What’s New in COVID Money Tracker?

This week we updated COVID Money Tracker with all of the major provisions from the $915 billion1 in COVID relief provisions in December’s Consolidated Appropriations/Response & Relief Act. In addition to adding the provisions from the latest bill, we also have added all of the recent COVID-related executive actions taken by President Biden in his first few days in office.

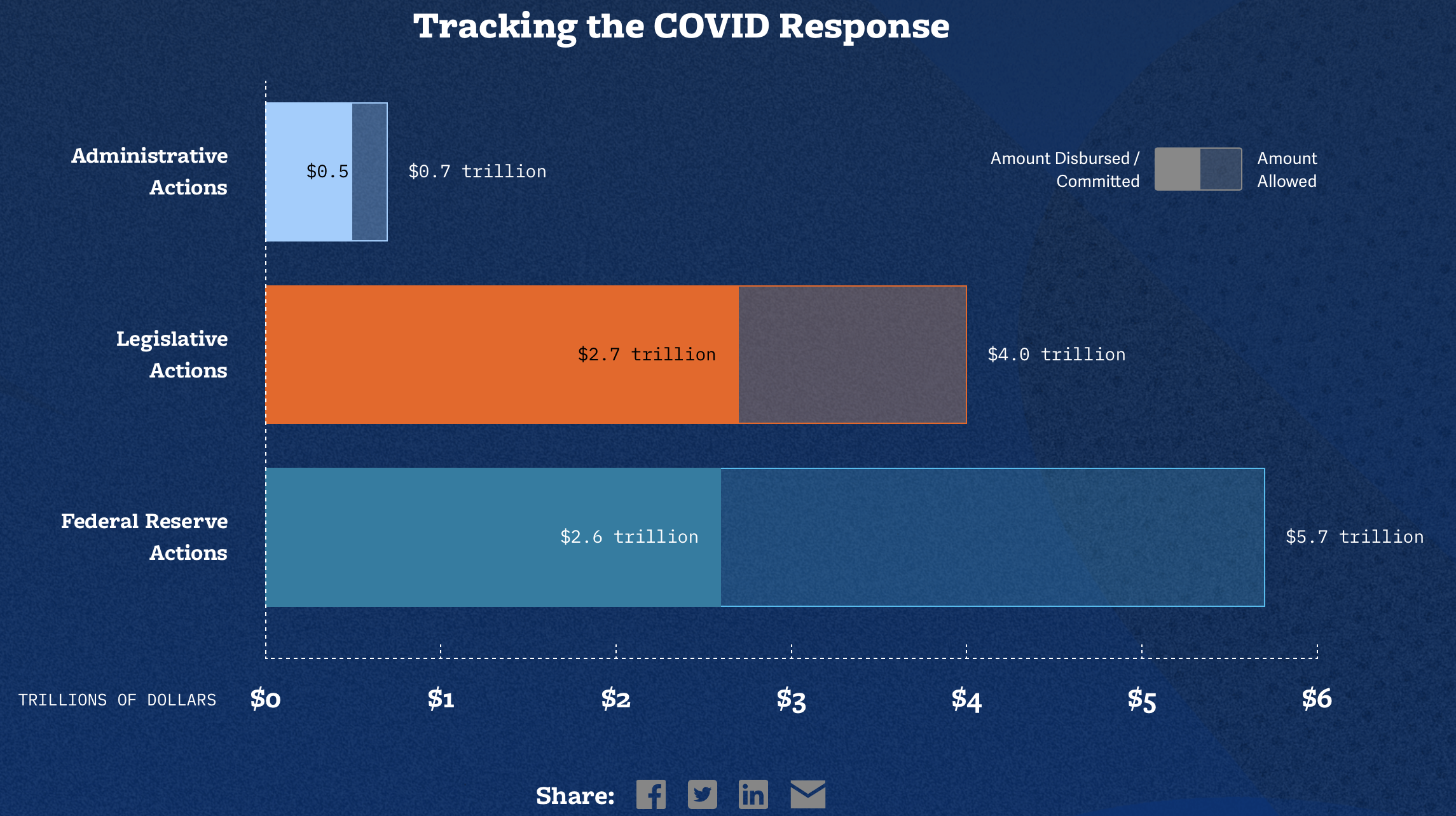

To date, enacted legislation has authorized around $4 trillion of fiscal support, which will ultimately add around $3.4 trillion to the deficit. As of our update, at least $2.7 trillion of those funds have been disbursed or committed – though disbursals from the Response & Relief Act are moving quickly. Administrative actions from Presidents Trump and Biden have provided around $660 billion in support, $480 billion of which has already been committed or disbursed, that will have a net cost of around $75 billion. The Federal Reserve has undertaken around $2.6 trillion in emergency lending, asset purchases, and other liquidity actions, out of around $5.7 trillion in allowed support.

These represent substantial changes since our last data update before the new year. Most of the change is due to the end-of-year deal, which not only allocated new funds, but rescinded previous legislative and Federal Reserve funds. We’ve also updated estimates for several tax provisions that appear to have been utilized much less than originally estimated. The table below shows how the figures have changed.

| Amount Allowed (Old) | Amount Allowed (New) | |

|---|---|---|

| Federal Reserve Actions | $7.3 trillion | $5.7 trillion |

| Legislative Actions | $4.1 trillion | $4.0 trillion |

| Administrative Actions | $600 billion | $660 billion |

| Committed/Disbursed (Old) | Committed/Disbursed (New) | |

| Federal Reserve Actions | $2.5 trillion | $2.6 trillion |

| Legislative Actions | $2.5 trillion | $2.7 trillion |

| Administrative Actions | $465 billion | $480 billion |

| Deficit Impact (Old) | Deficit Impact (New) | |

| Federal Reserve Actions | N/A | N/A |

| Legislative Actions | $2.7 trillion | $3.4 trillion |

| Administrative Actions | $65 billion | $75 billion |

Legislative Updates

The total amount authorized from legislation remains roughly constant at about $4 trillion, despite the increase in net COVID relief from $2.7 to $3.4 trillion. On the one hand, the end-of-year Response & Relief Act allowed roughly $940 billion of additional fiscal support. On the other hand, it rescinded about $430 billion in Treasury support for Federal Reserve facilities and nearly $150 billion in funding for the previous iterations of the Paycheck Protection Program and other small business support programs.

Additionally, we revised down our estimates of the employee retention credit, Families First paid sick leave credit, employer-side Social Security tax deferral, and net operating loss (NOL) limit changes in light of new tax data. These benefits were used much less than originally anticipated by the Joint Committee on Taxation and others.

We are already seeing disbursements and commitments from the December relief bill. Using COVID Money Tracker, you can see the roughly $190 billion (20 percent of the overall net cost) in disbursals and commitments to date.2

Federal Reserve Updates

Our total authorized amount for Federal Reserve operations has been reduced from $7.3 to $5.7 trillion as a result of the cessation in operations of and recession of most funding for several CARES-Act-funded-facilities, which include the Main Street Lending Program, Corporate Credit Facilities, Municipal Liquidity Facility, and Term Asset-Backed Securities Loan Facility. Combined, these facilities were backed with up to $195 billion in Treasury funding, which allowed for up to $1.95 trillion in potential lending and liquidity operations. They ended operations on December 31 after providing $42 billion in support (2 percent of their total capacity).

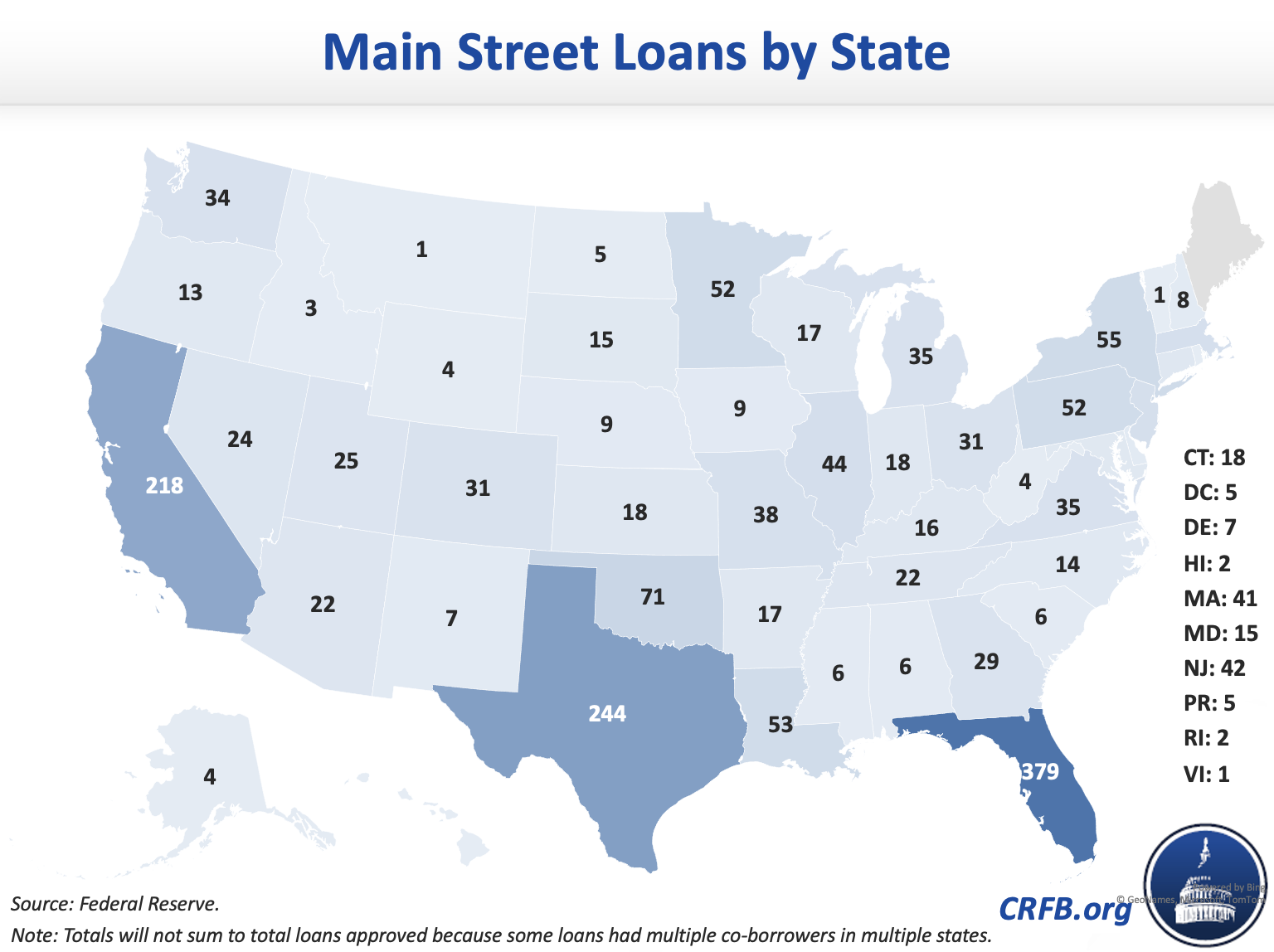

COVID Money Tracker also has all of the transaction-level detail from the CARES-Act funded-facilities through December 31, 2020, the date most of them ceased operations.3 The Main Street Lending Program, which was created to support lending to small and medium-sized businesses, saw more activity in the month of December than since its inception in March. The number of loans closed rose from 650 to 1,800, representing a 175 percent increase in the dollar amount of participation purchased by the facility from $6 to $16.5 billion. Interestingly, Maine was the only state with no Main Street loan recipients.

You can see the full list of companies by state with their loan amounts, as well as the Secondary Market Corporate Credit Facility corporate bond holdings, Municipal Liquidity Facility recipients, TALF borrowers, through December 31, on COVID Money Tracker today.

Administrative Action Updates

President Biden was inaugurated on January 20, 2021, and has already signed a number of executive actions in direct response to the COVID crisis. Some of the executive orders he has made to date include:

- Extending the moratorium on evictions and foreclosures of federally-backed mortgages through the end of March.

- Extending the moratorium on evictions of renters from February through March.

- Continuing the existing student loan payment deferral and interest waiver from February 1 through September.

- Providing FEMA funding for 100 percent of National Guard activity related to responding to the pandemic through the end of September.

- Instituting mask mandates on interstate transportation and on federal property as well as implementing a mask mandate for all federal employees.

We estimate that the continued student loan payment deferral and interest waiver will provide up to $55 billion in support, for a net deficit impact of $15 billion, while most of the other recent orders will have a de minimis or undefined cost. We will continue to monitor for new COVID-related executive actions in the coming days and weeks.

We will continue to track all the latest federal actions to the crisis at COVIDMoneyTracker.org.

This blog post is a product of the COVID Money Tracker, an initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

1 Our score of the bill includes provisions in Divisions M and N, tax provisions in Division EE, and some other emergency appropriations in the other Divisions.

2 Slightly overstated due to shared pots of funding that are linked to prior legislation.

3 The Main Street Lending Program technically stopped buying participations in eligible loans on January 8, 2021. Loans bought after December 31 were only those submitted after December 14.