Bernie Sanders's Plan for Universal Child Care and Pre-K Education

Democratic presidential candidate Senator Bernie Sanders (I-VT) today unveiled his plan to provide free universal child care and pre-kindergarten education for all. Per his campaign website, the proposal would cost $1.5 trillion over ten years and would be financed by his plan to impose an annual graduated wealth tax on households with a net worth over $32 million. However, it is not clear that Senator Sanders’s wealth tax would raise enough to finance his child care plan, housing plan, and part of Medicare for All, as intended.

The following policy explainer is generated as part of US Budget Watch 2020, a project covering the 2020 presidential election. In the coming weeks and months, we will continue to publish analyses of candidate proposals that are having the greatest impact on the debate over our nation’s future. You can read more of our policy explainers and factchecks here. US Budget Watch 2020 is designed to inform the public and is not intended to express a view for or against any candidate or any specific policy proposal. Candidates’ proposals should be evaluated on a broad array of policy perspectives, including but certainly not limited to their approaches on deficits and debt.

What’s In the Universal Child Care and Pre-K Plan?

Senator Sanders would offer free full-day universal child care and education to all children from infancy through kindergarten age.

Up to age three, a federally-funded but state-administered program would offer at least ten hours a day of child care to all parents. Starting at age three, school districts would be required to offer full-day, full-week pre-kindergarten to all children that would also be paid for by the federal government.

The federal government would fund both the operating costs and investments in construction and renovation of child care facilities and preschools for the programs. Small centers and home-based child care operations would also be eligible for this funding. While the federal government would cover costs, states would be required to meet a variety of quality standards – including wage standards and limits on the amount of children per adult worker and size of the groups of children.

Senator Sanders’s plan would also ensure support for children with disabilities, including through new federal standards, greater research, expanded access to Augmentative and Alternative Communication technology, and new technical assistance for teachers of students with disabilities.

In addition to providing for universal child care and pre-K, Senator Sanders would double funding for the Maternal, Infant, and Early Childhood Home Visiting Program and pass the Universal School Meals Act, which would provide free meals and snacks all year long for every child enrolled in child care and pre-K.

How Much Would the Plan Cost and How Would It be Paid For?

The Sanders campaign estimates its universal child care and pre-K plan would cost the federal government $1.5 trillion over ten years. We are not aware of any independent estimate of this particular plan; however, estimates of similar plans suggest this cost estimate is at least the right order of magnitude.

To fund this $1.5 trillion, Senator Sanders has proposed a tax on extreme wealth. Specifically, a wealth tax would be imposed annually on households with over $32 million of net worth. The tax would be 1 percent of wealth up to $50 million, 2 percent up to $250 million, and would continue to rise on a graduated schedule until reaching 8 percent for household wealth over $10 billion.

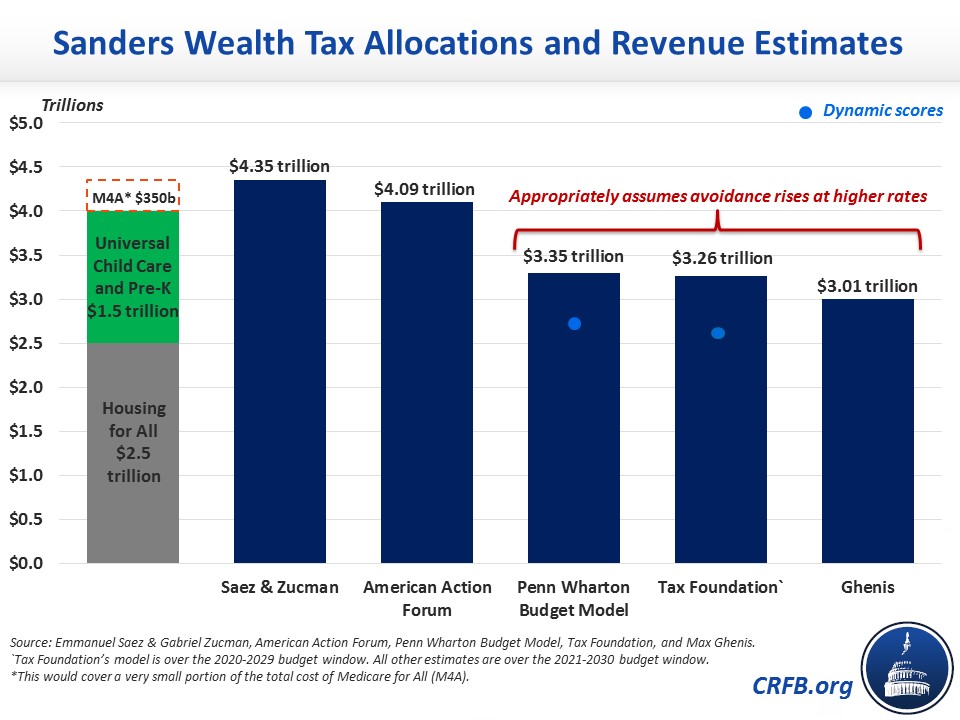

Based on the work of economists Emmanuel Saez and Gabriel Zucman, the Sanders campaign estimates this wealth tax would raise $4.35 trillion. This would be enough to finance Senator Sanders's $1.5 trillion universal child care and pre-K plan, his $2.5 trillion housing plan, and $350 billion of his Medicare for All plan (note that our analysis previously assumed he would dedicate $800 billion, not $350 billion, to Medicare for All).

In our assessment, however, Senators Sanders’s wealth tax is likely to raise significantly less than advertised due to high levels of tax avoidance and the erosion of taxable wealth over time. We believe the wealth tax is likely to raise roughly $3.3 trillion. Assuming the proceeds are distributed evenly, that would leave the universal child care and pre-K plan nearly $400 billion short.

*This would cover a very small portion of the total cost of Medicare for All. For more, see here.

The Saez and Zucman estimate of the wealth tax assumes 15 percent avoidance rates and 4 percent revenue growth – which is a reasonable assumption for a 2 percent wealth tax (assuming an 8 percent elasticity as they do). However, as the tax rate rises so too will legal and illegal efforts to avoid the tax – by hiding, under-valuating, spending, donating, distributing, or otherwise diminishing taxable wealth. The 8 percent elasticity Saez and Zucman identify in the literature would imply a 47 percent avoidance rate for the very wealthiest households paying the 8 percent tax.

A high wealth tax will also, by design, reduce the amount of wealth held by rich households and thus shrink the tax base over time.1

Max Ghenis, who appropriately accounts for the fact that avoidance rises with the rates, estimates the Sanders wealth tax would generate $3 trillion – about a thid less than the Saez and Zucman estimate. Penn Wharton Budget Model and Tax Foundation, which incorporate elasticities and also tax base erosion into their estimates, estimate revenue of around $3.3 trillion. These figures are based on conventional scoring; both modelers find less revenue from dynamic scoring.

Note that the American Action Forum – which, like Saez and Zucman, assumes a fixed avoidance rate and no tax base erosion – estimates $4.1 trillion of revenue.

In our assessment based on the most comprehensive estimates, Senator Sanders’s wealth tax will fall somewhat short of financing his proposals.

Where Can I Read More?

- American Action Forum - Wealth Taxes and Workers

- Max Ghenis - Warren’s wealth tax would raise less than she claims

- Penn Wharton Budget Model - Senator Bernie Sanders' Wealth Tax

- Saez and Zucman analysis of Sanders and Warren wealth taxes

- Tax Foundation - Analysis of Sen. Warren and Sen. Sanders’ Wealth Tax Plans

- Committee for a Responsible Federal Budget - Primary Care: Estimating Leading Democratic Candidates’ Health Plans

****

With the 2020 campaign now in full gear, the presidential candidates are putting forward many ambitious proposals aimed at solving very real problems and concerns. The voting public deserves to know how these proposals would work, how much they would cost, and what they would mean for the debt we will be leaving to our children and grandchildren.

This policy explainer is part of our US Budget Watch 2020 series covering the 2020 presidential election. In the coming weeks and months, we will continue to publish analyses of candidate proposals that are having the greatest impact on the debate over our nation’s future. You can read more of our policy explainers and factchecks here.

1 In our paper, Primary Care, we explained the reduction in expected wealth tax revenue in the following way:

"There are three main reasons we believe Sanders’s wealth tax will raise substantially less than estimated by Saez & Zucman. First, the high effective tax rates will lead to high rates of legal and illegal avoidance, including through donation, distribution, and consumption of wealth. Saez & Zucman estimate 15 percent avoidance, but that figure is based on an 8 percent elasticity and thus would only apply to a 2 percent wealth tax (see Max Ghenis, “Warren’s wealth tax would raise less than she claims – even using her economists’ own assumptions,” November 8, 2019, https://medium.com/@MaxGhenis/warrens-wealth-tax-would-raise-less-than-she-claims-even-using-her-economists-own-assumptions-bea43840bc0a). Assuming this elasticity, we should assume 8 percent avoidance on wealth from $32 million to $50 million, 15 percent up to $250 million, 21 percent up to $500 million, 27 percent up to $1 billion, 33 percent up to $2.5 billion, 38 percent up to $5 billion, 43 percent up to $10 billion, and 47 percent above $10 billion. (Though 47 percent seems high, it is worth noting that roughly half of individuals with net worth above $10 billion have taken the “Giving Pledge” to donate half or more – and in many cases almost all – of their wealth to charity.) This factor alone would greatly reduce the revenue raised. In addition to high levels of avoidance, significant wealth taxation would have the intended effect of reducing wealth and thus reducing the base of taxation. For example, Saez & Zucman estimate the 15 wealthiest individuals would be worth $196 billion today if the Sanders wealth tax had been in effect since 1982 – only a fifth of the $943 billion they are currently worth. Bill Gates would only be worth $10 billion as opposed to $97 billion. This reduction in wealth means less would be available to tax and thus would reduce revenue collection over time. Finally, Sanders’s proposals to dramatically increase taxes on earned income, capital gains, dividends, and estates would all have the effect of reducing wealth among multi-millionaires and billionaires – thus further shrinking the tax base. In addition to those three reasons, some research suggests the Saez & Zucman figures substantially overstate the amount of wealth held by billionaires and/or understate the appropriate elasticity, though our figures assume their estimates are accurate in our central estimate. Our estimates also ignore dynamic effects, which are likely to further reduce revenue collection. There are also potential constitutional issues with a wealth tax that we set aside for purposes of our analysis.

While our current estimates of the Sanders wealth tax are rough, they are consistent with those provided elsewhere. Both Ghenis and PWBM (derived by Zucman and confirmed by PWBM) have estimated Warren’s wealth tax of 2 percent up to $1 billion and 6 percent above that would raise less than three-quarters of what Saez & Zucman estimate, while Natasha Sarin and Lawrence H. Summers suggest it would raise much less than that. Even estimates from Saez & Zucman state that the long-run revenue-maximizing wealth tax rate is about 6.25 percent. Given Sanders’s higher tax rates at most wealth levels, we expect both more avoidance and more base erosion from his wealth tax than from Warren’s wealth tax alone."