Trustees: Social Security & Medicare Approaching Insolvency

The Social Security (our analysis here) and Medicare (our analysis here) Trustees just released their annual reports for 2021 on the financial status of their respective trust-fund programs. The Trustees show that the Social Security and Medicare Part A trust funds are rapidly approaching insolvency, and their funding imbalances need to be addressed sooner rather than later to prevent across-the-board benefit cuts or abrupt changes in tax or benefit levels.

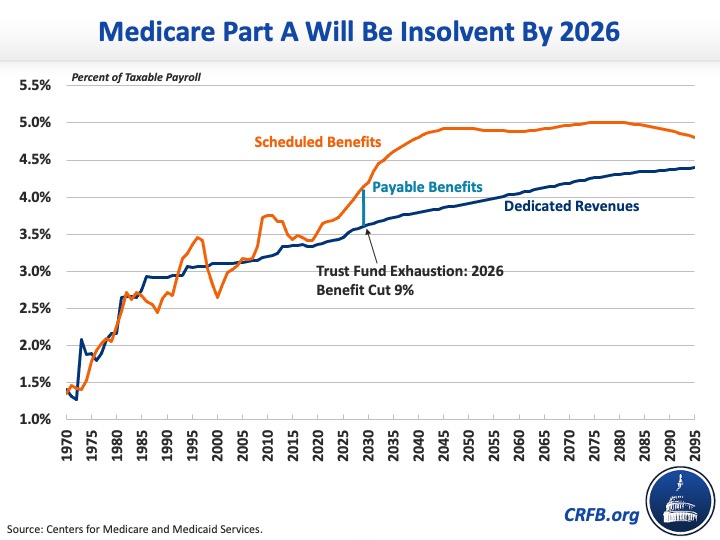

The Medicare Trustees project the Medicare Part A Hospital Insurance (HI) trust fund will run out of reserves in only five years, by 2026. Upon insolvency, Medicare Part A spending must be cut by 9 percent, with those cuts growing to 22 percent by 2045. The Trustees estimate a 75-year actuarial shortfall of 0.77 percent of taxable payroll, meaning that restoring solvency would require the equivalent of a 16 percent benefit cut or 27 percent increase in the standard payroll tax rate.

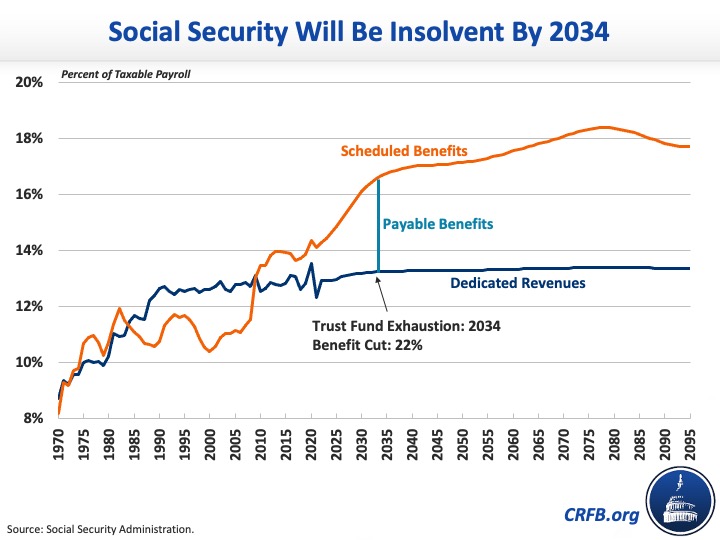

The Social Security Trustees, meanwhile, project the Social Security Old-Age and Survivors Insurance (OASI) trust fund will deplete its reserves by 2033 and the Social Security Disability Insurance (SSDI) trust fund by 2057. The theoretically combined trust funds will exhaust their reserves by 2034, when current 54 year-olds reach the full retirement age and today’s youngest retirees turn 75. Upon insolvency, all beneficiaries will face a 22 percent across-the-board benefit cut, growing to 26 percent by 2095. The Trustees estimate a 75-year actuarial shortfall of 3.54 percent of taxable payroll for Social Security, which is 0.33 percentage points higher than last year’s estimate of 3.21 percent of payroll.

The Committee for a Responsible Federal Budget will publish our full analyses of both Trustees’ reports later today and tomorrow, and will host an event (register here) on the state of the trust funds tomorrow.

Read our press release on the 2021 Social Security and Medicare Trustees’ reports here.