Why Did the Deficit Fall in 2014?

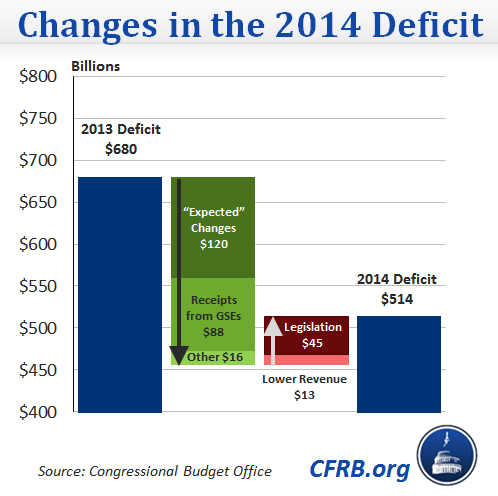

Yesterday, the Congressional Budget Office released its annual report on the federal budget, which outlines their projections of all federal spending and revenues over the next 10 years and serves as a baseline against which to measure all of this year's legislation. The report showed that the deficit is expected to fall by $166 billion since last year, from $680 billion in 2013 to $514 billion in 2014. However, this one-year improvement in the deficit is not a cause for celebration: it was largely the expected result of a recovering economy, and partially the result of one-time revenues. Not only does a close look at the report not indicate good news, but the long-term picture is significantly worse, with a ten-year deficit $1.7 trillion worse than previously projected.

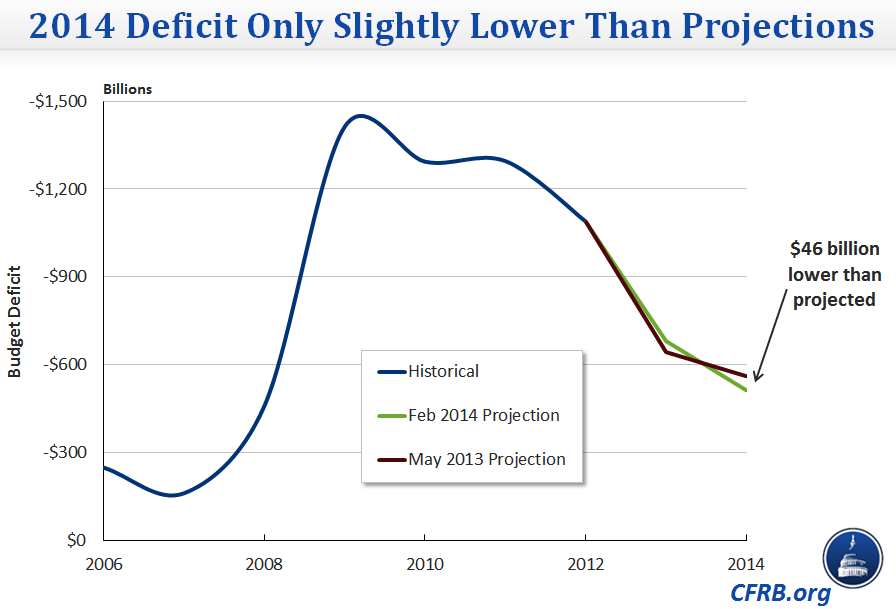

Almost three-quarters of the deficit reduction should be no surprise at all: CBO's report last year expected deficits to drop to $560 billion because of increased revenue and decreased safety net payments due to the recovering economy. We will post a follow-up blog next week describing the sources of these "expected" changes, which include higher revenues from economic growth, new taxes passed as part of last year's fiscal cliff deal, and increased outlays for health care programs as a result of the Affordable Care Act. Without these expected changes, the deficit only dropped by $46 billion from last year's projection.

There were forces that shifted deficits both upward and downward since last year's projections. Unexpectedly good returns from Fannie Mae and Freddie Mac, which return excess profits to the Treasury, resulted in an $88 billion gain. New estimates for coverage under the Affordable Care Act reduced deficits by $8 billion: $6 billion from reduced exchange subsidies and $2 billion from reduced outlays for Medicaid and CHIP. Other economic and technical changes to CBO's projection methodology lowered budget outlays by another $8 billion. On the deficit-increasing side, Congress passed additional legislation increasing spending by almost $45 billion, most notably the Murray-Ryan budget agreement, which partially lifted the sequestration budget caps. Revenue also dropped by $13 billion, the net effect of improved economic projections and CBO's downward technical adjustments.

From the chart above, one can see that the annual deficit dropped by $166 billion since last year, but almost three-quarters of that figure was projected last year, as a natural response to the end of the recession. Excluding this expected drop, deficits only improved by $46 billion. Yet most of those changes were outside of Congress' control – such as increased revenues from Fannie Mae and Freddie Mac and CBO's technical corrections. If the deficit only measured by the actions of Congress, the deficit actually increased by about $45 billion.