Ways & Means Hearing on Business Extenders

The House Ways and Means Committee is holding a hearing Tuesday to consider whether to permanently extend the business tax breaks that expired at the end of 2013. In particular, the hearing will focus on the provisions extended by Camp's Tax Reform Act of 2014; the two largest of which are the research and experimentation (R&E) tax credit and Section 179 expensing. This hearing is the first in a series intended to reinstate some provisions permanently while allowing others to remain expired. It is laudable that Camp is thoroughly reviewing each instead of continuing to extending them all of them as a package with little scrutiny. However, these provisions should not be reinstated temporarily or permanently without offsetting the costs.

First, a little background. Chairman Camp recently released a comprehensive tax reform proposal which extended seven of the business provisions found to be worthwhile, while letting approximately twenty others expire. Responsibly, other parts of the bill paid for the costs of extending these expired provisions, so the bill was revenue-neutral relative to current law; extending these provisions did not add to the deficit.

However, the proposal was unusual for its fiscal responsibility. The hearing notice points out that offsetting these costs “is not consistent with recent practice by Congress in its consideration of tax extenders legislation.” Disappointingly, Chairman Camp subsequently suggested permanently extending some expired tax provisions in advance of tax reform so they would be built into the baseline used for consideration of tax reform. Meanwhile, the Senate Finance Committee has reported legislation extending virtually all of the expired tax provisions for two years without offsets.

The hearing will focus specifically on the business provisions that were either made permanent or provided long-term extensions in the Tax Reform Act of 2014. First, the proposal made the R&E credit permanent, making the main credit slightly larger, while modifying the items that qualify as "research expenses," halving the cost of the credit. The proposal also extended Section 179 small business expensing at lower 2009 levels, two provisions dealing with the overseas income of multinational corporations, and provisions for S Corporations. Notably, the Tax Reform Act did not extend the costly bonus depreciation, which was enacted in 2008 as a temporary tax incentive but has been extended several times and was included in the Senate Finance Committee extenders package.

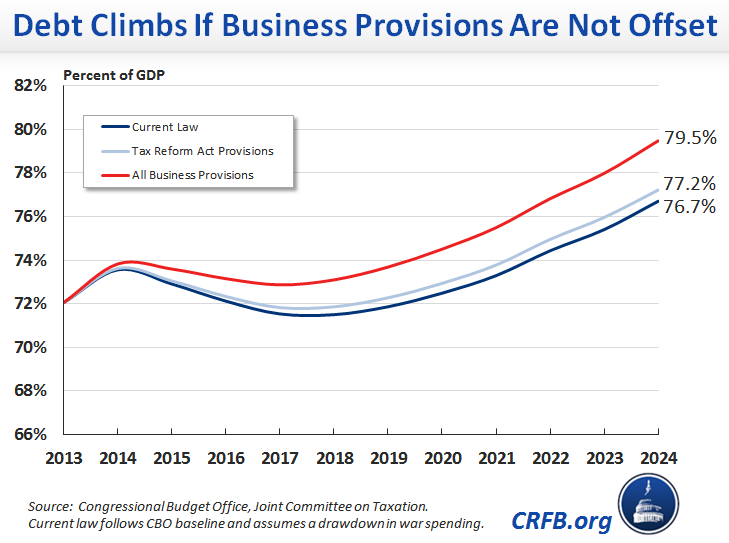

Permanently extending the business tax provisions that were extended in the Tax Reform Act of 2014 without offsets would cost more than $120 billion ($160 billion when interest is included). Debt held by the public would be about half a percent of GDP higher after ten years than under a current law baseline, which assumes the tax cuts either remain expired or are paid for. However, permanently extending every business provision (the Senate Finance Committee extended them all for two years) would cost nearly $600 billion ($750 billion with interest) and increase debt by nearly 3 percent of GDP.

Continuing to extend these provisions by borrowing results in revenues below the levels in Ryan's budget and would mean future tax reform would start from a baseline with lower revenues. In a letter to the Ways and Means Committee commenting on the tax reform discussion draft, CRFB President Maya MacGuineas warned that “it would be irresponsible to permanently extend even some of the more popular expiring provisions without offsets in advance of tax reform in order to build them into the current law baseline,” stating that it “would make an unsustainable debt situation even worse.”

Update: This post was updated after the hearing with additional scoring estimates from JCT, increasing the estimated cost of extending the seven provisions in the Tax Reform Act.