Updated Report: The Case for the Chained CPI

Earlier this month, we reported on CBO’s updated cost estimate for switching to the chained CPI to provide a more accurate measure of inflation for indexed provisions in the tax code and in spending programs. Yesterday, the Moment of Truth Project released an updated version of their report Measuring Up: the Case for the Chained CPI along with a new one-page summary reflecting the latest cost estimate as a result of legislative changes in the American Taxpayer Relief Act (ATRA) and new data.

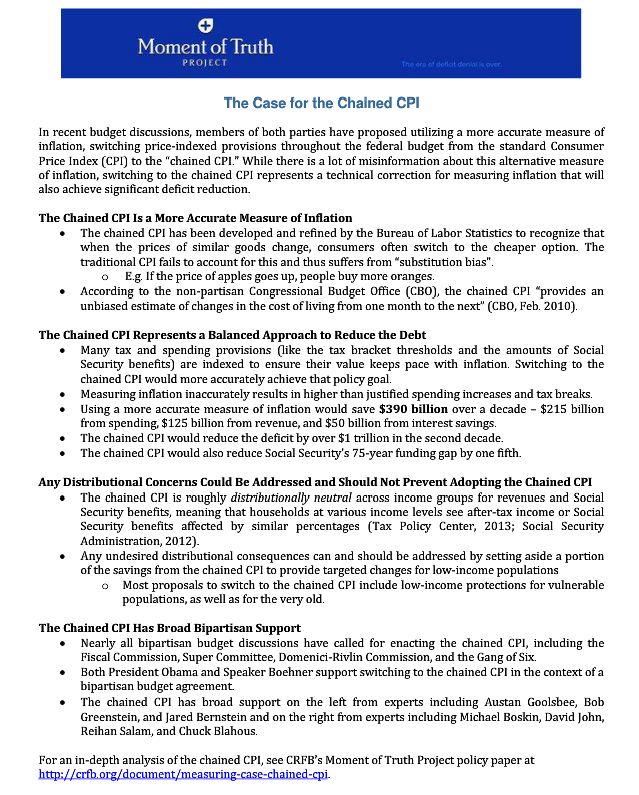

In recent budget negotiations, both President Obama and Speaker Boehner supported switching to the chained CPI as part of a broader deficit reduction framework. The policy has continued to receive bipartisan support from lawmakers and experts on both sides of the aisle. As lawmakers carry on their work toward reaching a budget deal, the Moment of Truth’s updated report offers a helpful explanation of the budgetary and policy impact of this policy.

Specifically, the report includes new information about the increased savings – now projected to save $340 billion over the next decade ($390 billion including interest), up from $250 billion in previous estimates ($290 billion including interest). It also discusses the distributional impact on Social Security benefits and after-tax income in light of tax changes in the ATRA and finds the chained CPI is still roughly distributionally neutral across income groups. The report argues that concerns for the impact on vulnerable populations can be addressed through targeted policy changes to help those populations:

Chained CPI is a more accurate measure of inflation and there is no reason to maintain an average $320 tax windfall for those in the top quintile as a result of using an inaccurate measure of inflation in the tax code just to prevent a $20 tax increase for those in the bottom quintile. Likewise, there is little reason to provide higher than warranted increases in benefits for all Social Security beneficiaries just to protect lower-income beneficiaries when those concerns could be addressed by much more targeted policies and at lower overall costs.

As we’ve argued many times before, switching to chained CPI would provide not only a more accurate measure of inflation for inflation calculations in the federal government, but also significant deficit reduction and a reduction in the Social Security funding shortfall.

To read the full paper click here.

To read the one-page summary click here and to read our blog analysis of the chained CPI click here.