SALT Repeal Just Below $1 Million is Still Costly and Regressive

To avoid cutting taxes for households making over $1 million, some politicians have suggested eliminating the State and Local Tax (SALT) deduction cap for households making below $900,000 or $950,000 per year. Such a plan would be still be very costly and regressive, delivering the largest tax cut to very high-income households, including households with millions of dollars in assets and some with over $1 million per year in pre-tax income.

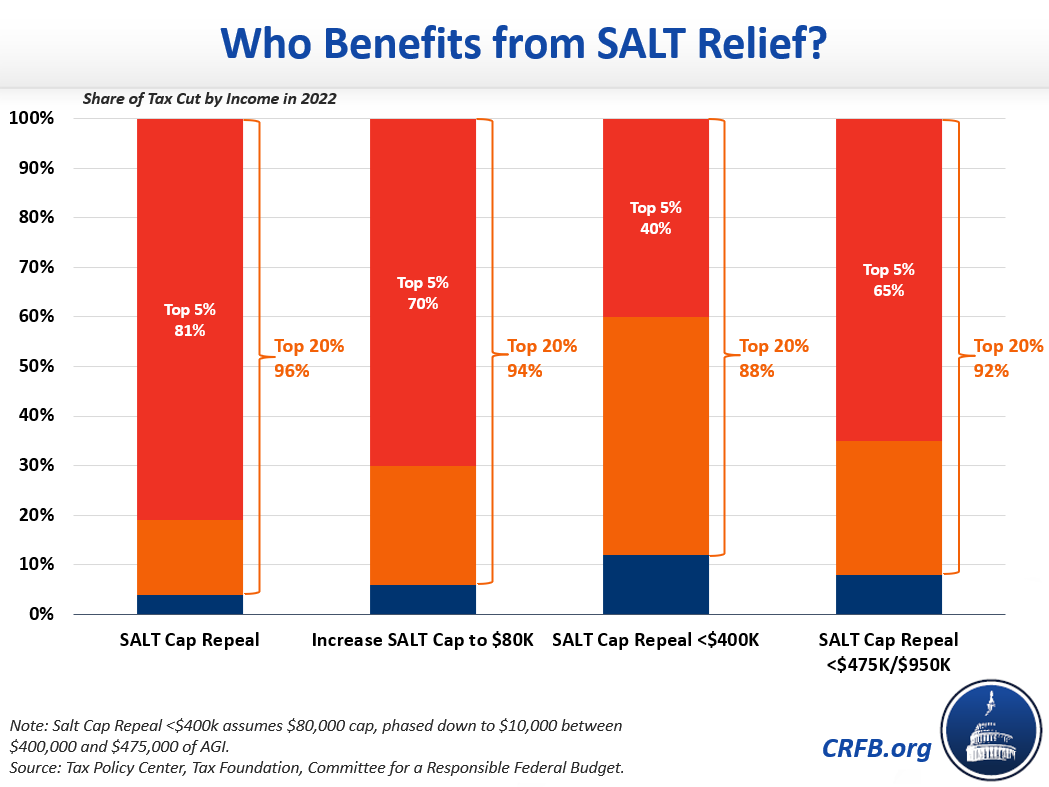

We estimate eliminating the SALT cap for individuals making up to $475,000 and for couples making up to $950,000 would cost roughly $220 billion over five years. Based on modeling from the Tax Foundation and Tax Policy Center, we estimate roughly two-thirds of the benefit from such a plan would go to households in the top 5 percent of the income spectrum, with 92 percent going to those in the top quintile. This is nearly as regressive as the House's plan to raise the SALT cap to $80,000 (more so in some ways).

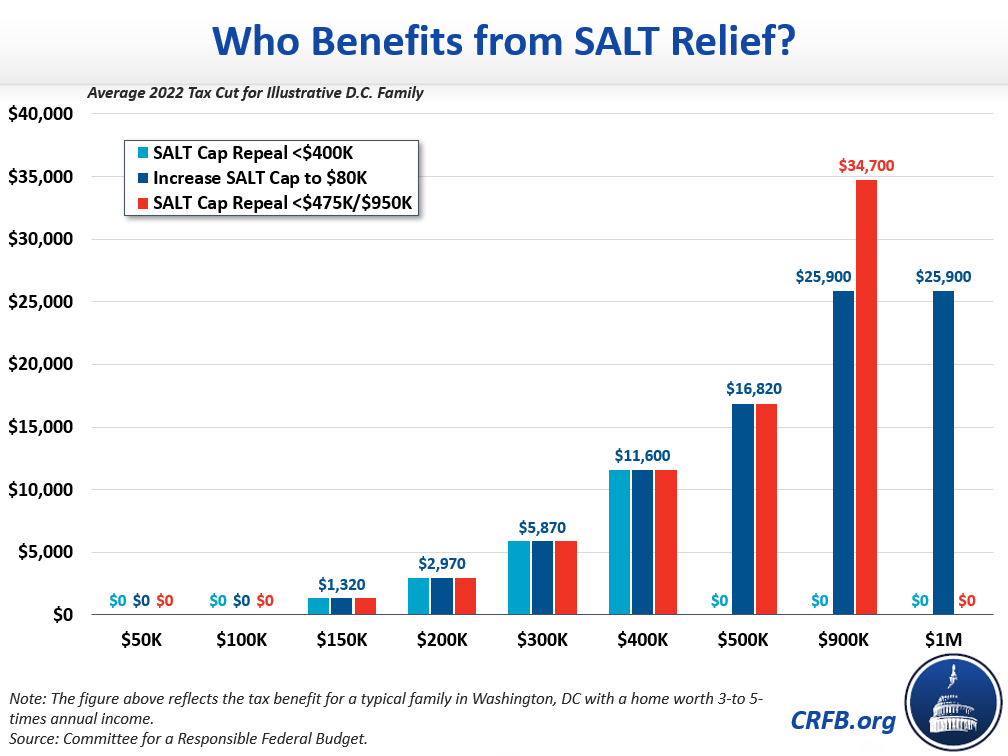

Since the value of the SALT deduction grows with income, the largest benefit would go to those with $950,000 in Adjusted Gross Income (AGI) and even higher levels of total income. Furthermore, since property taxes would become fully deductible, the proposal would prove exceptionally lucrative to wealthy taxpayers with high earnings and high-value real estate holdings.

We estimate this framework would provide nearly $35,000 per year in tax cuts to a typical Washington, DC family with $900,000 of AGI, compared to nearly $17,000 for a household making $500,000, nearly $3,000 for a household making $200,000, and nothing for the vast majority of households making less than $150,000. Those making $900,000 per year would receive a benefit over one-third larger than they would receive from the SALT cap relief provision in the House's version of Build Back Better. Most of these households have millions of dollars in assets, and many actually make over $1 million in income per year before subtracting retirement account contributions and other adjustments.

For comparison, a middle-class family of four with one child under six would receive $2,600 on average from the extension of the expanded Child Tax Credit (CTC) included in the Build Back Better Act. In other words, a household making $900,000 per year would receive a tax cut from SALT relief over 13 times as large as the benefit a middle-class family might receive from extension of the expanded CTC. Even worse, because SALT cap relief would last for five years while the CTC increase would only last one year, that household earning $900,000 would ultimately receive 67 times as much from SALT relief over a five-year period as a typical family would from the one-year CTC expansion.

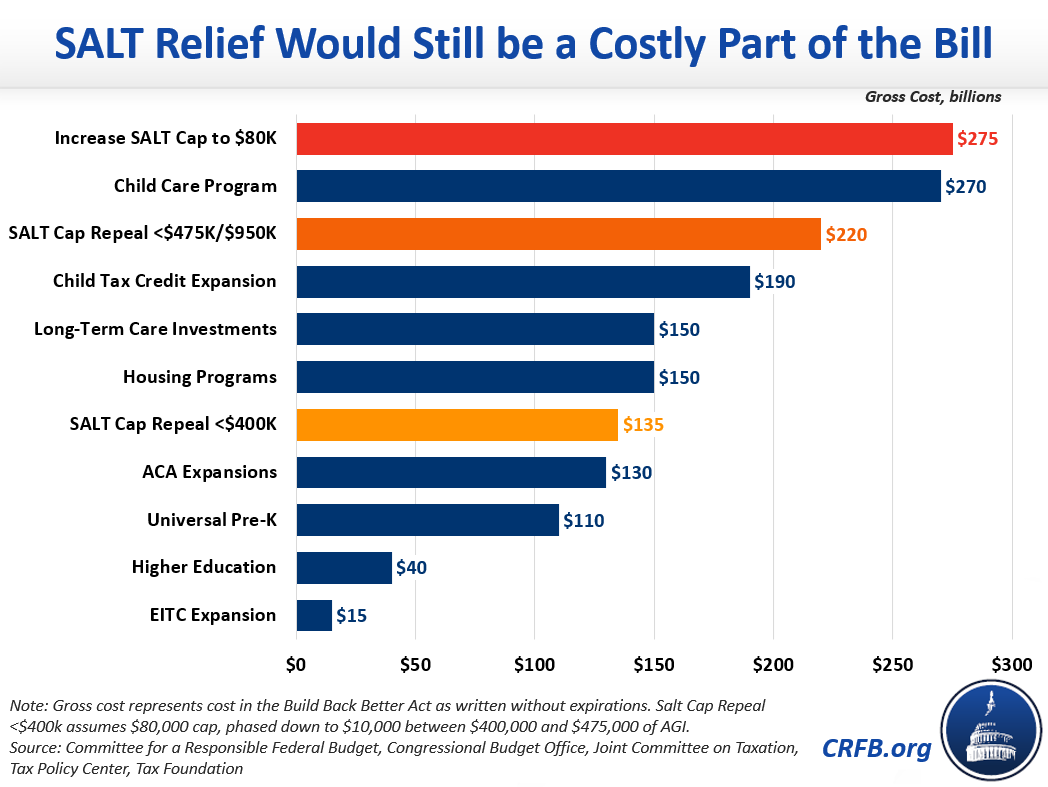

Finally, this version of SALT relief would still be one of the costliest parts of Build Back Better. At $220 billion over five years, it would be larger than the cost of the CTC, universal pre-K, long-term care, expansions of the Affordable Care Act, and investments in higher education and the workforce. Only the child care subsidies would be more expensive.

As we explained recently, claims that this type of SALT relief is fully paid for are based on a budget gimmick and not reflective of reality.

A proposal modeled yesterday by the Tax Policy Center to increase the SALT cap to $80,000 and then phase out this increase above $400,000 of income would still be expensive and regressive - but much less so. We estimate it would cost roughly $135 billion over five years, with 40 percent of the benefit going to the top 5 percent. While this plan to phase in the $10,000 cap above $400,000 would still be quite problematic, it would represent a meaningful improvement relative to the House bill or "revenue neutral" SALT cap relief. The same cannot be said for a plan to repeal the cap up to $950,000 of household income.

Limiting SALT relief to those earning just below $1 million might make for a better political slogan, but it does little to improve the cost or regressivity of SALT cap relief.

Read more options and analyses on our Reconciliation Resources page and our SALT Deduction Resources page.