"Revenue Neutral" SALT Cap Relief is Costly and Regressive

Several senators are apparently pursuing "revenue neutral" state and local tax (SALT) deduction cap relief, meaning the cost of increasing the SALT deduction cap through 2025 would be fully paid for on paper by extending it past its current expiration date of 2026 through 2031. In this case, "revenue neutrality" is simply a budget gimmick, and the resulting SALT cap relief will be both costly and regressive.

The Joint Committee on Taxation estimates one such path to revenue neutrality could involve eliminating the SALT deduction cap entirely for individuals earning less than $550,000 per year and for families earning about double that amount. While lawmakers are apparently tweaking this proposal to ensure benefits do not go to those making over $1 million per year, it is nonetheless useful to understand the implications of this particular version of SALT cap relief.

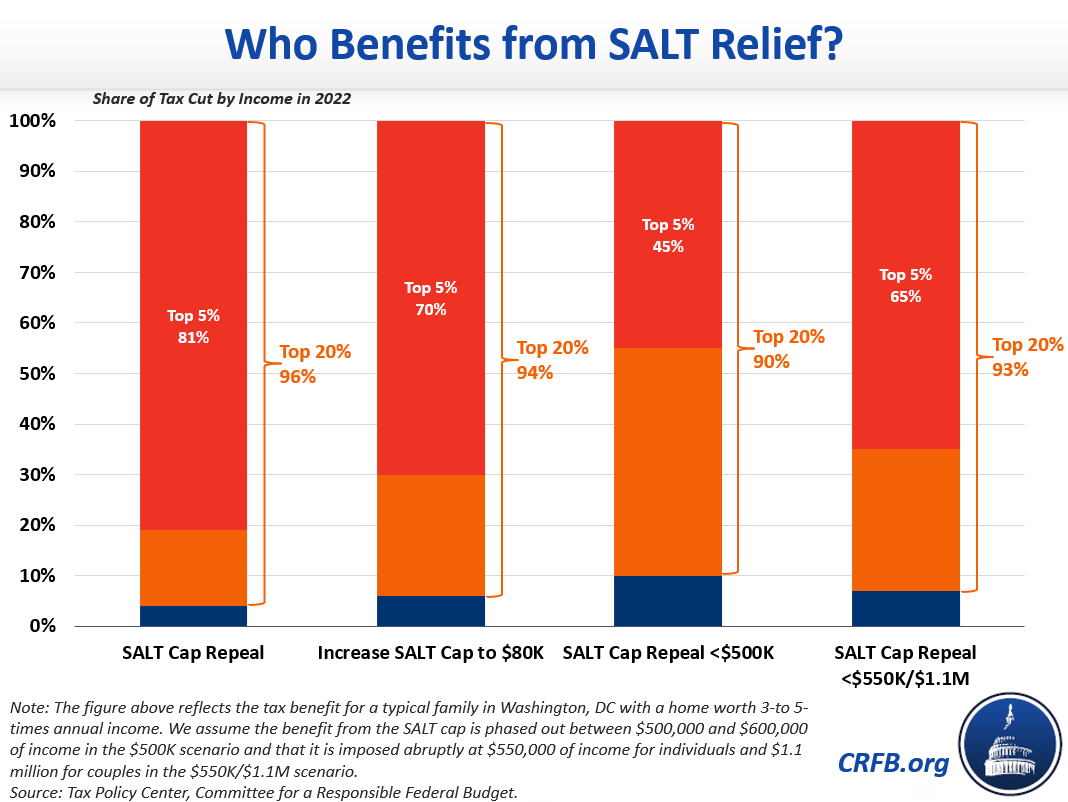

We estimate repealing the SALT cap for individuals earning up to $550,000 and for couples earning up to $1.1 million would cost about $250 billion over five years, with the largest benefits going to households with incomes near the $1.1 million per year threshold. The policy would be far more costly and regressive than eliminating the SALT cap below $500,000 of income for both individuals and couples, and nearly as costly and regressive as the House plan to boost the SALT cap from $10,000 to $80,000.

Though this new proposal has not been formally modeled for distribution of benefits, our rough estimate suggests 93 percent of the benefit would go to those in the top one-fifth of the income spectrum, with nearly two-thirds going to those in the top 5 percent. By income group, this is nearly as regressive as the House proposal to raise the SALT cap to $80,000. Only about 7 percent of the benefit from this proposal would go to households in the bottom 80 percent of earners — those making less than $180,000 per year. The average taxpayer would see only a $20 per year benefit.

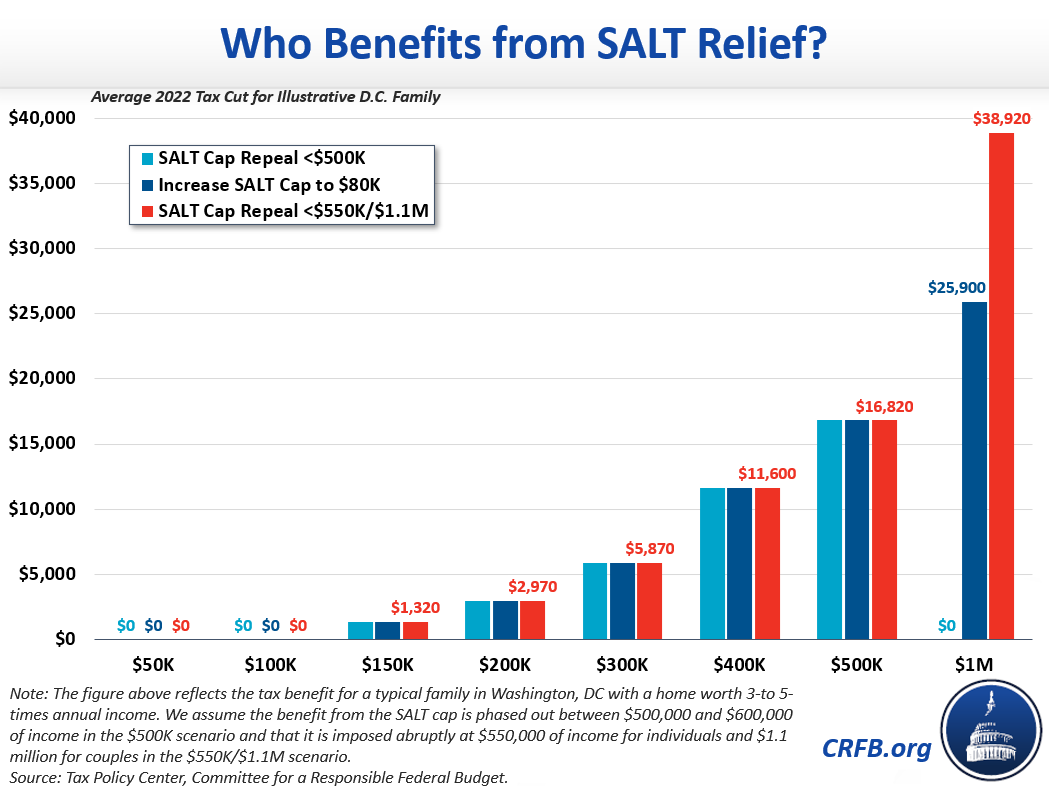

Since the value of the SALT deduction grows with income, the largest benefit would go to those with $1.1 million of Adjusted Gross Income (AGI) and even higher levels of total income. Furthermore, since property taxes would become fully deductible, the proposal would prove exceptionally lucrative to wealthy taxpayers with high earnings (up to $1.1 million) and high-value real estate holdings.

Unlike the House proposal, which would lift the cap to $80,000 for all taxpayers, this version would not deliver a benefit to households making well in excess of $1.1 million. However, for those below that threshold, it would actually prove more regressive than the House version. For example, this plan would deliver a benefit of nearly $39,000 to a typical Washington, D.C. family with $1 million of annual income and a $3 million home – 50 percent larger than the benefit they'd receive from the House version. Meanwhile, a typical household making $150,000 in D.C. would receive a tax cut of only $1,300. Less than 5 percent of DC households with income below $150,000 would receive any benefit from SALT cap repeal, a figure that is even lower nationally.

For comparison, a middle-class family of four with one child under six would receive $2,600 on average from the extension of the expanded Child Tax Credit (CTC) included in the Build Back Better Act. In other words, a household earning $1 million per year would receive a tax cut from SALT relief roughly 15-times as large as the benefit a middle-class family might receive from extension of the expanded CTC. Even worse, because SALT cap relief would last for five years while the CTC increase would only last one year, that household earning $1 million would ultimately receive 75-times as much from SALT relief over a five year period as a typical family would from the CTC expansion.

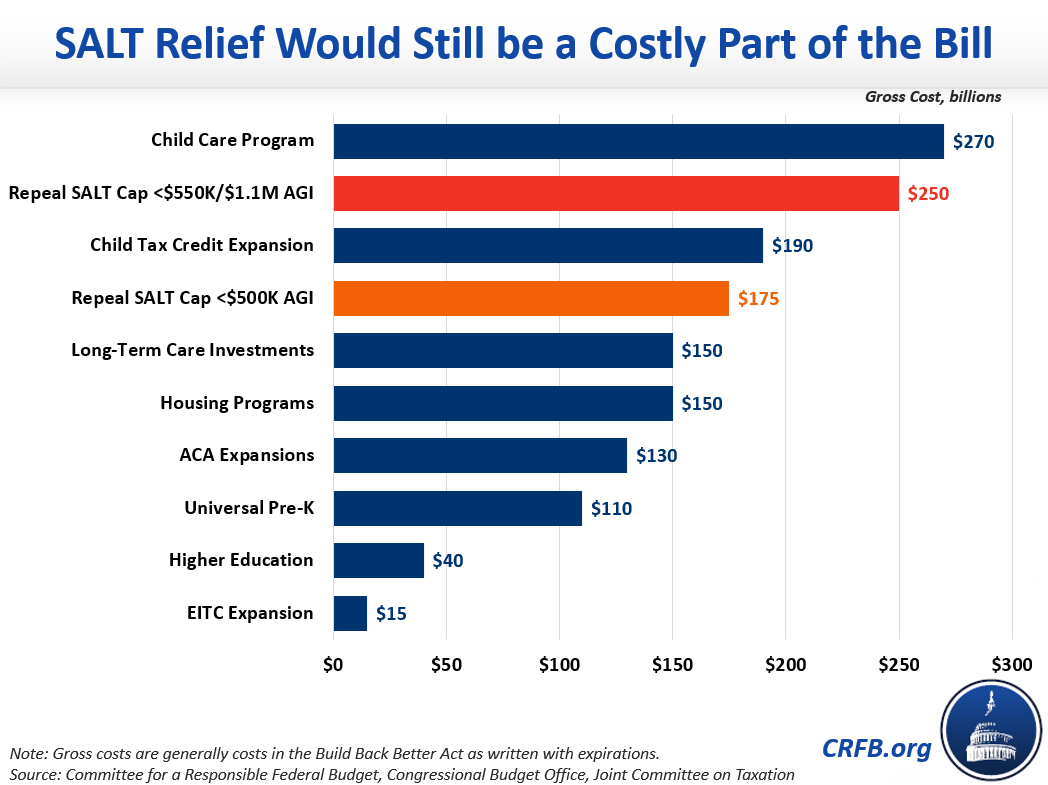

Finally, this version of SALT relief would still be one of the costliest parts of Build Back Better. At $250 billion, it would be larger than spending on the CTC, universal pre-K, long-term care, expansions of the Affordable Care Act, and investments in higher education and the workforce. Child care subsidies in the bill would be more expensive, but only slightly.

While a "revenue neutral" SALT cap relief proposal could be altered to change how benefits are distributed along the income spectrum, modifying the proposal to be significantly less expensive or regressive would be impossible so long as the (gimmicky) offset is scheduled to be in place through 2031. For example, repealing the SALT cap for both couples and single taxpayers earning $900,000 or less per year – as opposed to $550,000 or less for individuals and $1.1 million or less for couples – would eliminate the benefit for households making $900,000 to $1.1 million per year, but at the cost of increasing benefits for high-income individuals making between $550,000 to $900,000. A similar share of benefits would flow to those in the top 5 percent of the income spectrum, and while distribution of benefits among couples would be less regressive, the distribution of benefits among single taxpayers would become even more regressive.

Unless policymakers allow the SALT cap to expire before the end of 2031, or couple SALT cap relief with other tax changes or extensions of expiring Tax Cuts and Jobs Act (TCJA) provisions, any version of "revenue neutral" SALT cap relief will inevitably cost roughly $250 billion in the first five tax years. This is far too much for a policy that would complicate the tax code, undermine tax reform, reduce revenue, and deliver a large tax cut to very high earners.

Importantly, claims that this relief is "paid for" rely on a shell game. In practice, decoupling the SALT deduction cap from other parts of the TCJA will make any full or partial extensions more expensive. This tax increase on paper functions more as a "pre-tax cut" in reality (we plan to write more on this subject soon).

Overall, a "revenue neutral" SALT relief proposal – particularly one that would repeal the cap for couples making up to $1.1 million per year – would be nearly as costly and regressive as the version included in the House bill. While reducing the income threshold to $500,000 for singles and couples would be an improvement, the proposal would still remain far too costly and regressive. SALT cap relief simply does not belong in this bill.

Read more options and analyses on our Reconciliation Resources page and our SALT Deduction Resources page.