The War Gimmick Simplified

With CBO recently having scored President Obama's 2013 Budget Request, included within the total score is a score of a policy known as capping Overseas Contingency Spending. While this is a good policy, this policy, when coupled with counting it is deficit reducing or using it to offset other spending, which President Obama, like many others before him, have done, is quite simply a gimmick.

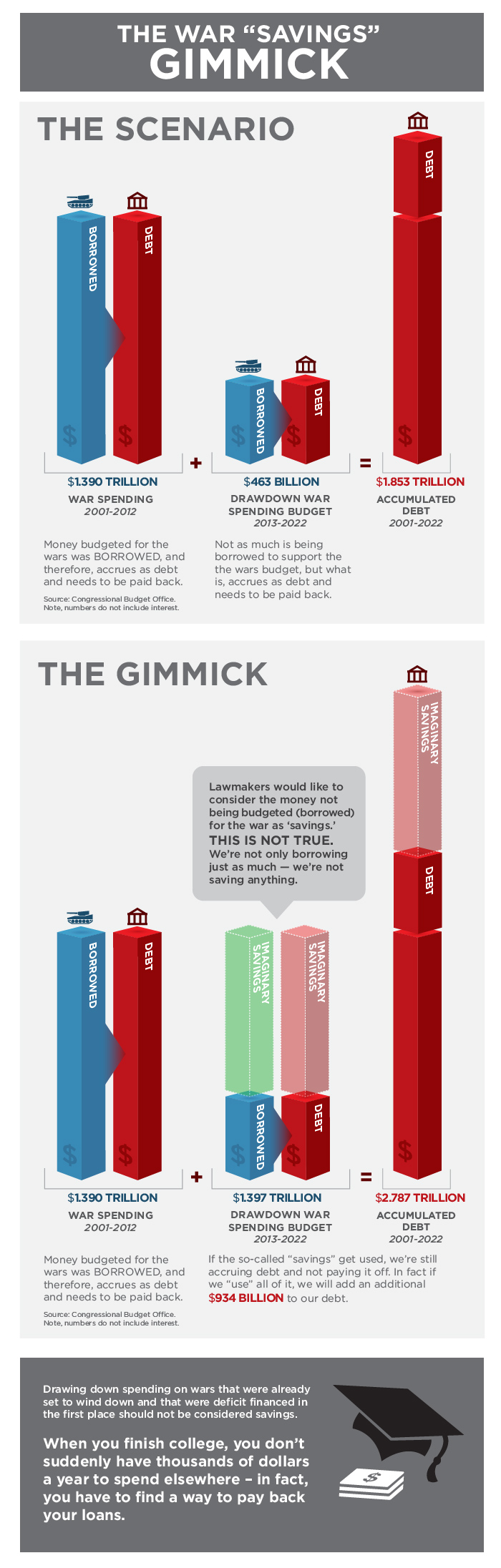

This is one of the most notorious budget gimmicks as of late and is called the "War Gimmick." We at CRFB have talked about this gimmick frequently in the past, such as here during the debt ceiling debate and here when we analyzed President Obama's 2013 budget. Both parties are guilty of using this trick. Additionally, we noted when appropriators were trying to get around cuts through the use of the gimmick. Considering its prevalence in the budget debate, CRFB has developed an infographic for anyone interested in a simple explanation of this accounting trick.

To recap, policymakers can claim to save significant amounts of money by putting in law a policy to cap Overseas Contingency Operations spending (which is the technical term for war spending). This cap would be equal to the amount that is already set in policy due to the drawdowns of the wars in Iraq and Afghanistan. By law, CBO must project that war spending will grow with inflation, capping war spending counts as "savings" according to the baseline. But this is not savings - the policy is already in place. Worse than that, there is talk about using these so called "savings" to offset other policies.

Because of the issue with the baseline, CBO would have to count these caps as deficit reduction, which would allow it to offset deficit-increasing policies. But since none of these savings are real, the deficit-increasing policies would still add to the deficit. As CRFB president Maya MacGuineas said,

Drawing down spending on wars that were already set to wind down and that were deficit financed in the first place should not be considered savings. When you finish college, you don’t suddenly have thousands of dollars a year to spend elsewhere – in fact, you have to find a way to pay back your loans.

Check out the infographic below!