15 Major Problems with the Senate Reconciliation Bill

The House is set to consider the Senate-passed reconciliation bill. Below we outline 15 major problems with the Senate-passed bill.

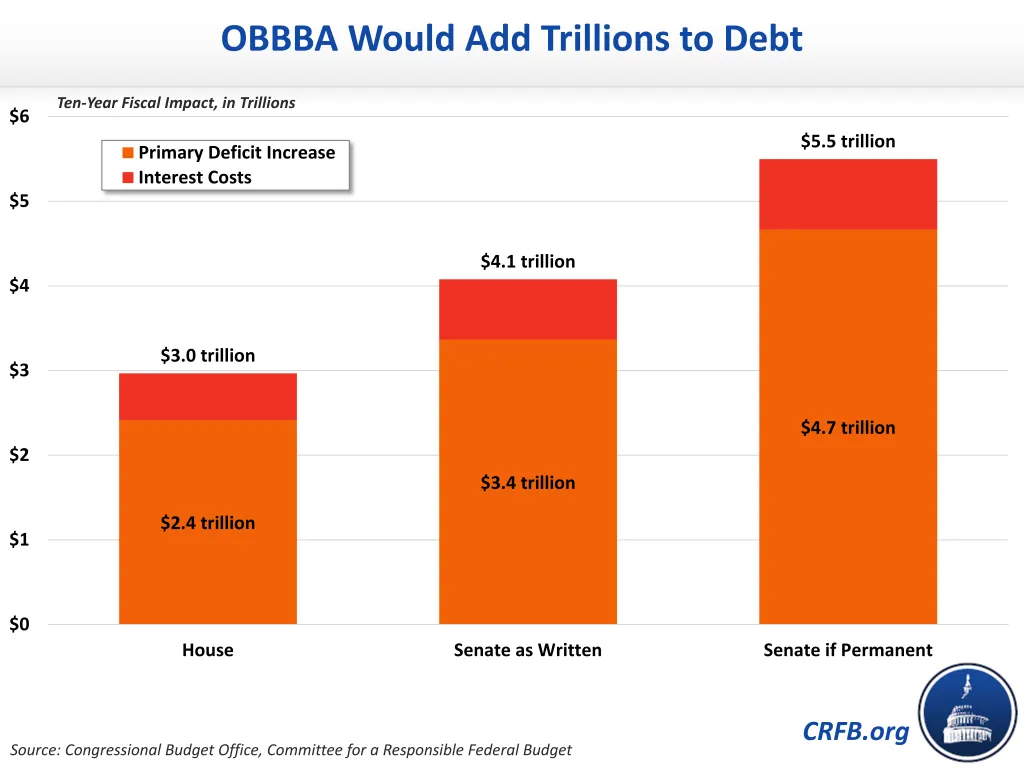

1. Adds $4.1 trillion to the debt through 2034 – more borrowing than any reconciliation bill in history.

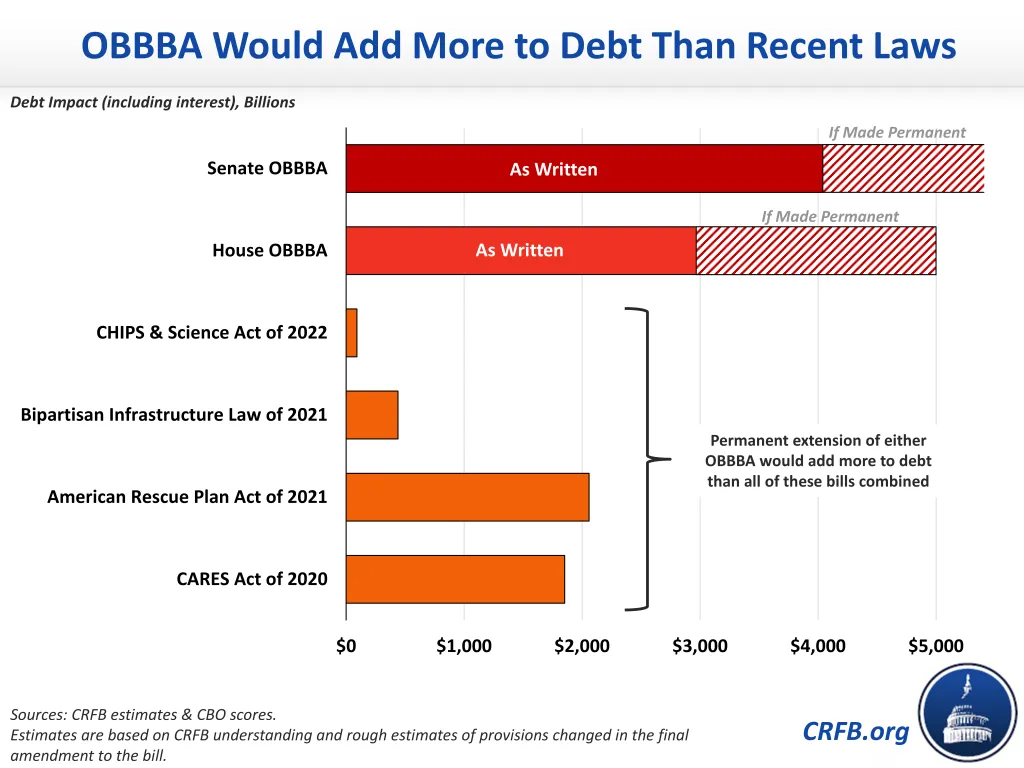

2. Would add $5.5 trillion to the debt if made permanent – more than the CARES Act, American Rescue Plan, Bipartisan Infrastructure Law, and the CHIPS and Science Act combined.

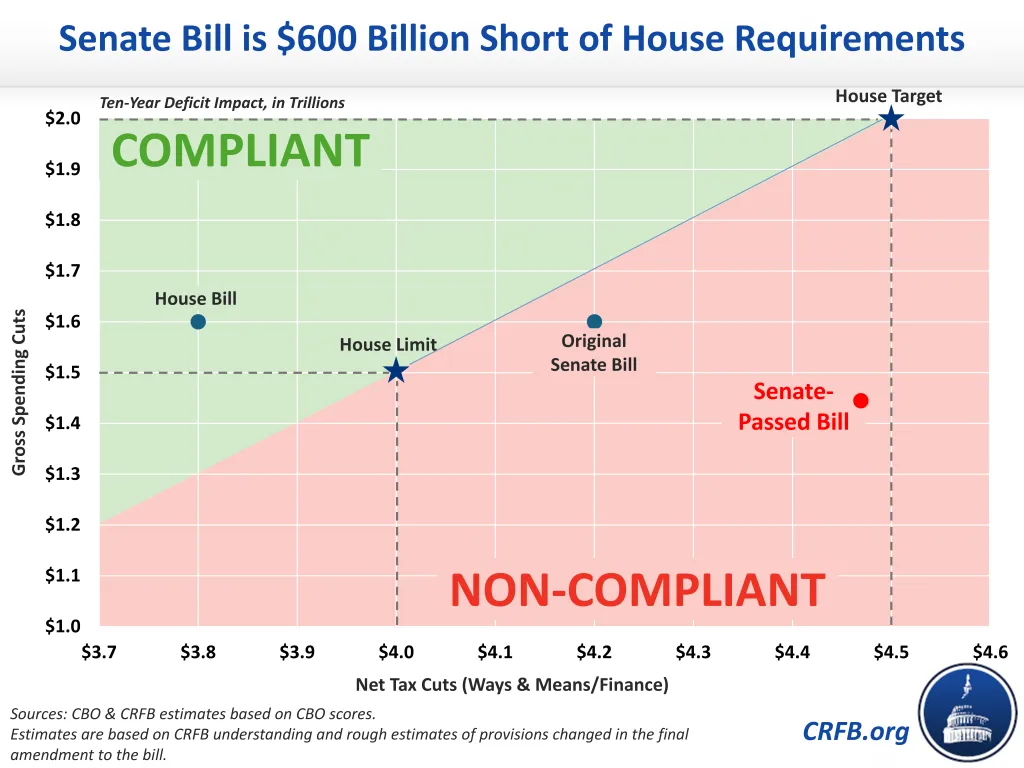

3. Violates the House reconciliation framework by $600 billion – with only $1.4 trillion of gross spending cuts and $4.5 trillion of tax cuts.

4. Accelerates Social Security and Medicare insolvency to 2032 – a year earlier than under current law.

5. Is littered with special interest giveaways and new tax and spending entitlements – including a SALT cap increase, hospital fund, RECA expansion, farm bailout, new car loan subsidies, and a variety of narrowly targeted tax breaks.

6. Relies on numerous budget gimmicks – including arbitrary expirations, phony baselines, and fantastical growth assumptions.

7. Undermines future budget enforcement – setting the precedent that the majority can make up whatever budget score they want, which could allow massive new spending increases or tax cuts that are claimed as free.

8. Increases future spending if made permanent – with spending increases and interest costs outweighing the spending cuts in the bill.

9. Makes the tax code more complicated and less fair – creating new deductions, credits, and phase outs that treat similar income differently and increases the number of itemizers.

10. Explodes interest costs to nearly $2 trillion per year – including by adding to the debt and pushing up interest rates throughout the economy.

11. Worsens deficits by even more using dynamic scoring – higher interest costs will increase the debt more than faster growth reduces it.

12. Increases the debt limit by $5 trillion in exchange for deficit increases – asking members who had previously not supported debt ceiling increases or demanded dollar-for-dollar deficit reduction to instead agree to almost a dollar-for-dollar debt increase.

13. Makes the 3% of GDP deficit goal much harder to achieve – boosting annual deficits above 7 percent of GDP, nearly $600 billion a year further from the 3% goal, if provisions are extended.

14. Uses up key offsets needed for debt reduction – enacting meaningful savings from health care, higher education, and tax breaks but using them to justify a massive deficit increase.

15. Poisons the environment for bipartisan budget and trust fund deals – by signaling that the majority party will unilaterally add to the debt by cutting taxes and pad their appropriations priorities.

Key Charts on the Senate Reconciliation Bill