Tax Break-Down Series Gathering Attention

Our new series, "The Tax-Break Down," continues to look into the costs associated with specific tax breaks, the arguments for and against them, and several options for reform, and it is gaining a lot of attention from policymakers and the media. Over the last two weeks, we published three more entries in the series, profiling a popular manufacturing deduction, municipal bonds that finance infrastructure, and fringe benefits offered by employers. Our posts have been covered in Forbes magazine, the Bond Buyer, and Global Tax News. We were also mentioned by Reuters and prompted other think tanks to write op-eds based on our posts.

The article in Forbes did a particularly nice job summarizing why the series is important:

It’s part of a series of reports, The Tax Break-Down, analyzing lesser known tax expenditures, to coincide with Congress’ return from summer break and return to tax reform talks. The idea is that paring back tax preferences will allow for lower tax rates and help reduce the deficit.

The problem is that everyone has a favorite tax break. Maybe yours is the mortgage interest deduction or the charitable deduction or the exclusion of interest income on municipal and private activity bonds.

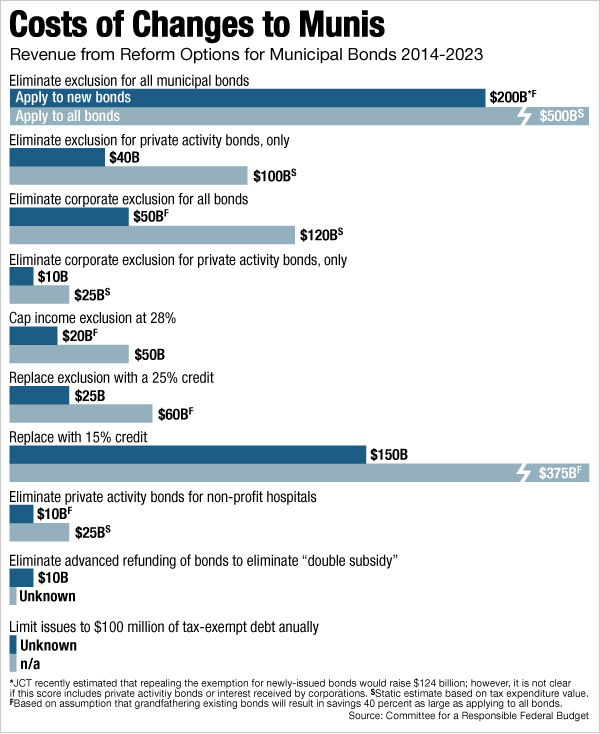

Everybody has favored tax expenditures, but the series shows that even the most popular expenditures could often be reformed, simplified, or better targeted. For instance, converting the tax exemptions on municipal bonds to a credit could deliver the same subsidy to local borrowing at at less cost to the taxpayer. And earlier, we wrote about reforms to the charitable deduction that would make the tax break available to more people and increase charitable giving, while reducing the deficit.

In addition to the features of the series, the Bond Buyer made a nice graphic out of our options to reform municipal bonds.

Below you can read all the Tax Break-Downs, listed individually:

- The State and Local Tax Deduction

- LIFO Accounting

- Preferential Rates on Capital Gains

- Child Tax Credit

- Section 199, the Domestic Production Activities Deduction

- Municipal Bonds

- Cafeteria Plans and Flexible Spending Accounts

- Accelerated Depreciation

- Individual Retirement Accounts

- American Opportunity Tax Credit

- Intangible Drilling Costs

- Foreign Earned Income Exclusion

- FICA Tip Credit

- Low-Income Housing Tax Credit

- Charitable Deduction

- Tax Extenders