A Roundup of Our Analysis on the Bipartisan Path Forward

Over the last two weeks, the Committee for a Responsible Federal Budget has been analyzing the new proposal from former Fiscal Commission co-chairs Erskine Bowles and Alan Simpson, “A Bipartisan Path Forward to Securing America’s Future.” The new proposal contains $2.5 trillion of additional savings over ten years, enough to put debt on a clear downward path and falling below 70 percent of GDP by 2023. Below we present our analysis on the CRFB’s blog, The Bottom Line.

Simpson and Bowles Release "A Bipartisan Path Forward": Simpson and Bowles presented their framework for the plan earlier in February, but the new report contains all of the policies needed to meet their savings target. In this post, CRFB features a table containing all of the policy changes as well as ten-year deficit reduction estimates.

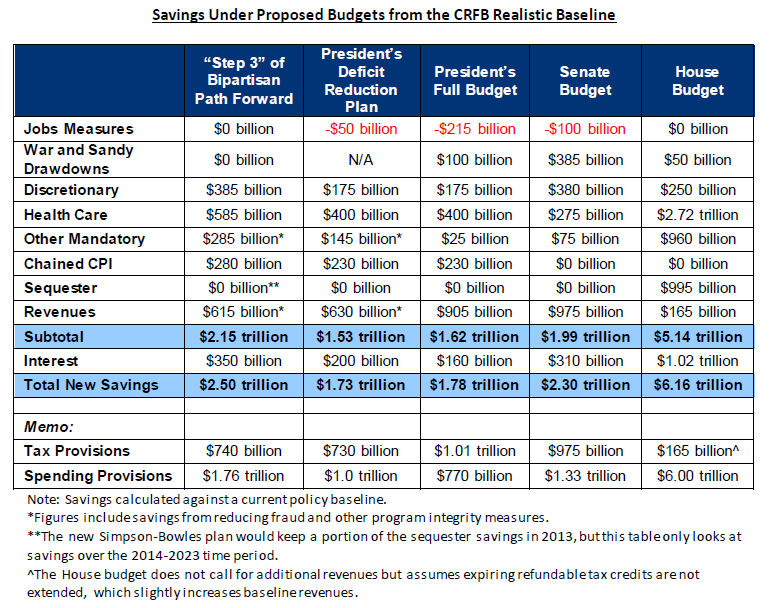

Comparing the Bipartisan Path to Other Budget Proposals: In addition to “A Bipartisan Path Forward,” the House, Senate, and White House all presented new budgets in April that were able to put debt on a downward path. However, these proposals achieve their deficit reduction in different ways. In this post, CRFB estimates savings compared to our realistic baseline, in order to allow for a direct comparison of the new Simpson-Bowles plan to the other major budget proposals. We also show how each proposal would affect debt, revenues, and spending as a share of the economy.

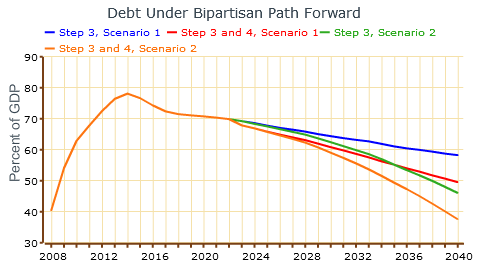

"A Bipartisan Path Forward" and the Long Term: The goal of lawmakers should be to put debt on a downward path in the long term and not just temporarily. In this post we show that the new Simpson-Bowles plan succeeds in achieving this goal, using the report’s long-term estimates.

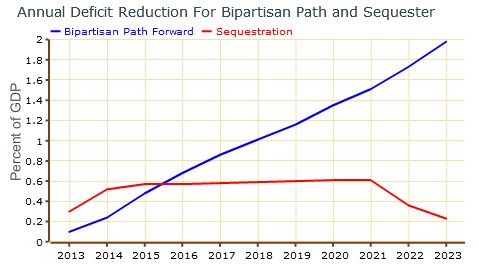

New Simpson-Bowles Plan Would Boost Economic Growth, Not Slow It: Some commentators have dismissed deficit reduction plans as austerity, but “A Bipartisan Path Forward” would actually reduce short-term austerity. By waiving sequestration and phasing in cuts slowly, economic output would likely be greater under the Simpson-Bowles plan than under sequestration in the next few years. In this post, CRFB also shows how the plan would boost economic growth in the medium term through a lower debt burden and tax reform. We analyze several supporting studies that suggest that the plan could increase economic output by over 1 percent by 2023.

How Simpson and Bowles Protect the Disadvantaged: One of the core principles of the Fiscal Commission’s recommendations was that the truly disadvantaged should be protected as much as possible in deficit reduction. In this post, CRFB shows that “A Bipartisan Path Forward” places particular emphasis on protecting low-income and vulnerable populations through a number of policies, including repealing sequestration, proposing benefit enhancements along with the chained CPI, strengthening the Pell Grant program, and leaving many means-tested programs untouched. Most importantly, the plan would fix the country’s fiscal problem and ensure that the burden of higher debt does not fall on the most vulnerable.

How Simpson and Bowles Plan to Bend the Health Care Cost Curve: The projected rise in health care spending is the primary driver of debt in the long-term, and the Simpson-Bowles plan includes many policies to “bend” the health care cost curve. In this post, we describe many of the plan’s structural health care reforms to provider payments, beneficiary, cost-sharing, and Medicaid. In addition, the blog describes the cap on the growth rate of the federal budgetary commitment to health care and the mechanism used to enforce it.

The Bipartisan Path Forward's Medicare Buy-in: The Simpson-Bowles plan includes a new take on raising the Medicare age. This post further describes the plan's Medicare buy-in proposal combined with its retirement age increase. Specifically, it describes the progressive premium assistance system that intends to protect lower-income beneficiaries from potential adverse effects from raising the age.

Tax Reform in A Bipartisan Path Forward: This blog talks about the plan's proposed tax reform, including its broad framework and an example of how the original Simpson-Bowles plan accomplished it. It also discusses the plan's proposed enforcement mechanism to ensure that the revenue from tax reform actually materializes.

Budget Enforcement Provisions in the Bipartisan Path Forward: Along with specific policies, A Bipartisan Path Forward also contains many budget reforms in the plan intended to either enforce those policies or ensure that fiscal responsibility is maintained overall. The blog talks about the requirement that Congressional and President's budget put debt on a stable or downward path, the 67-vote threshold for rolling back certain aspects of the plan, and indexing the debt ceiling to GDP.

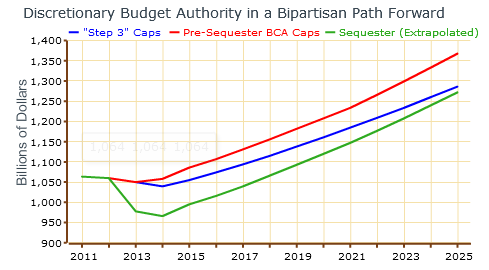

Discretionary Savings in the Bipartisan Path Forward: While much of the deficit reduction achieved by lawmakers has used savings from the discretionary budget, there are still areas where greater efficiency could be achieved. In this blog, we break down the $385 billion of discretionary savings along with other enforcement changes to the discretionary spending caps.

Education Reforms in A Bipartisan Path Forward: In this blog, we talk about education reforms contained in the plan. The blog mainly focuses on how the plan reduces the implicit Pell Grant funding shortfall and how it permanently solves the Stafford student loan interest rate issue, when rates are scheduled to double on July 1.

User Fees in the Bipartisan Path Forward: In this blog, we show how the new Simpson-Bowles plan achieves $50 billion in savings through reforms to user fees in order to recoup the cost of some government services that benefits particular groups or industries.