Budget Director: We Still Have a Long-Term Debt Problem

Reading the news these days, you might think our debt problem has been solved: the federal deficit has been revised downward and is falling to its lowest level in five years. Yesterday, however, Congressional Budget Office (CBO) Director Doug Elmendorf made clear that he, for one, does not subscribe to that view.

In a presentation entitled, The Deficit is Down, But the Fundamental Challenge Remains, Elmendorf made clear that "debt remains historically high and is on an upward trajectory in the second half of the coming decade" and that "the fundamental federal budgetary challenge has hardly been addressed."

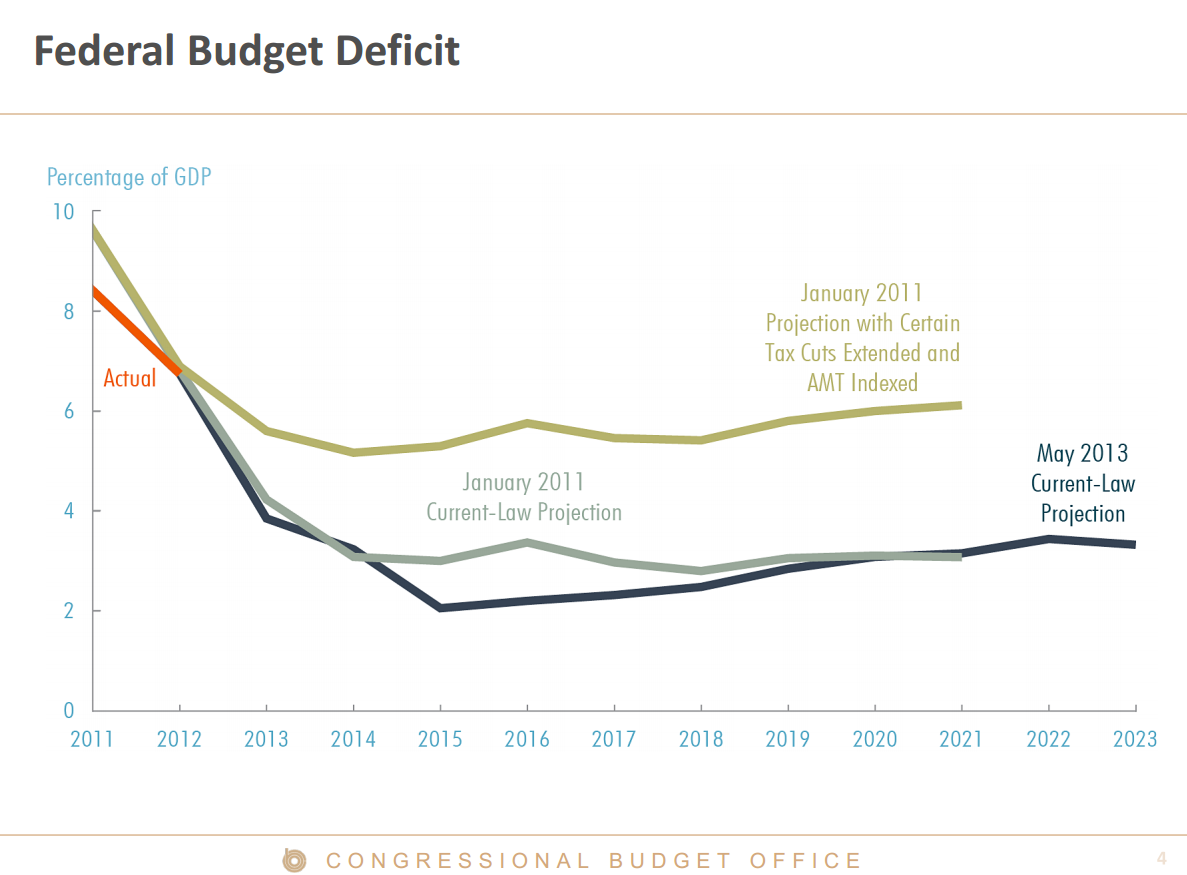

Elmendorf also shows how projections for the deficit in 2013 are nearly identical to current law projections in January 2011 — when the Fiscal Commission had just called for a large, comprehensive deficit reduction package and before Congress started addressing the fiscal situation with the 2011 debt limit showdown, the sequester, and the fiscal cliff deal. Although Congress has agreed to nearly $2.7 trillion in deficit reduction since December 2010 (relative to current policy), much of the savings were offset by extending almost all of the 2001/2003/2009 tax cuts, previously assumed to expire under current law. The deficit situation today is roughly the same as if Congress had done nothing since 2011.

The fact that the deficit is still rising in the second-half of the decade points to our longer-term fiscal problems. One slide illustrates how Social Security, health programs, and interest payments are projected to consume an increasing share of the budget, and that federal deficits will grow unless our fiscal path is altered.

Yet Elmendorf makes clear that the longer-run nature of our biggest fiscal problems should not dissuade us from acting now:

Even if policy changes were not implemented for a few years, however, making decisions about those changes quickly would give people more time to plan and would tend to increase output and employment in the next few years by holding down longer-term interest rates, reducing uncertainty, and enhancing businesses’ and consumers’ confidence.

This presentation echoes many of the points we made in a recent report, "Our Debt Problems are Far From Solved," in which we also highlight the debt's fast-rising trajectory beginning at the end of this decade and continuing in perpetuity. Both make clear that the core drivers of our future deficits -- health care cost inflation, the aging of the population, and an outdated tax code that raises too little revenue -- remain unaddressed.

See Dr. Elmendorf's full presentation here.