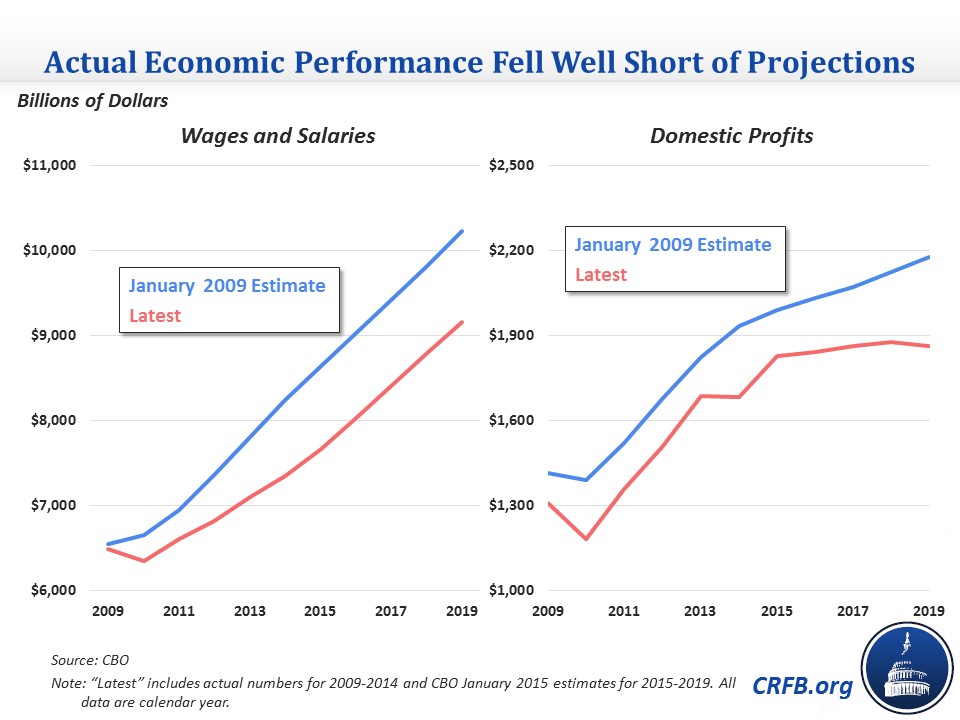

The reason for these changes is most likely the unexpected popularity of Build America bonds and worse-than-anticipated economic performance compared to what CBO projected in January 2009 (the projection off which ARRA scoring was based). On the latter point, higher unemployment and lower wages and salaries pushed up enrollment in unemployment insurance, the Supplemental Nutrition Assistance Program, and Medicaid and increased the size of refundable tax credits (these four categories combined came in $90 billion higher than expected). Meanwhile, lower domestic profits meant that businesses could not take as much advantage of the tax breaks, since many of the provisions were deductions that businesses with low net income did not gain much from.

Along with financial stabilization, monetary policy, and other stimulus, the ARRA was clearly an important piece of the federal government's strategy to halt the output and employment decline in 2008 and 2009, speed up the recovery, and mitigate the effects of the Great Recession. CBO's final report certainly won't be the final word on this effort, but it closes the books on the government's official mandatory tracking of the stimulus.