The Tax Break-Down: The State and Local Tax Deduction

This is the first post in a new CRFB blog series The Tax Break-Down, which will analyze and review tax breaks under discussion as part of tax reform.

The state and local tax deduction is one of the largest in the tax code and allows individual income taxpayers who itemize to deduct from their income the cost of certain taxes paid to state and local government. Specifically, it allows for three different types of taxes to be deducted from income: income taxes, property taxes, and sales taxes – though the sales tax deduction expires at the end of the year.

The deductions for state and local taxes have been in place since the income tax was created in 1913 – though the sales tax deduction was removed in the Tax Reform Act of 1986 before being added back on a temporary (but continued) basis in 2004. Most other countries have no equivalent deduction, in part because the federalist nature of the United States (with autonomous state governments) is relatively unique.

Below, we answer a number of questions about this tax break.

How Much Does It Cost?

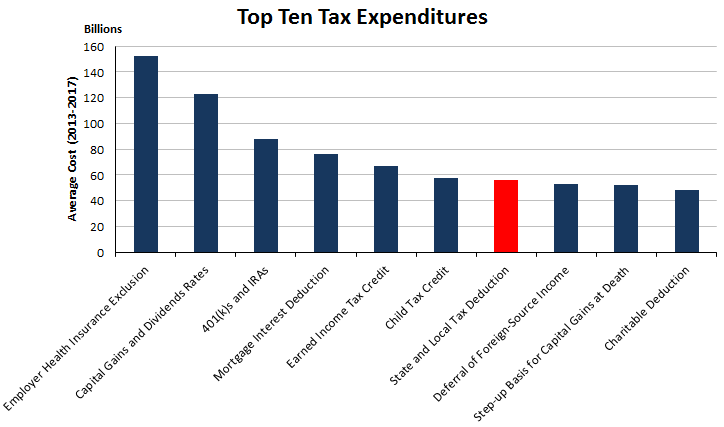

The state and local tax deduction is the seventh largest tax expenditure in the tax code costing the federal government $77 billion of foregone revenue in 2013 according to JCT and CBO and $1.1 trillion over the next ten years. OMB estimates the cost at $64 billion in 2013. Based on CBO's numbers, this amount of revenue could be sufficient to reduce all individual taxes by about 5 percent (which translates into 2 points for the top rate) or reduce each rate uniformly by about 1.5 points.

About three-fifths of the deduction’s cost comes from the income tax deduction and the remainder from the property tax deduction. A small portion – about 2% in 2011 – comes from the sales tax deduction which would cost $15-20 billion to extend over the next ten years.

Importantly, the value of the state and local tax deduction interacts significantly with the Alternative Minimum Tax (AMT) which allows no deduction for these taxes. Repealing the AMT, as a number of tax reform plans propose, would noticeably increase the size of the state and local tax deduction. According to numbers published in 2010 by the Tax Policy Center, when taxpayers recalculate their income under the AMT, roughly two-thirds of the increase comes from denying state and local tax deductions.

Who Does It Affect?

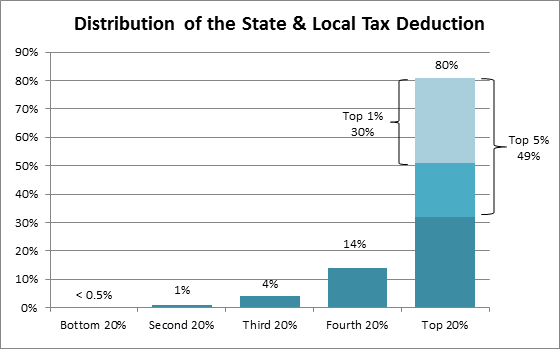

As an itemized deduction, only 27 percent of taxpayers take advantage of the state and local tax deduction every year. According to the Congressional Budget Office (CBO), a full 80 percent of the value of the preference flows to the top 20 percent of the income spectrum. Three tenths of the value of the deduction, meanwhile, flows to the top 1 percent of the population. Whereas the deduction increases after-tax income for the average taxpayer by about 0.8 percent, it increases after-tax income for the top one percent by 2.2 percent.

Source: CBO

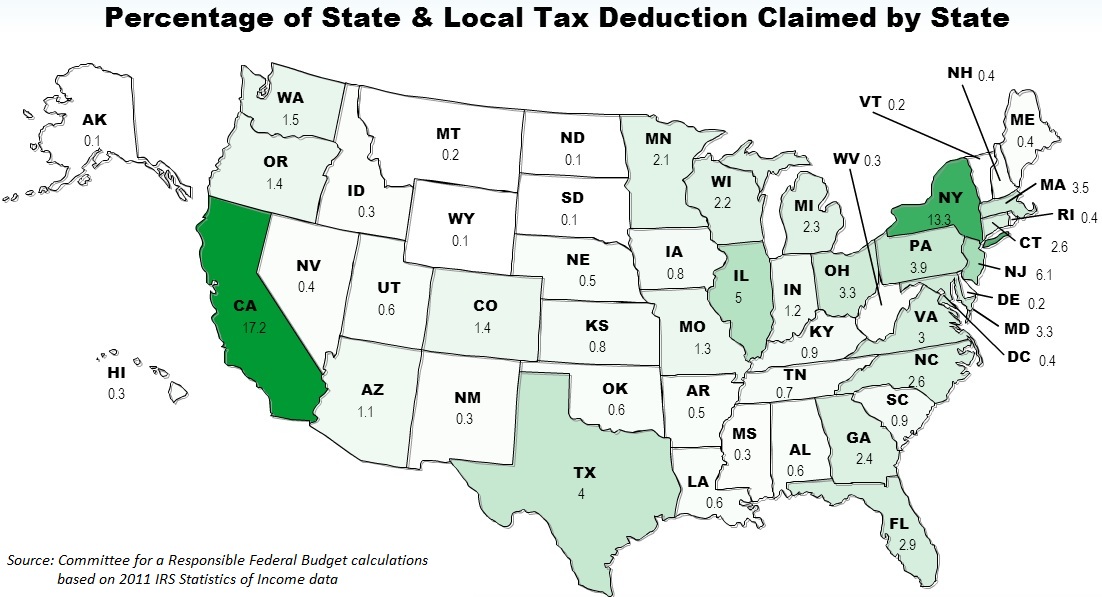

Yet the benefit of the tax deduction is skewed not just by income but by state. High-income, high-tax states like California and New York claim 17 and 13 percent, respectively, of the deduction, while residents in many low-tax states in the Midwest and Rocky Mountains see almost no benefit. As the Tax Policy Center points out, half the beneficiaries and over 60 percent of the amount deducted comes from just 10 states.

Source: CRFB calculations based on 2011 IRS Statistics of Income data. Mapping tool provided by the National Council of Teachers of Mathematics

Eight states have no state income tax, and get much more benefit from the sales tax deduction. If the sales tax deduction expires at the end of the year, states that depend on sales tax revenues rather than the income tax, like Washington, Texas, Florida, and Tennessee will lose most of the deduction’s benefits.

What are the Arguments For and Against the Deduction?

Proponents of keeping the state and local tax deduction argue that the deduction prevents double taxation, since a portion of the taxpayer's income that would otherwise be taxed by the federal government is already taxed at the state level. Proponents also argue that the state and local tax deduction is a form of financial assistance to the states, by reducing the tax burdens of their residents. In addition, it is important to remember that the state and local tax deduction – or at least the income tax deduction – reduces taxpayer’s effective marginal rates by blunting the impact of high state income tax rates.

Critics point out that that deduction is regressive and provides a back-door subsidy to high-tax states and localities. This provision unwittingly has residents in low-tax states subsidize budgets in states with larger governments. The deduction also favors some state revenue sources over others, for example license fees and severance taxes – which fund much of the government in Delaware and Alaska, respectively, are not deductible. Finally, critics argue the $1.1 trillion cost of the deduction could be better used for repealing the much-loathed Alternative Minimum Tax while reducing rates or deficits.

What are the Options for Reform?

A number of options exist to reduce the cost of the state and local tax deduction. One possibility would be to eliminate it in its entirety (possibly in part of a trade to repeal the AMT), or to eliminate either the property or income portion of the deduction.

Short of elimination, the deduction could be converted into a credit, limited to a certain rate (i.e., the 28 percent rate), capped as a percentage of income, or limited to a certain dollar amount. The most recent available score of full repeal was in 2011, when CBO estimated $862 billion in ten year savings. In today’s terms measured against the laws currently in place, this would likely be the equivalent of nearly $1.1 trillion. More modest options would result in smaller amounts of savings.

| Options for Reforming the State and Local Tax Deduction | |

|---|---|

| Option | 2014-2023 Revenue |

| Repeal the S&L Tax Deduction | $950 billion |

| Repeal the Income Tax Deduction Only | ~$600 billion |

| Repeal the Property Tax Deduction Only | ~$350 billion |

| Cap the Deduction at 2 percent of Income | $720 billion |

| Cap the Deduction at $5,000 Per Person (indexed) | $600 billion |

| Limit the Value of the Deduction to the 28% Bracket | $150 billion |

| Replace the Deduction with a 15% Credit | $240 billion |

What Have Tax Reform Plans Done With The Deduction?

Unlike some of the other large tax expenditures, there appears to be substantial support among bipartisan plans for a full repeal of the state and local tax deduction. Since the 1984 Treasury paper that launched the 1986 tax reform effort called for its complete repeal (which was not achieved in 1986), a number of plans have followed in step.

President Bush's 2005 tax reform panel called for complete elimination, arguing that state and local taxes pay for public services and “should be treated like any other nondeductible personal expense, such as food or clothing, and that the cost of those services should be borne by those who want them – not by every taxpayer in the country.” The Fiscal Commission illustrative plan and the Domenici-Rivlin tax reform plan also fully repealed the deduction.

To be sure, not all tax reform plans follow that model. The Center for American Progress, for example, replaces the state and local tax deduction with an 18% credit. And the Wyden-Coats Bipartisan Tax Fairness and Simplification Act leaves the deduction in its entirety (though it would likely be used less, because the standard deduction is tripled). It remains to be seen what the tax reform bills put forward by Chairmen Camp and Baucus do with the deduction.

Where Can I Read More?

- Congressional Budget Office – The Deductibility of State and Local Taxes

- Yuri Shadunsky (Tax Policy Center) – Tax Facts: State and Local Tax Deductions

- Tax Policy Center – State and Local Tax Policy: How does the deduction for state and local taxes work?

- National Review Online – The Blue Tax

- Federal Reserve Bank of Boston – The Subsidy from State and Local Tax Deductibility

- Kim Rueben (Tax Policy Center) – The Impact of Repealing State and Local Tax Deductibility

- Louis Kaplow – Fiscal Federalism and the Deductibility of State and Local Taxes under the Federal Income Tax

- Bruce Bartlett – The Deduction for State and Local Taxes

* * * *

The state and local tax deduction is expensive, regressive, targeted toward a small number of states, and is certainly ripe for reform. At the same time, any changes to the deduction, unaccompanied by other reforms, could modestly reduce work incentives, make some states less appealing to live in, and substantially increase the tax burden of some taxpayers.

How far policymakers are willing to go in modifying the state and local deduction may depend in large part on what they are able to achieve with regards to tax rates and the Alternative Minimum Tax. Even without the outright repeal recommended in a host of bipartisan tax plans, many options exist to trim the cost of this tax break.

See the other tax preferences discussed in The Tax Break-Down here and read more options and analyses on our SALT Deduction Resources page.