Understanding the Difference Between Temporary and Permanent in Budget Scoring

This week, Congress will continue to deliberate if and how to continue the “tax extenders” which expired at the end of 2013. In doing so, both the House and Senate must deal with the fact that any un-offset extensions of these breaks would add to the debt and thus violate pay-as-you-go (PAYGO) rules.

This reality has helped to revive a long-standing debate about whether policymakers should have to offset the costs of policies which are currently in place (or in this case, recently expired) but scheduled to expire under current law.

Some simply argue that because current policies are likely to occur anyway, they represent “budget fakery” that should be ignored. A more sophisticated argument suggests that current baseline rules treat revenue and spending differently and create a pro-spending bias in budget rules.

Curtis Dubay of the Heritage Foundation, for example, recently asserted an “extension is not a tax cut” and that CBO would agree if an extension was treated the same as various spending programs. He writes:

The problem arises because of the incorrect way the Congressional Budget Office (CBO) constructs its revenue baseline. CBO assumes that Congress intends to allow expiring tax-reducing provisions, such as the tax extenders, to expire permanently. This is contrary to the way it estimates its discretionary spending baseline, where it assumes that Congress intends expiring spending programs such as the farm program, highway spending, and annual appropriations to continue permanently.

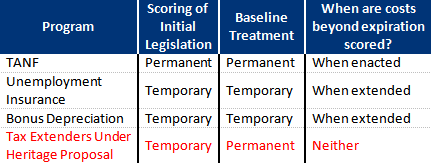

There is a kernel of truth to this; some types of spending – like farm payments and Temporary Assistance for Needy Families (TANF) – do expire. Unlike temporary tax provisions, CBO does not score a “cost” to extending them. However, there is also a very major difference. The costs of spending policies are assumed to continue in the baseline beyond their expiration. When legislation established these policies, it already incorporated the costs that continued beyond expiration.

In contrast, a temporary tax extenders package has never been scored and passed with a recognition it would be permanent. Therefore, allowing a costless extension now would violate the principle that every cost must be acknowledged and accounted for in the budget process.

In contrast, a temporary tax extenders package has never been scored and passed with a recognition it would be permanent. Therefore, allowing a costless extension now would violate the principle that every cost must be acknowledged and accounted for in the budget process.

In general, CBO is required to follow current law, assuming mandatory spending programs and tax provisions expire when scheduled. However, budget conventions allow the Budget Committees and OMB to determine, in consultation with CBO, whether any new spending program costing over $50 million annually should be treated as continuing after their expiration. Importantly, this decision applies to both the scoring of the legislation creating the provision and its future treatment in the baseline. If budget scorekeepers choose to assume a program continues after its expiration, current and future costs beyond the expiration are all recognized in the initial legislation, and reauthorizations of that legislation are only scored to the extent they spend less or more than that initial legislation would have provided.

Thus, a new “four-year” program would be scored as though it lasted for ten years when it is being considered, so adherence to PAYGO would require Congress to offset its costs for ten years. An extension for the remaining six years does not have to be paid for, since Congress has already offset its 10-year costs.

By contrast, legislation which policymakers pass as temporary will have a smaller cost initially but additional costs when extended. A new tax break or provision expanding a program that is scheduled to expire after four years would only be scored with costs for four years, so legislation extending the provision would be scored with additional costs beyond expiration.

This difference could be illustrated by comparing TANF to extending unemployment benefits. Reauthorizing TANF (which expires this year) at its current level of about $17 billion per year would be “scored” as costing nothing because the costs of the program after the expiration were accounted for when the program was initially authorized. By contrast, extending unemployment benefits (which expired last year) for a year scores as costing about $25 billion, since the last extension only accounted for the temporary cost of doing so. The same rule which applies to unemployment benefits also applies to the tax extenders.

Although these rules may be imperfect, no inconsistency exists. Rather, it would be inconsistent to pass legislation as temporary, score its costs as temporary, and then assume it as permanent so that the long-term costs were never acknowledged. As then-CBO Director Peter Orszag explained:

A fundamental principle for the integrity of the budget process is that, when a particular policy or program has a set expiration date, its long-term cost should be scored either at the time of enactment or when it is extended beyond the expiration date. … Scoring expiring provisions as entailing no budgetary cost after their expiration, but then assuming their extension in the baseline, would cause the costs of extending those provisions to “disappear” from the process—which would substantially undermine its integrity.

This point goes beyond integrity. If costs are never recognized, lawmakers will have opened a huge loophole they could use to significantly increase the deficit. Expiring tax breaks were enacted as temporary provisions, which limited their cost on paper and the amount of offsets needed. Suddenly assuming these temporary provisions to be permanent would allow lawmakers to enact costly tax breaks (or spending increases) while only acknowledging a small portion of their cost.

To be sure, there is room to reform the current budget rules. Because the conventions allowing costs to be assumed in the baseline only apply to whole programs and not individual provisions, policymakers are currently not given the opportunity to pass tax breaks which they want to include in the baseline. Rules could be reformed so individual tax breaks are treated as programs and assumed to continue after expiration in the baseline. But in the name of consistency, if an expiring tax break were treated as permanent in the baseline, it would be scored with the full ten years of costs for PAYGO requirements.

Whether they choose to address all the costs now or do so one year at a time, policymakers must recognize all the costs of all tax breaks or spending increases. Those which have not been recognized in the past should be paid for in the future so as not to worsen an already dismal fiscal picture.