Taking a Closer Look at the Senate's Highway Bill

We commended the Senate last week for seeking a long-term solution to the highway funding shortfall and for funding its proposal with real offsets. That said, the bill's current form has a few problems. In particular, the bill actually worsens the structural mismatch between revenue and spending in the Highway Trust Fund (HTF) by increasing spending levels in the baseline without a corresponding increase in revenues and approving six years of funding but only paying for the first three, increasing the pressure for a future bailout of the fund. While the short-term patch passed by the House is more likely to become law in the near term, it is worth considering these issues in more detail because they are likely to arise again when negotiations on a long-term solution resume.

But before we jump into the problems with the Senate’s highway bill, it’s useful to revisit the unique budgetary treatment of the HTF.

The HTF’s unique budgetary treatment

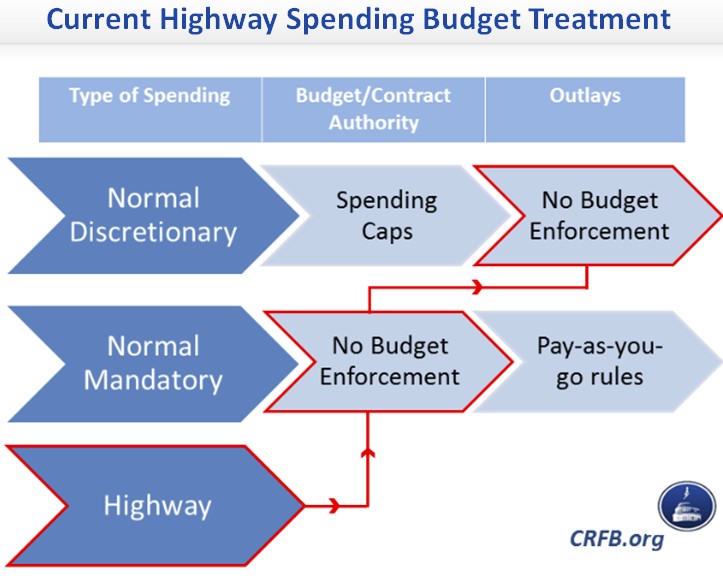

As we wrote last year, highway spending is subject to a unique hybrid of discretionary and mandatory budgetary treatment which effectively allows it to sneak by budget rules. Currently, budget rules limit new discretionary spending through statutory caps on budget authority and limit new mandatory spending by applying pay-as-you-go (PAYGO) rules to mandatory outlays. However, highway spending evades both these limits since its contract authority counts as mandatory, meaning it is not subject to PAYGO, while its outlays count as discretionary.

In addition, scorekeeping conventions used by CBO assume that baseline spending on highway programs will continue at current levels regardless of whether the HTF has sufficient funds to allow such spending. The result is that allowing spending to continue at current levels after the trust fund is depleted does not increase spending relative to the CBO baseline. This means that general revenue transfers into the HTF are not scored as a net cost to the government. It is therefore possible for Congress to increase authorization levels without paying for higher spending and then provide general revenue transfers to cover the higher spending levels without paying for them either. Helping to alleviate this issue in the short term, a special scoring rule in this year’s House budget means that transfers from the general fund to the HTF must count as a cost, and therefore must be offset. It is uncertain whether such a rule will be in force in the future.

Six years of spending approval, three years of offsets

The Senate’s bill would provide spending approval for six years, but only identifies offsets for the first three. The unique budgetary treatment of the HTF and the structure of the bill means that the increase in mandatory contract authority above the current baseline in years 4-6 of the bill does not need to be offset, skirting PAYGO rules. It is debatable whether policymakers would be willing to commit to this increase in spending if they had to identify ways to offset the cost. At the very least it would force them to consider the tradeoffs associated with this increase in spending, instead of pinning that problem on future lawmakers.

While the spending authority only lasts as long as there is money in the trust fund, effectively requiring additional revenues for the trust fund to continue spending after three years, this structure increases the pressure for a future bailout and increases the size of the bailout that will be required. This could show up in two ways: highway spending may get first preference on future offsets, to the detriment of other priorities in the budget; or if there are no budget rules in effect in three years requiring general revenue transfers to be scored as a cost, policymakers may simply choose to bailout the trust fund with a general revenue transfer without finding offsets.

A failure to bring revenues and spending in line

While the bill proposed by the Senate does include genuine offsets, it does not address the underlying structural mismatch between revenues and spending in the HTF that has existed since 2008. This structural mismatch has made it necessary for general revenue transfers (typically not paid for) to keep trust fund solvent. We have been advocating for some time now for a comprehensive solution to this issue that brings revenues and spending into line.

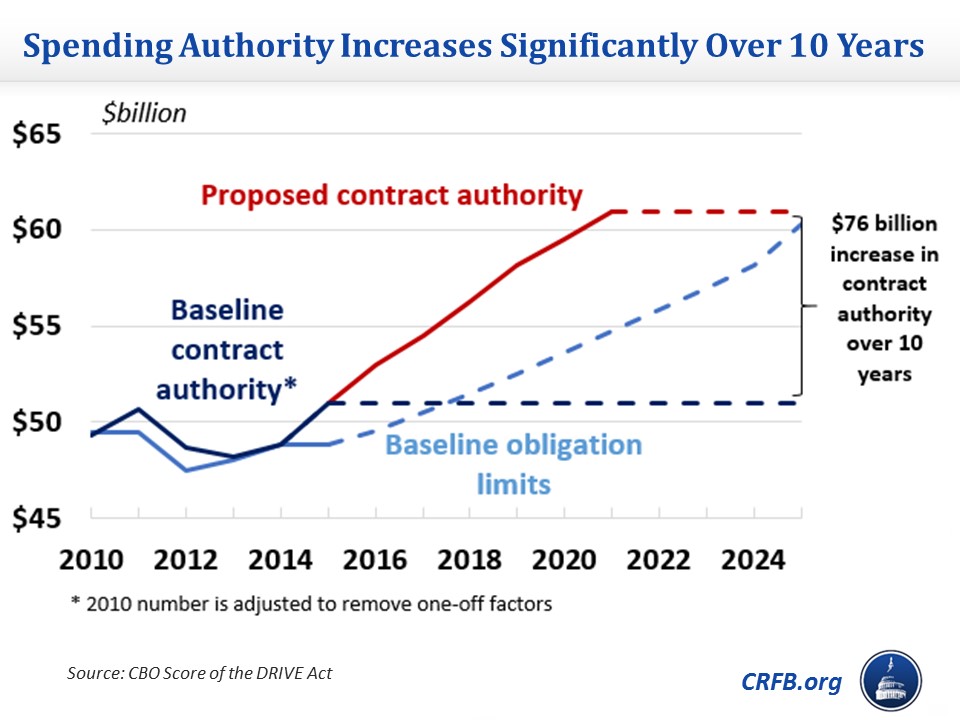

Moreover, the bill actually worsens the structural deficit in the trust fund by increasing projected spending above ‘baseline’, which is essentially current spending. In the first three years, the bill would increase contract authority by around $11 billion over the current baseline. Contract authority would be $26 billion higher in years 4–6 when the increase in spending was not constrained by the need for offsets. This increase in contract authority is built into the baseline for the rest of the decade and beyond. Over the 10-year budget window, actual and projected contract authority will be $76 billion higher than the current baseline for contract authority, and $43 billion higher than the current baseline for obligation limits, which unlike contract authority are assumed to increase with inflation in the baseline.

Time to revisit the treatment of highway spending

This bill highlights the need to change the budgetary treatment of highway spending. Highway spending should be either entirely mandatory, in which case it would be subject to PAYGO requirements for offsets, or entirely discretionary, which would make it subject to discretionary caps and force it to compete with other priorities.