Sizing Up Revenue With the Tax Bill Enacted

As lawmakers return for the new year after the enactment of the Tax Cuts and Jobs Act (TCJA), they also face a new budget outlook with significantly lower tax revenue.

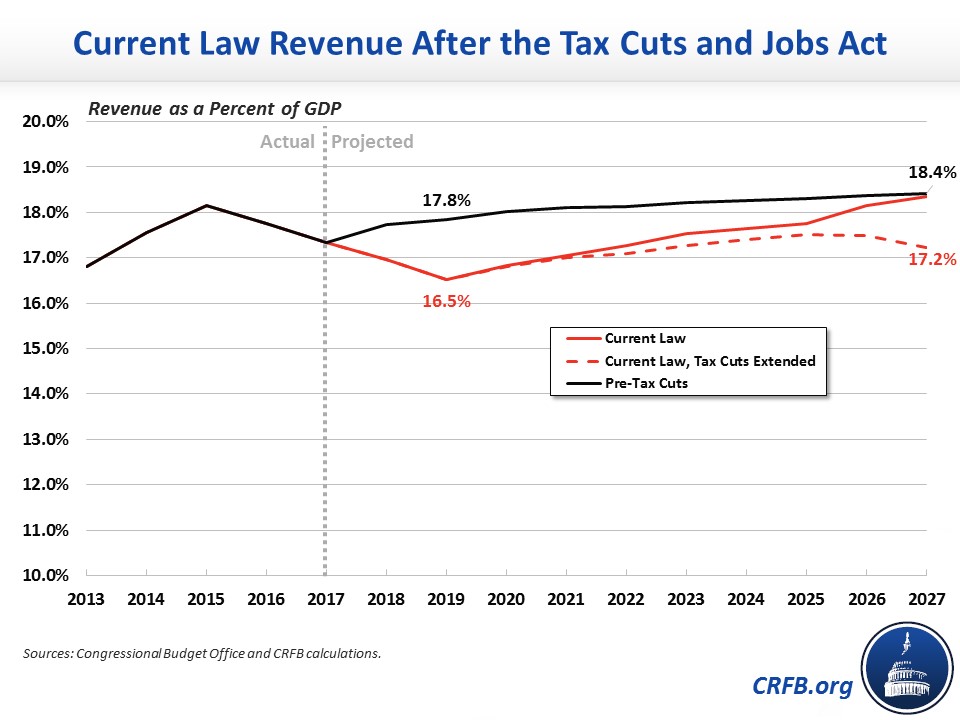

With the TCJA enacted, we estimate that current law revenue will total 17.5 percent of GDP over the next decade, dipping to a low of 16.5 percent of GDP in 2019 – significantly below pre-law projected levels of 18.2 and 17.8 percent of GDP, respectively.

Because significant portions of the bill are set to expire by 2025 (and other parts expire or take effect earlier), revenue will roughly return to its previously-projected 2027 level of 18.4 percent of GDP. However, if all cuts are extended, revenue would total 17.1 percent of GDP and end the decade at 17.2 percent. In other words, the tax bill will reduce projected revenue by 1 percent of GDP on average when fully in effect through 2027.

These figures are based on the conventional score, but a dynamic score tells almost the same story – since both revenue and GDP would rise under dynamic scoring. For example, while under conventional scoring we estimate revenue will total 17.46 percent of GDP over the next decade with the bill enacted, under dynamic scoring we estimate it will total 17.54 percent of GDP over the decade.

Importantly, the drop in revenue from the tax legislation will make it more difficult to balance the budget, reduce the debt-to-GDP ratio, or achieve any other fiscal goal. For example, stabilizing the debt as a share of GDP prior to the tax cut would have required $4.1 trillion of deficit reduction. With the tax cut in effect, the same goal will require $5.4 trillion to $6.7 trillion, depending on how the tax cut is scored and whether it is extended.

In addition, revenue levels over the next decade are likely to be much lower than under almost any past budget plan that would be improved the fiscal situation. Ten-year revenue will be 1.7 to 2.0 percent of GDP lower than what was proposed in the 2013 Simpson-Bowles "Bipartisan Path Forward," similarly lower than the final Obama budget, and lower than every single plan put forward under the Peterson 2015 Solutions Initiative from groups left, right, and center.

Revenue will also be well below what has been proposed in past Republican budgets, prior to the FY 2018 budget resolution proposing the recent tax cuts. For example, revenue over the next decade will be 0.3 to 0.6 percent of GDP below what was proposed under President Trump's FY 2018 budget (based on the Congressional Budget Office's analysis of that budget) and 0.6 to 1.0 percent of GDP below the prior two Congressional budget resolutions.

Revenue will remain close to historic average (or a bit below it if tax cuts are extended), but at a time when spending will substantially exceed historic averages as a result of the aging population and rising interest costs. As a result, ten-year revenue will be 5 to 5.3 percent of GDP below spending over the next decade, leading to budget deficits as high as 6.4 percent of GDP by 2027.

| Ten-Year Revenue as a % of GDP |

Difference from Current Law Revenue |

Difference from Revenue With Extended Tax Cuts |

|

|---|---|---|---|

| Post-TCJA Current Law Revenue | 17.5% | n/a | 0.3 pp |

| Post-TCJA Current Law Revenue, Tax Cuts Extended | 17.2% | 0.3 pp | n/a |

| Simpson-Bowles "Bipartisan Path Forward" | 19.2% | 1.7 pp | 2.0 pp |

| FY 2018 Congressional Budget Resolution | 17.5% | 0.0 pp | 0.3 pp |

| FY 2017 Congressional Budget Resolution | 18.1% | 0.6 pp | 0.9 pp |

| FY 2016 Congressional Budget Resolution | 18.2% | 0.7 pp | 1.0 pp |

| President's FY 2018 Budget (Trump) | 17.8% | 0.3 pp | 0.6 pp |

| President's FY 2017 Budget (Obama) | 19.3% | 1.8 pp | 2.1 pp |

| Historical Average for Revenue | 17.4% | * | 0.2 pp |

| Pre-TCJA Revenue | 18.2% | 0.7 pp | 1.0 pp |

| Historical Average for Spending | 20.3% | 2.8 pp | 3.1 pp |

| Post-TCJA Current Law Spending | 22.5% | 5.0 pp | 5.3 pp |

* Less than 0.1 pp

Solving the nation's fiscal challenges was difficult before the tax bill was enacted, and it has only gotten even more challenging. Returning to historic averages of revenue will not be sufficient with spending on its current course well above historic averages and rising as a result of an aging population. Lawmakers need to make changes that both raise more revenue and slow the growth of spending – particularly on entitlement programs that face looming insolvency – in order to get the nation's fiscal house in order.

Note: this blog was edited for clarity on 1/10/2018