Social Security and Medicare Trustees Release 2023 Reports

The Social Security and Medicare Trustees just released their annual reports on the financial status of the Social Security and Medicare programs over the next 75 years. The Trustees project that the Medicare Hospital Insurance (HI) trust fund will be insolvent by 2031 and the Social Security trust funds by 2034. Trust fund solutions are needed sooner rather than later to prevent across-the-board benefit cuts or abrupt changes to tax or benefit levels.

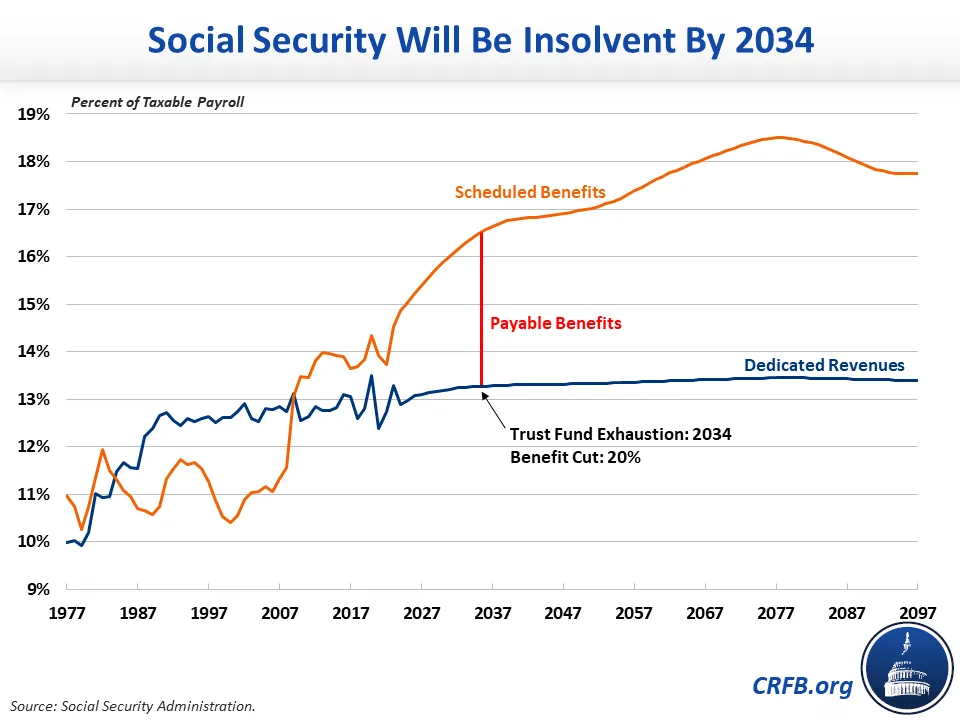

Regarding Social Security, the Trustees estimate that the Old-Age and Survivors Insurance (OASI) trust fund will deplete its reserves within the next decade, by 2033, and the Social Security Disability Insurance (SSDI) trust fund will remain solvent through the 75-year projection window. On a theoretically combined basis, assuming revenue is reallocated between the trust funds in the years between OASI and SSDI insolvency, Social Security will become insolvent by 2034, when today's 56-year-olds reach the full retirement age and today's youngest retirees turn 73. Upon insolvency, all beneficiaries regardless of age, income, or need will face a 20 percent across-the-board benefit cut, which will grow to 26 percent by 2097.

Under the Trustees' projections, Social Security faces a 75-year actuarial imbalance of 3.6 percent of taxable payroll, up from 3.4 percent in the 2022 report.

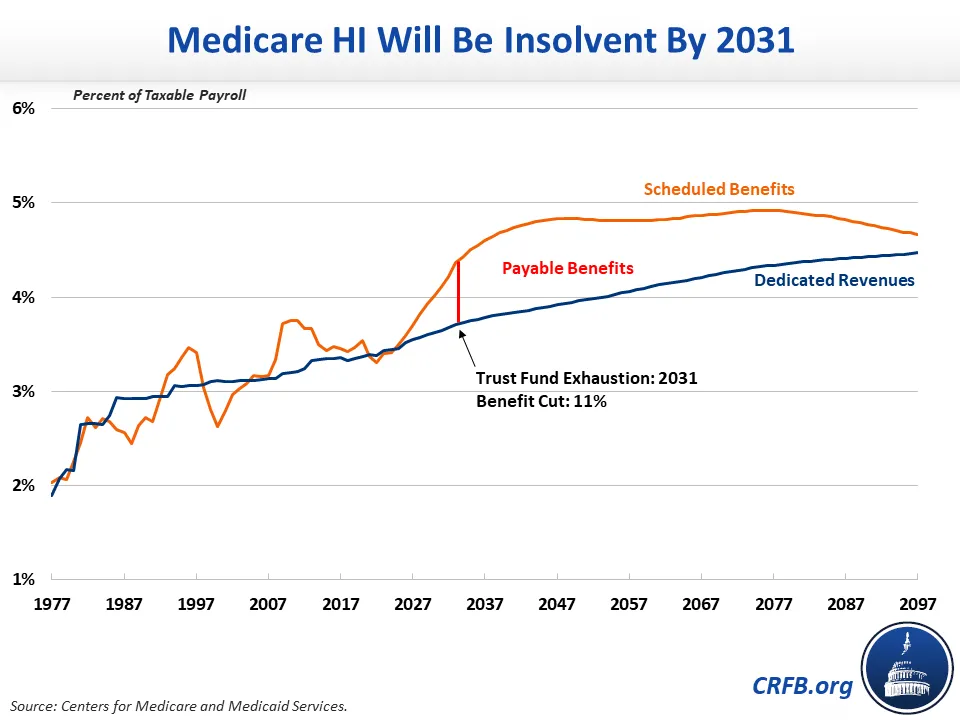

The Medicare Trustees estimate that the Medicare HI trust fund will exhaust its reserves by 2031, when today's 57-year-olds are eligible for the program and today's youngest beneficiaries turn 73. Upon insolvency, HI spending will be cut by 11 percent, and that cut will grow to 19 percent by 2047. This cut is likely to lead to disruptions in health services and access to care.

Under the Trustees' official projections, Medicare HI faces a 75-year actuarial imbalance of 0.62 percent of taxable payroll, which is lower than the 0.70 shortfall estimated in the 2022 report. Under the Medicare Actuary's illustrative alternative projections, the HI shortfall would be 1.46 percent of payroll.

The Medicare Trustees also project cost growth for Medicare Parts B and D, which do not operate with a traditional self-funded trust fund. Overall Medicare costs have already grown from 2.2 percent of Gross Domestic Product (GDP) in 2000 to 3.7 percent of GDP today. The Trustees project costs will continue to grow to 6.0 percent of GDP by the late 2040s, and costs will remain at about that level thereafter. Under the Chief Actuary's illustrative alternative projections, costs would grow to 6.5 percent of GDP by 2050 and 8.3 percent of GDP by 2097.

The Committee for a Responsible Federal Budget will publish our full analyses of the Social Security and Medicare Trustees reports later today and will host an event (register here) on the state of the Social Security and Medicare trust funds on April 4.

Read our press releases on the 2023 Trustees' reports here.