Trustees' Report Confirms Medicare Cannot Be Ignored Much Longer

Though health care has been a hot topic in Washington this year, Medicare has been conspicuously absent from the debate despite being the largest federal health program. This month's Medicare Trustees' report, released along with the Social Security Trustees' report, provides a reminder that regardless of what happens with health reform, policymakers will still need to make significant reforms to Medicare.

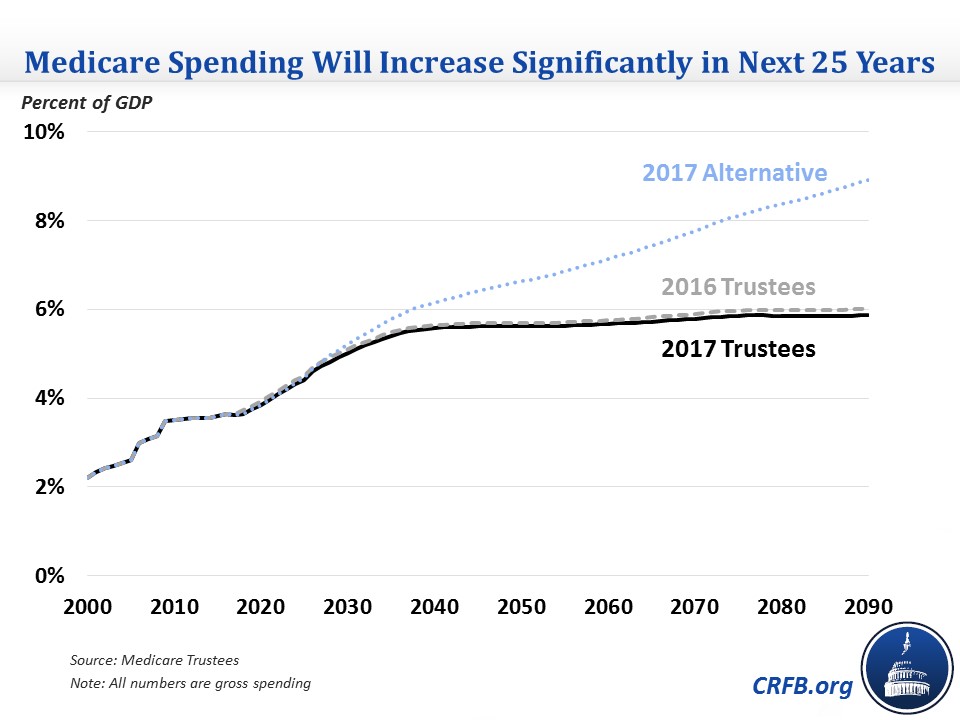

Although the report shows a slightly improved picture compared to last year, gross Medicare spending increases from 3.6 percent of Gross Domestic Product (GDP) in 2017 to 5.6 percent by 2040 and the Part A Hospital Insurance (HI) trust fund will become insolvent by 2029. Below are some of the highlights in the report.

Hospital Insurance (HI) Trust Fund

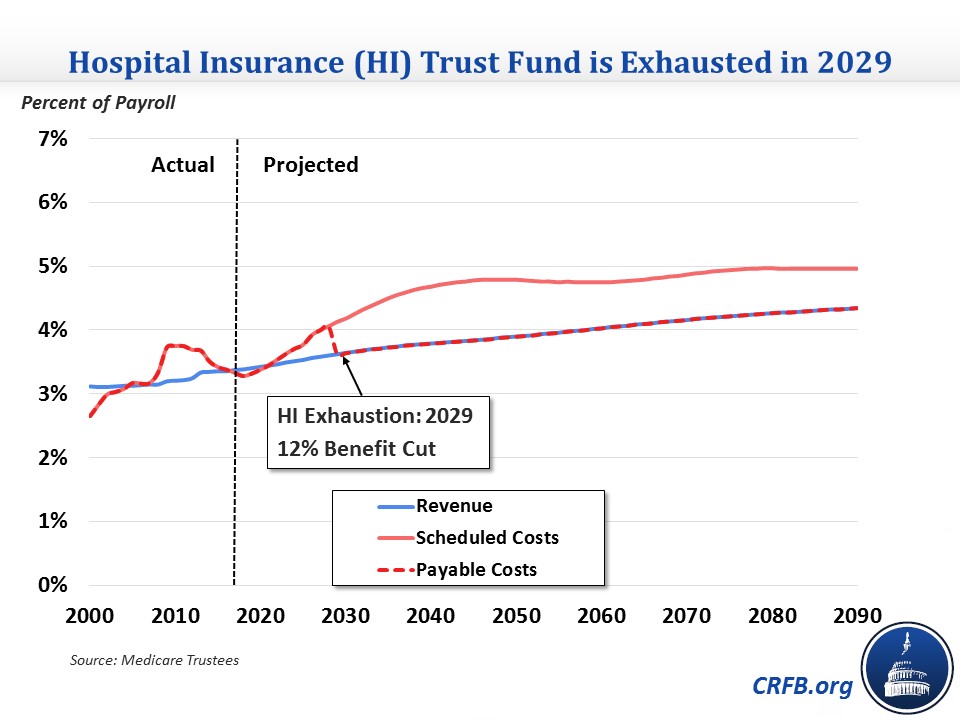

The Hospital Insurance (HI) trust fund for Part A is financed by dedicated revenue sources – mainly a payroll tax – and has a trust fund similar to the one used by Social Security. The Trustees project this trust fund will run out of reserves in 2029 and faces a shortfall of 0.64 percent of taxable payroll (or about 0.3 percent of GDP) over the next 75 years. Closing the shortfall would take an increase in the payroll tax of about 0.6 percentage points – from 2.9 to 3.5 percent on income below $200,000 ($250,000 for couples) and 3.8 to 4.4 percent on income above that – or equivalent spending cuts.

The trust fund's insolvency and long-term shortfall are due to spending growing much faster than revenue: benefits will grow from 3.3 to 4.8 percent of payroll over the next 30 years while revenue will only grow from 3.4 to 3.9 percent over the same period.

These HI projections are slight improvements over last year's report, which projected insolvency in 2028 and a 75-year shortfall of 0.73 percent of payroll. The improvement in the shortfall is largely due to lower-than-expected 2016 spending and lower expected hospital utilization of health care. On the other hand, slightly lower real wage growth in this year's report claws back part of these improvements. Still, the Trustees show growing HI deficits over the long term that policymakers will need to address.

Total Medicare Spending

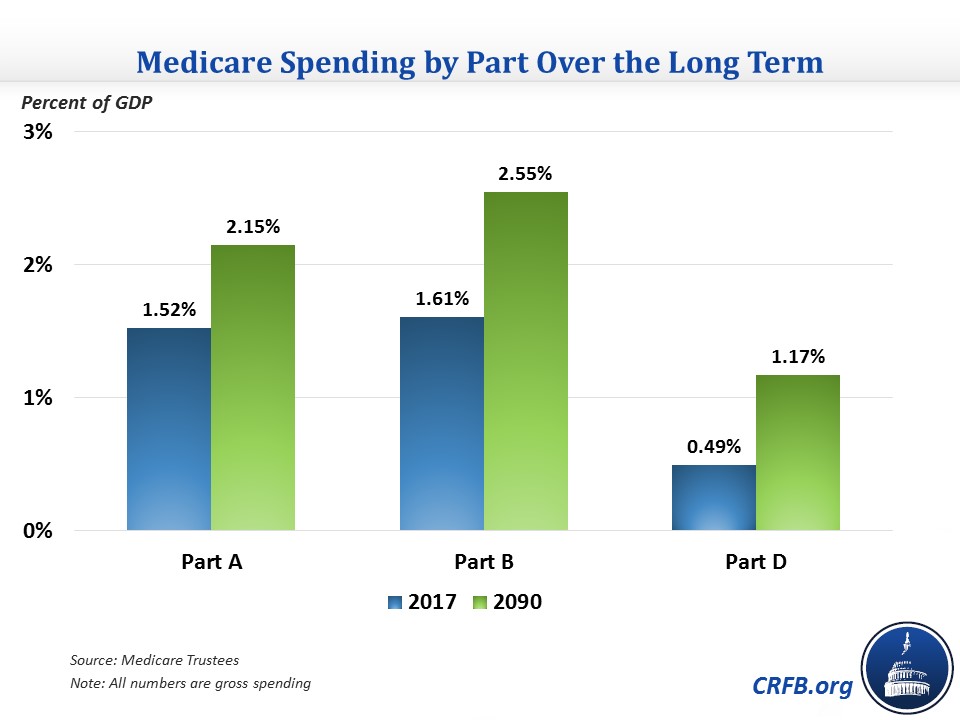

In addition to Part A, Medicare also has Parts B and D for outpatient care and prescription drugs, respectively. These programs are funded by premiums and general revenue as necessary to keep them solvent, so they can't become insolvent. But like HI, their costs are expected to grow significantly over the long term.

Total Medicare spending has already grown from 2.2 percent of GDP in 2000 to 3.6 percent of GDP in 2017. It is expected to grow further to 5.6 percent by 2040 and 5.9 percent by 2090. The 2090 total is slightly lower than the 6.0 percent of GDP that Medicare was expected to cost in last year's report.

The cost increases are spread across each part of Medicare but are more concentrated in Parts B and D, which will account for nearly three-quarters of the 2.2 percentage point of GDP increase between now and 2090. Part D is expected to grow particularly fast, doubling as a share of GDP between now and 2090, though it will remain smaller than the other two parts.

Since the Trustees expect Medicare per-beneficiary spending and per-capita economic growth to be about the same (just below 4 percent) over the long term, growth in Medicare as a share of GDP is due to an increase in the number of beneficiaries. Enrollment is expected to increase from 59 million in 2017 to nearly 89 million by 2040 and 120 million by 2090.

Illustrative Alternative Projections

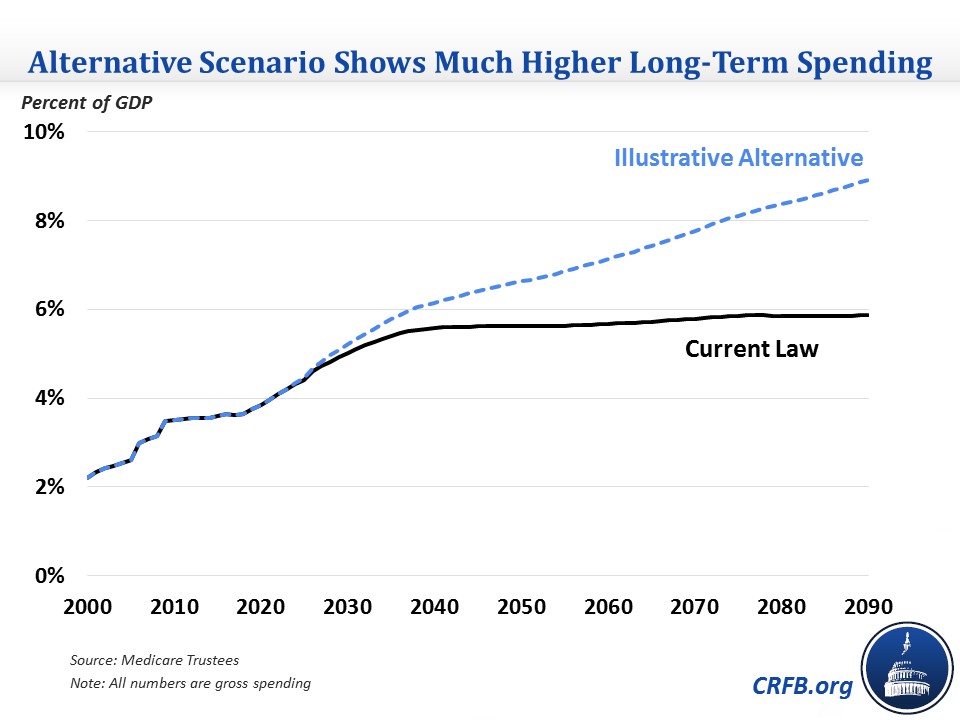

A significant reason why the Trustees project that per-person Medicare spending won't grow faster than the economy is that they assume a number of cost-containment policies under current law are allowed to continue, even though the policies may prove unsustainable over the long term. The Trustees specifically identify these policies as:

- Productivity adjustments that reduce the growth of payments for certain health care services by the amount of economy-wide productivity growth

- The expiration in 2025 of 5 percent bonuses for physicians who participate in Alternate Payment Models

- Physician payment updates that were enacted to avert large short-term payment cuts in 2015 but would result in even lower payment rates over the long term

- Cuts mandated by the Independent Payment Advisory Board (IPAB)

The Trustees produce an illustrative alternative projection that assumes many of these policies are overturned or rolled back. Specifically, this scenario reduces the productivity adjustments by nearly two-thirds, continues the 5 percent bonuses, increases physician payments by 2.2 percent instead of 0.6 percent per year over the long term, and eliminates IPAB cuts (which don't have a large effect under the default projection but would in the alternative one).

Under the alternative scenario, Medicare spending would grow much faster, particularly after 2040. Medicare spending would reach 6.2 percent of GDP in 2040 (compared to 5.6 percent under current law) and 8.9 percent by 2090 (compared to 5.9 percent under current law).

Independent Payment Advisory Board

The Independent Payment Advisory Board (IPAB) is tasked with reducing Medicare spending if it exceeds a certain target. That target is the average of medical inflation and general inflation through 2017 and GDP growth plus 1 percent after 2017. If Medicare growth exceeds the target, IPAB is instructed to produce a plan to reduce Medicare spending by the difference. If IPAB fails to act, the Secretary of Health Human Services must make a proposal. Congress is then tasked with either accepting the proposal as is, passing alternate but equivalent cuts, or preventing the cuts entirely (with a supermajority vote).

The Trustees estimate that IPAB would be triggered for the first time in 2021 (four years later than last year's report), though the cut would be only 0.002 percent, or $19 million. This means that Congress would be required to act on a package in 2022, or the cuts would go into effect in 2023. Over the next ten years, IPAB is projected to be triggered again in 2024, 2025, 2026, and beyond then, it would be triggered in 2028, 2031, and 2033.

Required IPAB Cuts in the Next Ten Years

| Trigger Year | Percent Cut | Dollar Cut* |

|---|---|---|

| 2021 | 0.002% | $19 million |

| 2024 | 0.32% | $3.8 billion |

| 2025 | 0.35% | $4.4 billion |

| 2026 | 0.32% | $4.4 billion |

Sources: Medicare Trustees, CRFB calculations.

*Based on gross Medicare spending. Net savings could be smaller since Part B and D premiums are linked to their programs' costs.

The President's budget proposed eliminating IPAB, which the Congressional Budget Office estimated would cost $20 billion over ten years. Since CBO also expects IPAB to be triggered four times in the next ten years, it is possible that the Trustees would find a similar cost for repeal.

*****

The Medicare Trustees continue to show a significant increase in Medicare spending, especially over the next quarter-century, and insolvency for Part A in just over ten years. Medicare spending has gone unaddressed in the debate over the Affordable Care Act so far, but it will need to be reformed as it is one of the main drivers of increasing debt over the long term. Importantly, there are many ways to reduce Medicare spending without cutting benefits. These changes include delivery system reforms, ensuring that quality is emphasized over quantity, and reforms to cost-sharing within the program. Policymakers should look to these reforms as the starting point for a discussion on how to make this vital program sustainable over the long run.