Appropriations Deal Will Cost $2.1 Trillion Over 20 Years

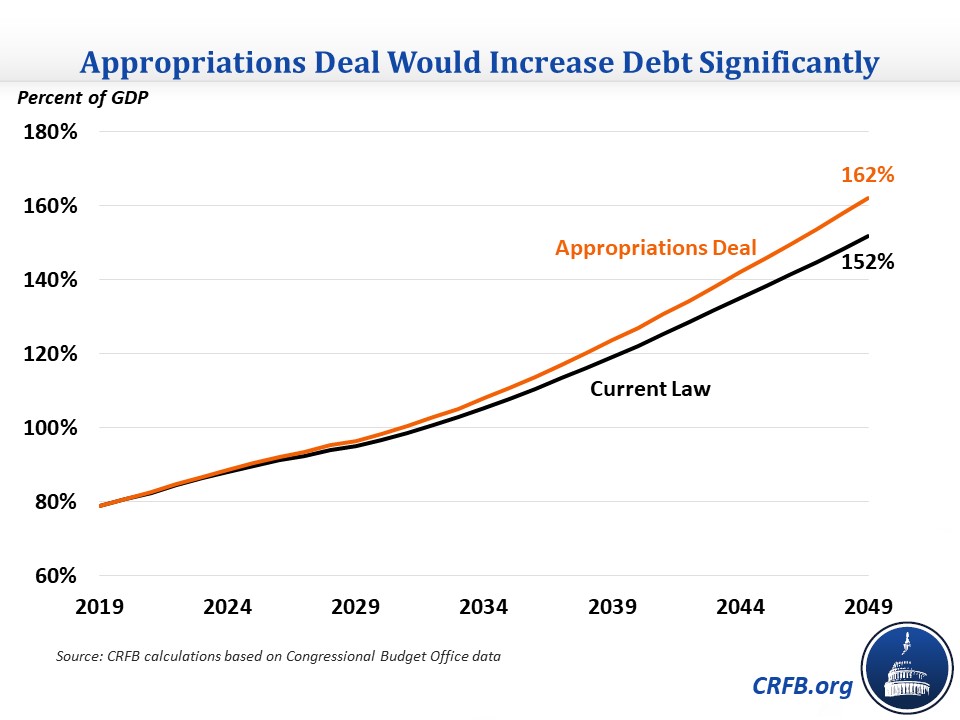

The appropriations deal's numerous deficit-increasing policies, most notably its permanent repeal of three Affordable Care Act (ACA) taxes, would cost $500 billion over the next ten years. That cost would only increase over time since the revenue raised by the "Cadillac tax" on high-cost insurance plans was expected to grow rapidly. As a result, the deal would cost $2.1 trillion including interest over 20 years and would increase debt from 152 to 162 percent of Gross Domestic Product (GDP) in 2049.

Of the policies in the appropriations deal, Cadillac tax repeal will be by far the most expensive over the long term. The Congressional Budget Office (CBO) expects that the revenue from the tax will increase from 0.1 percent of GDP in 2029 to 0.7 percent by 2049. At the same time, revenue from the other two repealed taxes would likely remain relatively flat as a share of GDP, and other parts of the deal would have very little long-term effect. This rapid growth means that the 20-year cost of the deal would be $2.1 trillion including interest, more than four times higher than the ten-year cost.

Long-Term Budgetary Effects of Year-End Appropriations Bill

| Policy | Ten-Year Cost | 20-Year Cost |

|---|---|---|

| Cadillac tax repeal | $200 billion | $1.2 trillion |

| Health insurer tax repeal | $150 billion | $415 billion |

| Medical device tax repeal | $25 billion | $65 billion |

| Tax extenders and other tax provisions | $55 billion | $60 billion |

| Other provisions | $15 billion | $10 billion |

| Interest | $55 billion | $390 billion |

| Total | $500 billion | $2.1 trillion |

Source: CRFB calculations based on Congressional Budget Office data.

This $2.1 trillion cost would rise even further if various expired tax provisions (most of which are extended for three years) continue to be extended.

This cost would also cause debt to rise more rapidly over time than current projections. Debt in 30 years would be 10 percent of GDP higher. It would increase from 79 percent of GDP in 2019 to 162 percent by 2049, compared to 152 percent under current law.

Lawmakers already added $1.7 trillion to the debt this summer to raise the spending caps for appropriations, and nearly 100 economists and health experts agree that the Cadillac tax shouldn't be repealed without a proper replacement. Adding another substantial amount to debt shows how broken the budget process is.