CBO Baseline Shows Troubling Long-Term Outlook

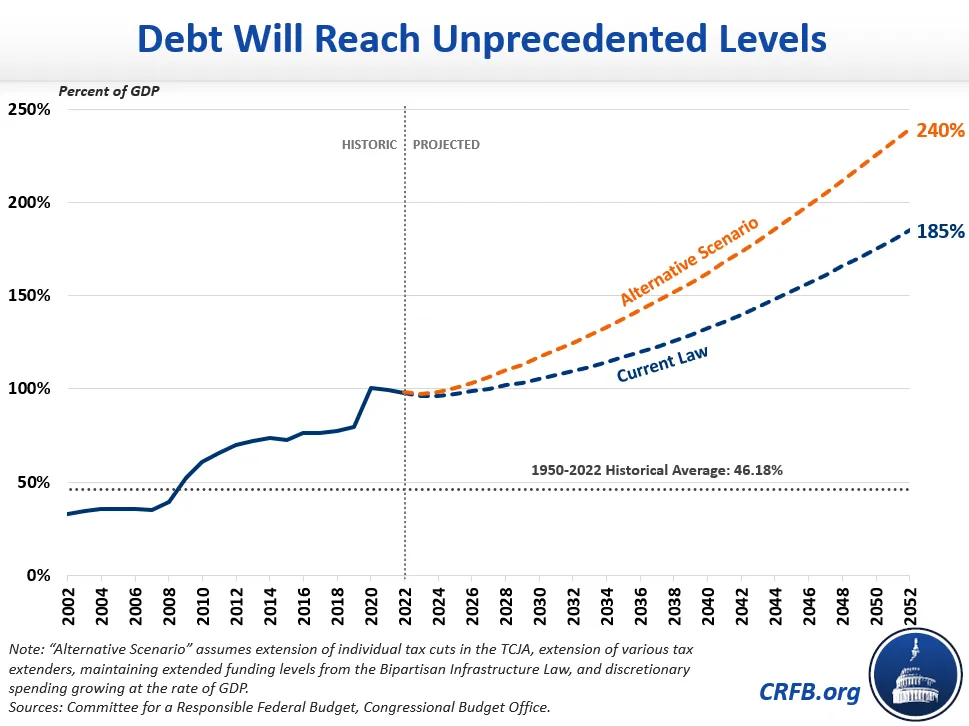

The Congressional Budget Office (CBO) recently published its latest Budget and Economic Outlook covering fiscal years (FY) 2022 through 2032. In the report, CBO also included a limited set of long-term projections through FY 2052. CBO’s long-term projections show debt could reach 185 percent of Gross Domestic Product (GDP) by 2052, and we project it could be 240 percent of GDP if policymakers extend expiring policies without paying for them.

The long-term projections included in the most recent baseline paint a disturbing picture of our nation’s fiscal trajectory over the coming three decades. CBO projects that deficits will nearly triple relative to the size of the economy, growing from 3.9 percent of GDP in 2022 to 11.1 percent of GDP in 2052. As a consequence, debt will also nearly double over the same period, growing from 97 percent of GDP in 2022 to 185 percent in 2052.

Debt could rise even higher if Congress continues to make fiscally irresponsible decisions. In an alternative scenario where Congress extends expiring tax cuts, maintains elevated funding levels from the Bipartisan Infrastructure Law, allows discretionary spending to grow with GDP, and extends other expiring measures, debt could reach 240 percent of GDP by 2052.

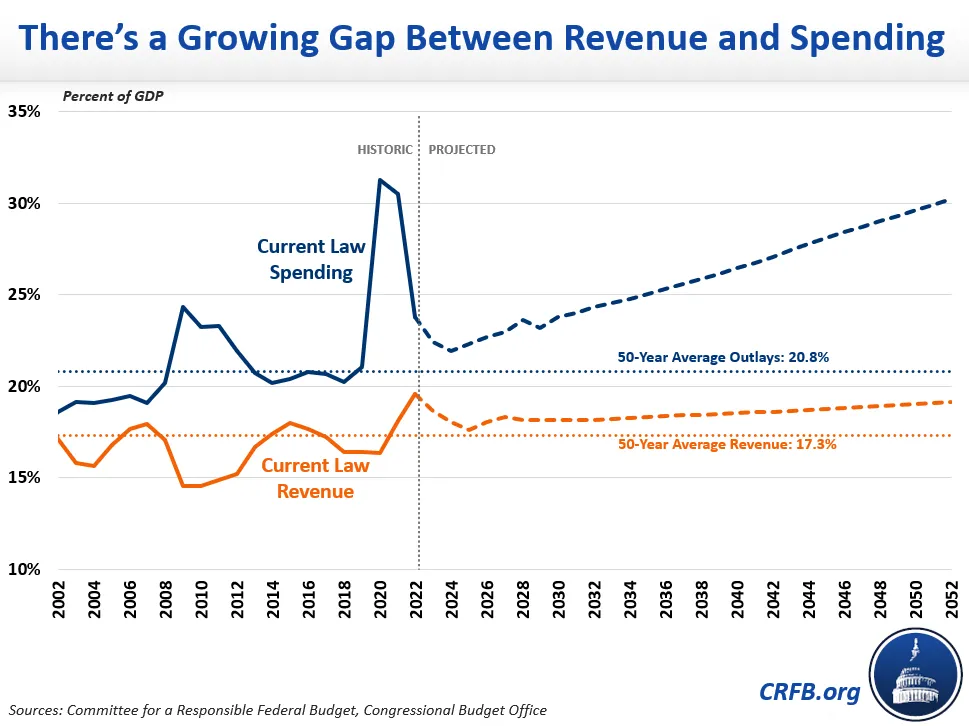

Underlying this pronounced increase in annual deficits and the national debt is a growing gap between spending and revenue as a percentage of the economy. Over the coming decade, federal revenues are expected to fall from a recent high of 19.6 percent of GDP in 2022 to 18.2 percent in 2032. From then on, revenues are projected to climb steadily but slowly, reaching 19.1 percent of GDP in 2052. This is in sharp contrast to the trajectory projected for federal spending, which is projected to climb from 23.5 percent of GDP in 2022 to 24.3 percent in 2032. From there, spending will increase even faster, rising to 30.2 percent of GDP in 2052.

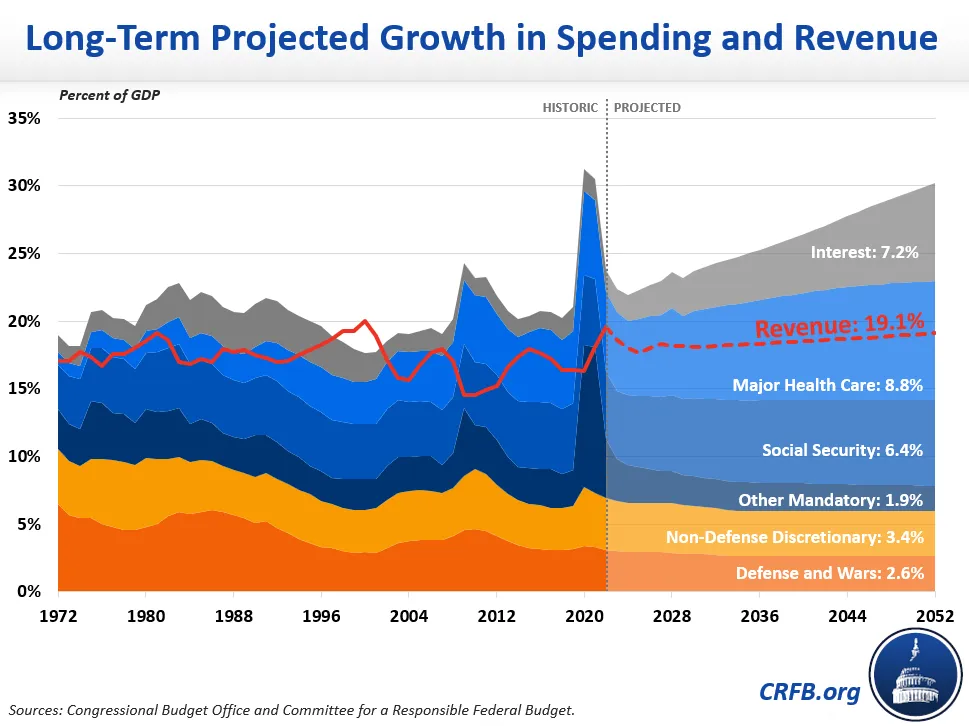

This increase in spending is being driven primarily by increases in spending on Social Security, major health care programs, and national debt interest. Just these three items account for 125 percent of the overall spending increase over the next three decades, measured as a percentage of the economy. Discretionary and other mandatory spending will fall by 25 percent as a percentage of GDP over that same period. Interest on the debt alone will account for 71 percent of overall spending growth. By 2052, nearly two-thirds of the deficit will be from interest, compared to just over 40 percent of the deficit today.