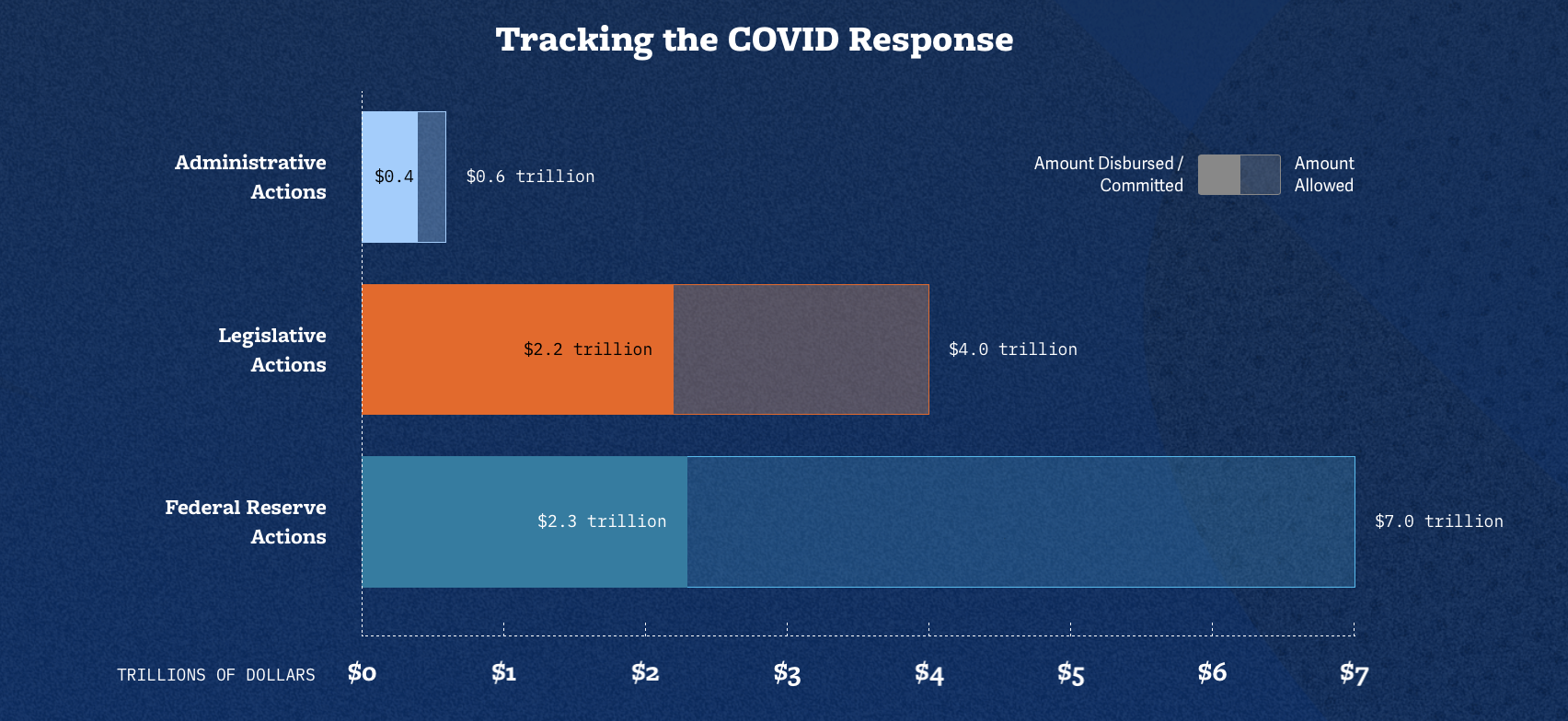

$2.2 of $4 Trillion in Fiscal Relief is Out the Door

We update our interactive COVID Money Tracker tool every week to reflect new COVID relief spending and estimates.

This week's updates are particularly significant, since they incorporate new estimates and data from the Congressional Budget Office (CBO) and Bureau of Economic Analysis (BEA).

We now estimate Congress has authorized $4.0 trillion of fiscal support, $2.2 trillion of which has been committed or disbursed. Our prior numbers had estimated $3.8 trillion allowed and $2.3 trillion disbursed.

Our tracker also shows that the Federal Reserve has provided $2.3 trillion of support through its asset purchases, liquidity measures, and emergency lending facilities out of $7.0 trillion allowed. Administrative actions have committed or disbursed roughly $435 billion out of nearly $590 billion of possible support, of which roughly $300 billion has already been recovered; we estimate that ultimately all but $60 billion will be recouped.

Changes to our legislative numbers come primarily from four sources:

- Higher unemployment spending: Based on updated CBO estimates, we increased the total cost of expanded unemployment benefits from $341 billion to $456 billion ($500 billion including administrative actions) — nearly two thirds of which is attributable to the $600 per week enhancement that expired at the end of July. We estimate around two-thirds of allowed unemployment insurance spending has been committed or disbursed to date.

- Lower Paycheck Protection Program spending: Our estimated deficit impact of the Paycheck Protection Program (PPP) lowered to $541 billion, down from $670 billion, reflecting the amount of forgivable loans and processing fees paid before the program ended on August 8. The latest PPP data through the end of the program is available for download here.

- Increased Medicaid spending: The Families Coronavirus Response Act First Act (FFCRA) increased the Federal Medical Assistance Percentage (FMAP), the percentage of Medicaid matching funds paid by the federal government. The FMAP was increased by 6.2 percentage points for the length of the public health emergency, conditional on states offering continuous coverage, at a projected cost of $50 billion. CBO now believes the public health emergency will remain in effect longer and individuals will spend more time on Medicaid. As a result, we now estimate the FMAP increase will cost $165 billion total, of which $36 billion is out the door.

- Less take-up of employer tax benefits. The FFCRA and CARES Act allowed employers to reduce their payroll tax payments through a paid sick leave tax credit, an employee retention tax credit, and an option to fully defer the employer-side of the Social Security payroll tax for 2020 (although it would have to be paid back in 2021 and 2022). CBO and JCT originally estimated these three provisions would cost $511 billion over the next two years and $172 billion on net after the repayments. However, few employers appear to be taking advantage of these provisions. Our very rough estimate suggests that take-up is only one-quarter of what was expected. As such, we have revised down our disbursal estimates for all three programs by assuming a uniform reduction in take-up — to $19 billion for sick leave, $10 billion for employee retention, and $45 billion for the employer payroll tax deferral. We will continue to revise these estimates as more information becomes available.

See more at COVIDMoneyTracker.org where you can take a deep dive into all of the legislative, executive, and Federal Reserve actions to date using our state-of-the-art interactive table and sunburst visualization.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.