Moving to Site Neutrality in Commercial Insurance Payments

Hospital care is the largest single source of expenditures within the health care system, driven in large part by high prices. One factor behind those high prices are payment differentials based on site-of-care, regardless of safety or clinical effectiveness.

In a previous Health Savers Initiative brief, “Equalizing Medicare Payments Regardless of Site-of-Care,“ we estimated adopting site-neutral payments in Medicare would save the program about $150 billion over 10 years. In this brief, we examine site-of-service payment issues in the commercial market and model a tiered policy strategy to address the problem and generate savings in national health expenditures and the federal budget.

Over the next decade (2024-2033), policies that encourage site-neutral payments in the commercial insurance market could:

- Reduce total national health expenditures by $458 billion

- Reduce commercial premiums by $386 billion and patient cost sharing by $73 billion

- Reduce the federal budget deficit by $117 billion

These policies would also reduce incentives that drive consolidation and limit facility fee bills for patients.

The high and rising costs of health care necessitates policy changes. In that context, it makes sense to address the market inefficiencies that come from site-specific payment rates. For one, they drive service provision to higher-cost sites, namely from physician offices to hospital outpatient departments (HOPDs). This leads to higher health care spending on common, low-resource services, such as office visits and minor procedures.

Second, these payment differentials incentivize hospitals to purchase physician practices and convert them to off-campus HOPDs to garner higher payments. This vertical integration has increased the market power and name recognition of health systems, allowing them to demand even higher prices from commercial payers.

The Health Savers Initiative is a project of the Committee for a Responsible Federal Budget, Arnold Ventures, and West Health, which works to identify bold and concrete policy options to make health care more affordable for the federal government, businesses, and households. This brief presents an option meant to be just one of many, but it incorporates specifications and savings estimates so policymakers can weigh costs and benefits, and gain a better understanding of whatever health savings policies they choose to pursue.

The Problem with Site-Based Payments

Site-specific payment arrangements are found in both Medicare and commercial health insurance. We examined the problem and its costs to Medicare in our brief, “Equalizing Medicare Payments Regardless of Site-of-Care.” Here, we look deeper into the unique problems of these arrangements in the commercial market given the impact hospital market power has on prices.

There are two main problems with site-based payments in both Medicare and commercial insurance. First, payments based on site-of-service have led to an increase in the number of services provided in higher-cost settings – primarily hospital-based outpatient departments (HOPDs). Second, payment differentials across sites encourage consolidation in provider markets, particularly with respect to hospitals purchasing independent physician practices. This consolidation drives up health care prices and premiums without evidence of quality improvements. 1

The Medicare Payment Advisory Commission (MedPAC) and the Health Care Cost Institute (HCCI) have identified significant shifts from physician offices to HOPDs for certain low-complexity services over the past decade and a half. For example, MedPAC found that the share of chemotherapy administration services provided to Medicare fee-for-service beneficiaries in HOPDs grew from 35 percent in 2012 to 51 percent in 2019. 2 Similarly, when HCCI looked at private insurance claims, it found that the share of level 5 drug administration visits in HOPDs grew from 23 percent in 2009 to 46 percent in 2017. 3

By purchasing independent physician offices, hospitals are able to treat these freestanding clinical offices as off-campus HOPDs for billing purposes. Between 2012 and 2018, the number of physician practices acquired by hospitals increased from 35,700 to more than 80,000, with 44 percent of US physicians employed by hospitals or health systems by the end of that period. 4 Recent research suggests the number is now significantly higher, with the economic impact of COVID-19 accelerating the trend. 5

This consolidation increases the pricing power of large hospital systems, enabling them to demand higher prices in negotiations with commercial insurers. As we found in our Health Savers Initiative brief, “Capping Hospital Prices,” hospitals command prices in the commercial market that are more than twice as high as Medicare on average, with more than 300 hospitals having a ratio of commercial-to-Medicare payment rates of three-to-one or higher. Furthermore, research has shown that between 80 and 90 percent of hospital markets are considered highly concentrated, up from 65 percent in 1990. 6 And, hospitals in highly concentrated markets with less competition tend to charge higher prices. 7

Legislative changes at the federal and/or state level could counteract the upward trend in hospital-related prices caused by the growth of hospital market power. Altering the payment incentives that drive higher spending – for example by moving to site neutrality – could be part of the solution.

Examples of Differential Pricing

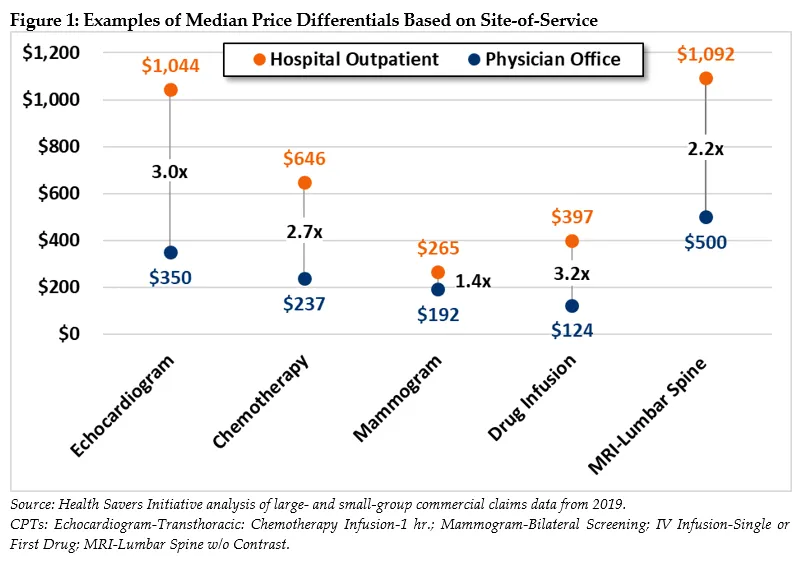

As discussed in our prior Health Savers Initiative brief on site-neutral policy in Medicare, MedPAC has identified a set of 57 health care services (called ambulatory payment classifications) that should be paid the same regardless of where they are provided because they do not require additional resources and are safe to provide either in an HOPD or in a physician’s office. 8 Using that list to review pricing in the commercial insurance market shows very large site-based differentials, the size of which vary depending upon the service provided.

For our analysis, we first determined the full price for HOPD services to compare with physician office-based prices. Currently, hospitals that own physician practices (re-labeled as off-campus HOPDs) are allowed in almost all states to charge add-on “facility fees” on top of the (often higher) fees they charge for the physician services they provide. While these two fees may be billed separately, our analysis shows they often sum to a higher total price for a given service than would be charged in a physician’s office.

This can also create confusion and financial harm for patients, especially right after a physician practice is purchased by a hospital. In these cases, the physical address of the practice does not change, but patients may start receiving multiple bills when they see their physician: one from their physician and a second from the hospital. The hospital fee could also be charged to the patient’s hospital deductible, directly leading to higher out-of-pocket spending. 9

In Figure 1, we highlight a few examples of price differences for services that are provided in physician offices between 40 and 60 percent of the time, (demonstrating that they can be safely and effectively performed there). For example, the median payment for an echocardiogram in an HOPD is three times the fee for the same service performed in a physician office. Relative payments for drug infusions are even higher, with HOPD fees 3.2 times higher than in physicians’ offices.

Mammogram screenings are another example, with typical costs 40 percent more at HOPDs compared to independent physician officess. That differential would likely be larger if not for the fact that Medicare already requires site neutrality for mammograms, which may have led to reduced differentials for the service in the commercial market. Nevertheless, for these and many other services not included in Figure 1, the higher HOPD payments directly lead to higher out-of-pocket spending for patients and higher health care costs for the system writ large.

Recent Efforts to Make Payments Site-Neutral

Medicare has steadily established site-neutral payments for selected services, both as a result of legislation and because of regulations from the Center for Medicare and Medicaid Services (CMS). In 2014, MedPAC issued recommendations to Congress and CMS to enact site-neutral payments in Medicare for a set of 57 hospital outpatient services. 10 Their list was based on criteria focusing on services performed in physicians’ offices at least 50 percent of the time, not usually associated with an emergency department visit, and with relatively comparable patient severity between settings.

In 2015, Congress acted on some of these recommendations by passing the Bipartisan Budget Act of 2015. This bill established site-neutral payments in Medicare for services received at off-campus HOPDs but applied the policy only to future HOPDs. All current off-campus HOPDs, as well as those under construction, were grandfathered into the higher site-specific payments. The law did not include site-neutral payment reforms for on-campus HOPDs.

Both President Obama and President Trump included Medicare site-neutral payment proposals in their budget submissions. President Trump’s final budget proposed to apply site-neutral payments to all services provided at all off-campus HOPDs, eliminating the grandfathering provision of the 2015 law. In addition, the budget called for site-neutral payments between on-campus HOPDs and physicians’ offices for services commonly performed outside hospital settings, such as Evaluation and Management/clinic visits (E&M) and imaging services. 11

In 2021, after years of litigation, CMS won the right to administratively adopt fully site-neutral payments (and eliminate add-on facility fees) for all E&M/clinic visits at all off-campus HOPDs. The Court of Appeals held that the higher payment rates available at the longstanding HOPDs led to overuse of services in those settings and that CMS has the authority to develop strategies to control “unnecessary increases in the volume of covered services.” This would suggest that CMS’s authority could be available for further use in reducing other instances of site-specific payments.

MedPAC continues to recommend that Congress move to direct the Secretary of HHS to “reduce or eliminate differences in payment rates between outpatient departments and physician offices for selected ambulatory payment classifications.” 12 These recommendations are considerably broader than the payment alignments currently being implemented by CMS and would lead to significantly more savings for the federal government if they were adopted. 13

In the commercial insurance realm, there has been some state action on enacting site neutrality. Connecticut has taken the most comprehensive approach among states, including barring the collection of facility fees for E&M office visits at off-campus hospital-based facilities as well as for telehealth services. Connecticut also requires hospital-based facilities to provide notices related to other facility fees. 14 Over the last several years new laws have also passed in New Hampshire, Ohio, and Washington related to facility fees that would either require transparency for patients, prohibit add-on fees for telehealth services, or require site neutrality for certain Medicaid services. Many more laws have been considered by states over the past two years. 15

At the federal level, recent activity has also focused on commercially insured services in off-campus HOPDs. Specifically, HR 8133, the “Transparency of Hospital Billing Act,” was introduced in the 117th Congress (2021-22) and focuses on requiring off-campus HOPDs to bill for services using the same forms as if they were physician providers, eliminating the opportunity to charge additional facility-related fees. 16

Policy Approach for the Commercial Market

Moving the commercial market toward site-neutral payment policies would reduce national health expenditures (NHE), allowing for lower premiums and cost-sharing. We also expect that, with premiums falling, employers would likely shift a share of worker compensation from non-taxable health care benefits to taxable wages, increasing government revenue.

Focusing on the commercial insurance market, we modeled the magnitude of current excessive payments due to site-of-service differentials using a step-wise policy approach that aims for site-neutral payments. We then translated that comparison into an estimate of savings for both national health expenditures and the federal budget.

The first step in the policy approach would prohibit off-campus HOPDs from billing add-on fees associated with their affiliated hospital by amending prior legislation governing billing and administrative complexity. 17 An off-campus HOPD, as defined by CMS, could only bill one fee for a given service and would be prohibited from charging patients out-of-pocket for separate facility fees. 18 This approach will limit patient exposure to additional and unexpected out-of-pocket costs.

Prohibiting add-on fees would also provide greater transparency regarding the total price charged for providing a given service in an off-campus HOPD. It would factor into re-negotiation between insurers and off-campus HOPDs on the final allowed prices for these services. In some cases, the elimination of the add-on facility fees could result in an increase in physician service fees. Provider market power will influence the outcome of such negotiations, determining whether and to what extent the resulting combined fees would be lower than the previous sum of both charged fees.

The second policy step would explicitly limit the total fee charged at off-campus HOPDs through direct site-neutral payment regulation. Specifically, fees for services provided by off-campus HOPDs would be capped at the median fee reimbursed for those same services when provided in a physician office. 19 We calculated savings based on the 2019 national median for fees. However, median fees could be calculated as an average over three years, similar to the approach taken to calculate fees for laboratory tests under the Medicare program. 20 In addition, the median fee could be calculated for a specified geographic area in which the service is provided, for example the county or a somewhat larger area.

The third step would take this general approach further, extending payment caps to selected services at on-campus HOPDs as well. The capped services would be limited to those that are low-complexity and typically done in physician offices – largely resembling MedPAC’s recommended list. 21

The HOPD setting is not associated with meaningful improvement in the quality of care or outcomes for these low-complexity services. MedPAC research also shows that higher payments for HOPDs, for certain services commonly provided in physician offices, are not justified by higher resource costs for HOPDs. 22

Taken together, the payment limits outlined here would have a significant effect on lowering commercial insurance payments for care. Moving to site-neutral payments under this approach could also reduce incentives for consolidation by lowering the benefits of purchasing physician practices in order to convert them to HOPDs.

Estimated Fiscal and Financial Impact

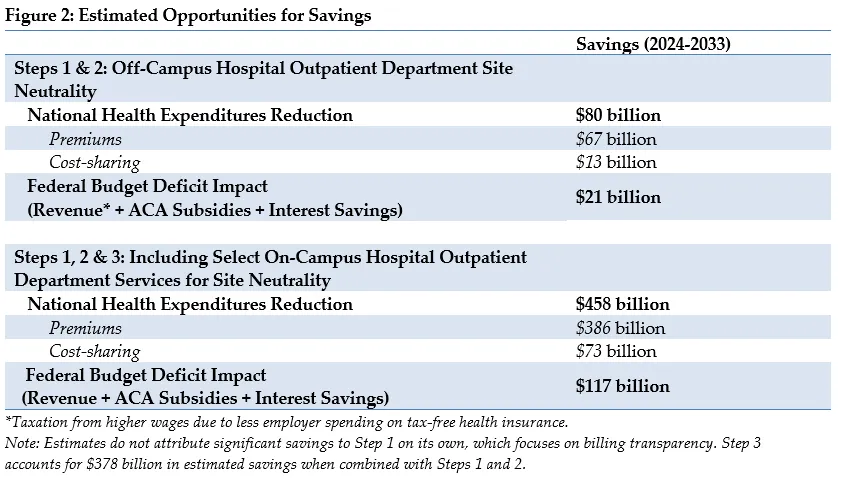

Modeling the combination of steps one and two, implementing a system for site neutrality in off-campus HOPDs, suggests a potential difference in total national health expenditures of $80 billion over 10 years, relative to the status quo. That translates into $67 billion in lower commercial insurance premiums and $13 billion in reduced patient cost sharing. In addition, consumers would benefit from the elimination of confusing add-on fees.

Expanding the policy to include selected services at on-campus HOPDs increases the savings opportunity. Our analysis suggests a potential reduction in total national health expenditures of $458 billion over 10 years. That translates into $386 billion in lower insurance premiums and $73 billion in lower patient cost sharing.

We also estimate that lower premiums will increase revenues as taxable wages increase. Meanwhile, lower premiums in the Affordable Care Act exchange marketplaces would reduce federal government premium subsidies. Along with the related lower interest payments on the national debt, we estimate the federal budget deficit would be reduced by $21 billion from 2024 to 2033 if site-neutral payment changes were limited to off-campus facilities and $117 billion if the payment changes include selected services at on-campus HOPDs.

Appendix: Estimating Methodology

The estimates in this document were produced through the joint effort of the partner organizations: The Committee for a Responsible Federal Budget, Arnold Ventures, and West Health. The starting points for savings estimates were the May 2022 Congressional Budget Office baseline and the March 2022 national health expenditure projections from the actuaries at the Centers for Medicare and Medicaid Services.

The claims data were drawn from several sources. Claims for the individual and small group markets were from the 2019 Enrollee-level External Data Gathering Environment (EDGE) Limited Data Set (LDS). 23 Claims for the large group insured and self-funded markets were from the 2019 Health Care Cost Institute (HCCI) multi-payer commercial claims data set. 24 For some services, the 5 percent sample 2019 LDS Medicare analytic files were used to estimate the relative frequency of on-campus and off-campus utilization. 25 Actuaries at Actuarial Research Corporation (ARC) developed the methodology described below and performed the analysis on small group and individual data. The analysis of large group data was performed by analysts at West Health in partnership with ARC.

The methodology was modeled on that used by MedPAC in Chapter 6 of its June 2022 Report to Congress. 26 At its core, this methodology compares, at a service level, the total allowed fee for services performed in on- and off-campus HOPDs to the median total allowed fee for services performed in physician offices. To obtain totals for services provided in on and off-campus HOPDs, we combined the claims submitted by both the clinician performing the service and the associated hospital’s institutional fees. In most cases, the combined total price of these two claims was significantly higher than a single claim for the same service performed in an independent physician office. The potential savings estimates in this analysis result from capping the HOPD fees for selected services at the median physician office-based fee.

The calculations were performed separately for off-campus HOPDs and on-campus HOPDs. The MedPAC report identified services associated with 57 ambulatory payment classifications (APCs) as reasonable for aligning payment rates across physician offices and HOPDs. For the on-campus HOPD analysis, only services associated with these 57 APCs were considered (plus standard mammograms, which are already site-neutral in Medicare). For the off-campus HOPD analysis, additional services were considered if at least 20 percent of claims were provided in the physician office.

Baseline savings estimates were developed independently at a per-member level for the individual, small group, and large group markets because of the different data sources and differences in contracting practices. Then, these per-member savings were aggregated and benchmarked to estimated commercial under-65 enrollment based on NHEA data. Ten-year projections were developed using NHEA enrollment and trend projections. Finally, the budgetary impacts were calculated recognizing the tax deductibility of employer-sponsored insurance and the federal subsidies of individual Marketplace plans.

1 Karyn Schwartz, et al, “What We Know About Provider Consolidation,” September 2020, https://www.kff.org/health-costs/issue-brief/what-we-know-about-provide…

2 Medicare Payment Advisory Commission, “June 2022 Report to the Congress: Medicare and the Healthcare Delivery System,” June 2022, Chapter 6, https://www.medpac.gov/wp-content/uploads/2022/06/Jun22_MedPAC_Report_t…

3 John Hargraves and Julie Reiff, “Shifting Care from Office to Outpatient Settings: Services are Increasingly Performed in Outpatient Settings with Higher Prices,” Health Care Cost Institute, April 2019, https://healthcostinstitute.org/in-the-news/shifting-care-office-to-out…

4 Physicians Advocacy Institute, “Updated Physician Practice Acquisition Study: National and Regional Changes in Physician Employment 2012-2018,” February 2019, https://www.heartland.org/_template-assets/documents/publications/02191…- Physician-Employment-Trends-Study-2018-Update.pdf

5 Physicians Advocacy Institute, “COVID-19’s Impact On Acquisitions of Physician Practices and Physician Employment 2019-2021,” April 2022, http://www.physiciansadvocacyinstitute.org/Portals/0/assets/docs/PAI-Re…

6 Brent D. Fulton, “Health Care Market Concentration Trends In The United States: Evidence And Policy Responses,” Health Affairs, September 2017, https://www.healthaffairs.org/doi/10.1377/hlthaff.2017.0556; Zack Cooper and Martin Gaynor, “Addressing Hospital Concentration and Rising Consolidation in the United States,” 1% Steps For Health Care Reform, https://onepercentsteps.com/policy-briefs/addressing-hospital-concentra…

7 Zack Cooper, Stuart V. Craig, Martin Gaynor, John Van Reenen, “The Price Ain’t Right? Hospital Prices and Health Spending on the Privately Insured,” The Quarterly Journal of Economics, Volume 134, Issue 1, February 2019, Pages 51–107, https://doi.org/10.1093/qje/qjy020

8 MedPAC, June 2022.

9 For more examples of the facility fee problem, see: Donna Rosato, “The Surprise Hospital Fees You May Just Get For Seeing A Doctor,” Consumer Reports, June 2019, https://www.consumerreports.org/fees-billing/surprise-hospital-fee-just…; and Sarah Boodman, “‘Facility Fees’ Are Surprise Cost For Many Patients,” Kaiser Health News, October 6, 2009.

10 Medicare Payment Advisory Commission, “March 2014 Report to Congress: Medicare Payment Policy,” March 2014, Chapter 3, https://www.medpac.gov/wp-content/uploads/import_data/scrape_files/docs…

11 The proposal would save $141 billion according to The Congressional Budget Office, “Analysis of the President’s 2021 Budget,” March 2020, estimates. https://www.cbo.gov/publication/56278

12 MedPAC, June 2022.

13 Committee for a Responsible Federal Budget, “Equalizing Medicare Payments Regardless of Site-Of-Care,” Health Savers Initiative, February 2021, https://www.crfb.org/papers/equalizing-medicare-payments-regardless-sit…

14 Connecticut General Statutes, CGS § 19a-508c(a)(3)), https://www.cga.ct.gov/current/pub/chap_368v.htm#sec_19a-508c

15 National Academy for State Health Policy, “State Legislative Action to Lower Health System Costs,” August 2022, https://nashp.org/state-legislative-action-to-lower-health-system-costs/

16 The legislation would also push Medicare toward full site neutrality by removing the grandfather clause from the Bipartisan Budget Act of 2015 and reaffirming the statutory authority for CMS to promote Medicare site neutrality. Congress.gov, Library of Congress "Text - H.R.8133 - 117th Congress (2021-2022): Transparency of Hospital Billing Act,” June 2022, https://www.congress.gov/bill/117th-congress/house-bill/8133/text

17 HIPAA X12 837P transaction or a CMS 1500 form are amended in HR 8133.

18 Reflecting their function as a physician office rather than a facility that requires hospital-level resources, off-campus HOPDs would be identified consistent with CMS regulations as not having a co-located emergency department and being situated more than 250 yards from their hospital’s main campus. This policy could have exceptions, for example, for radiology services when the physician reading the images may not be employed by the hospital where the images are taken.

19 Only those services that are performed in physician offices at least 20 percent of the time would be included in the capped fee system.

20 Centers for Medicare and Medicaid Services, “Clinical Laboratory Fee Schedule,” December 2022, https://www.cms.gov/medicare/medicare-fee-for-service-payment/clinicall….

21 We also include non-MedPAC list services that are performed at least 20% of the time in a physician’s office, and mammography screening, which is already paid on a site-neutral basis in Medicare.

22 MedPAC, June 2022.

23 Centers for Medicare and Medicaid Services, “Enrollee-Level External Data Gathering Environment (EDGE) Limited Data Set (LDS),” August 2022, https://www.cms.gov/research-statistics-data-systems/limited-data-set-l…

24 Health Care Cost Institute, https://healthcostinstitute.org/data

25 Centers for Medicare and Medicaid Services, “Limited Data Set (LDS) Files,” October 2022, https://www.cms.gov/research-statistics-data-and-systems/files-for-orde…

26 MedPAC, June 2022.