On Social Security’s 79th Birthday, CRFB Releases Updated "Social Security Reformer"

It was on this day 79 years ago that President Franklin Roosevelt signed into law the Social Security Act of 1935. While lawmakers have expanded the program since 1935 and changed it in many ways, the Social Security system still protects Americans against the “vicissitudes of modern life.” Social Security is the flagship program of social insurance in the United States.

It’s no secret that Social Security faces serious long-term funding challenges, as the latest report from the program's very own trustees highlights. If no action is taken, all benefits are set to drop by 23 percent in 2033, when all the programs assets would dry up, and disability benefits are on course to drop by almost one-fifth by 2016 when the Disability Insurance trust fund goes dry. It is critical that lawmakers address the gap between Social Security spending and revenues so the program can enjoy another 79 years (and more) of providing full benefits to retired workers, disabled workers, spouses, and any surviving family members. And the longer we wait, the more difficult solutions will become.

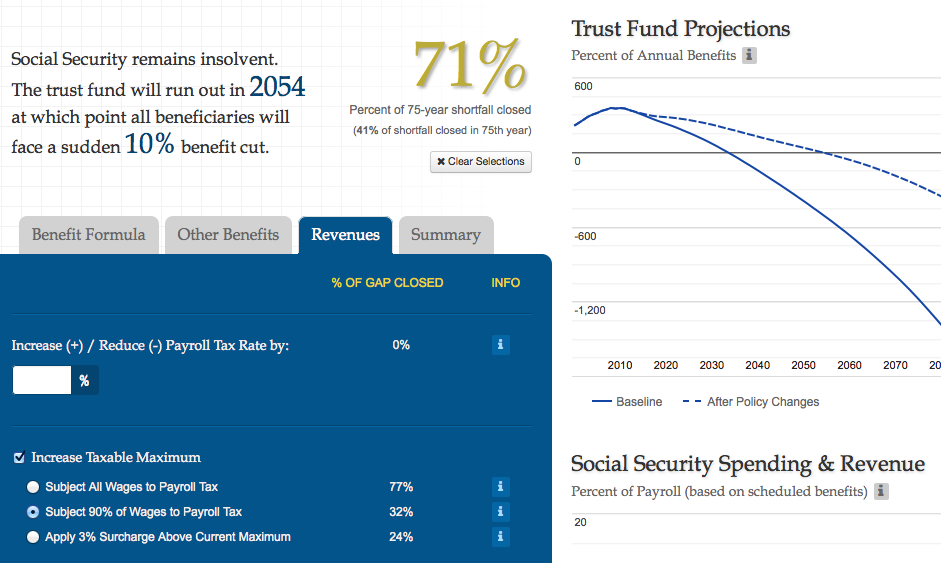

Luckily, CRFB has an incredible interactive tool to get lawmakers and the public started on picking and choosing from many reform options to set the program on a sustainable path: CRFB’s Social Security Reformer.

Users can pick from reforms to Social Security’s benefit structure – including increasing or decreasing initial benefits, changing the retirement age, and modifying annual COLAs – as well reforms to the program’s revenues – including increasing or decreasing the payroll tax rate, increasing the tax base, and making other changes. Users aim to close the 75-year shortfall and the shortfall in the 75th year, and The Reformer tracks your progress toward those goals.

Click here to check out CRFB's updated Social Security Reformer.

Even if you’ve tried your hand in the past at creating a plan to restore Social Security’s financial health, the Trustees’ projections change somewhat from year to year. Although the main takeaway that Social Security will exhaust its assets sometime in the early 2030s has remained unchanged in recent years, new projections may mean that a plan that used to create a solvent future for Social Security may now fall a bit short. The Reformer now includes the latest projections from the Trustees, so be sure to give the interactive tool another go to make sure you can restore solvency.

Since CRFB first released The Reformer in June 2013, the tool has been visited over 20,000 times. Many users have even opted to submit their results – showing exactly which reforms they would make to the benefit structure and program revenues to help shore up the program’s future.

Overall, nearly 60 percent of users who submitted their results succeeded in fully closing Social Security’s 75-year shortfall – a clear majority! And among all submitted results, the overwhelming majority of users relied on a combination of reduced program spending and increased revenues to improve Social Security’s finances.

Among the more popular selections were:

- Increase the taxable maximum to at least 90% (85%)

- Slow initial benefit growth for at least the top 20% of earners (77%)

- Reduce disability fraud and overpayments (75%)

- Increase the retirement age to at least 68 (67%)

- Reduce annual cost of living adjustments (COLAs) to at least account for substitution bias (52%)

- Means-test benefits for higher earners (52%)

Among the least popular selections were:

- Divert 2 percent of payroll tax to “Carve-Out” accounts (5%)

- Reduce payroll tax rate (7%)

- Apply 3 percent surcharge above current maximum (10%)

- Index COLAs to “CPI-E” (10%)

Fortunately, all of the most popular reforms would improve the long-term finances of Social Security, while some of the least popular options (such as the CPI-E and reducing the payroll tax rate) would worsen them.

We encourage you, your colleagues, your family, and your friends to give The Reformer a spin and see what changes you and they would pick to fix Social Security.

Click here to check out CRFB's updated Social Security Reformer.

For more information on Social Security, check out CRFB’s other resources:

- Dispelling Five Social Security Myths

- Analysis of the 2014 Social Security Trustees Report

- Updating the Cost of Delay for Social Security

- Social Security and the Cost of Delay

- Event Recap: Decoding the Social Security Trustees Report

- Measuring Up: The Case for the Chained CPI

- Social Security blog posts on CRFB’s The Bottom Line