Revised Projections from CBO, OMB, & Fed Give Hope of “Soft Landing”

Recent economic forecasts from the Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the Federal Reserve (Fed) present a more optimistic view of the economy over the next two years compared to previous projections, with higher near-term growth, lower inflation, and stabilized employment. Projections would suggest the Federal Reserve can continue to keep rates elevated and put the economy on path to a “soft landing,” where inflation is tamed without pushing the economy into recession or spiking unemployment.

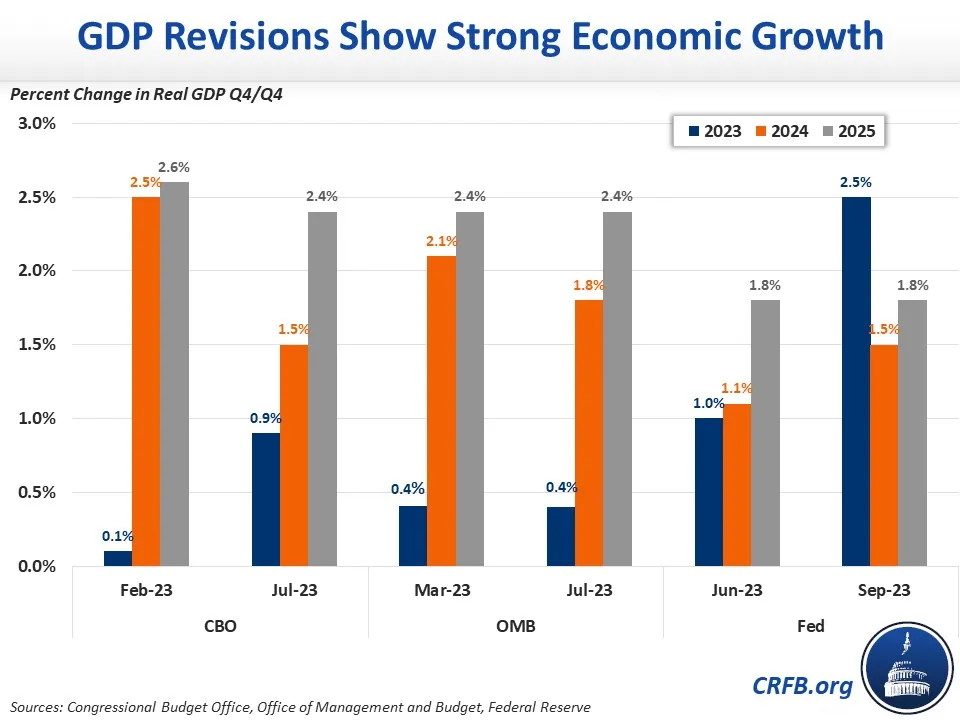

After growing by 5.4 percent as part of the economic recovery from COVID-19 from the fourth quarter of 2020 to the fourth quarter of 2021, real Gross Domestic Product (GDP) growth was 0.7 percent in 2022, representing a substantial slowdown as many of the economic recovery measures expired. All three forecasting agencies now expect the economy to grow in 2023; OMB maintains a 0.4 percent forecast while the Fed projects 2.1 percent growth, revised up from 1.0 percent in June. The Fed’s June projections closely align to CBO’s July projection of 0.9 percent, revised up from just 0.1 percent in February. This large uptick can be attributed to continued activity in the economy through both consumer spending and business investment despite higher interest rates.

The three estimators differ more significantly in their assumptions for 2024 and 2025. OMB projects 1.8 percent and 2.4 percent growth in 2024 and 2025, respectively, in part due to its assumption that the policies in the President’s budget will be enacted; notably, both of these growth rates would be substantially faster than OMB projected for 2023. Meanwhile, both CBO and the Fed project more modest growth in 2024 at 1.5 percent and the Fed expects growth in 2025 and beyond to converge around 1.8 percent – which is slightly below CBO’s 2.0 percent longer-term estimate of growth. Both revised their forecasts due to larger than expected consumer spending throughout 2023, with the expectation that spending will weaken in 2024. A rebound in the residential investment market and increased overall business investment will keep growth positive in 2024 and 2025 while the passing of the Fiscal Responsibility Act in June will limit the growth of appropriations for many federal programs.

The Fed now expects unemployment will remain at the current rate of 3.8 percent in 2023, a 30 basis point drop from the Fed’s projection in June due to continued job growth, job openings and low jobless claims. The Fed also believes unemployment will not go above 4.1 percent in 2024 and 2025, stabilizing at 4.0 percent thereafter. OMB estimates unemployment will rise to 4.2 percent in 2023, tick up to 4.3 percent in 2024, and decline to 4.1 percent in 2025. CBO estimates unemployment will be 4.1 percent in 2023, rise to 4.7 percent in 2024, and drop slightly to 4.5 percent in 2025. While CBO projects the highest unemployment rate, it is still a full percentage point below the historical average and a notable improvement from previous projections of 5.1 percent, 4.8 percent, and 4.6 percent.

Through 2025, inflation is expected to come down from its 40-year high of the past two years yet remain above its 2 percent target. CBO expects the Personal Consumption Expenditure (PCE) inflation to be 3.3 percent in 2023, 2.6 percent in 2024, and 2.2 percent in 2025, and the Federal Reserve expects a similar outlook of 3.3 percent, 2.5 percent, and 2.2 percent. OMB’s GDP price index – OMB’s chained index most comparable to PCE inflation – is projected to be 3.2 percent this year, 2.3 percent in 2024, and 2.1 percent in 2025.

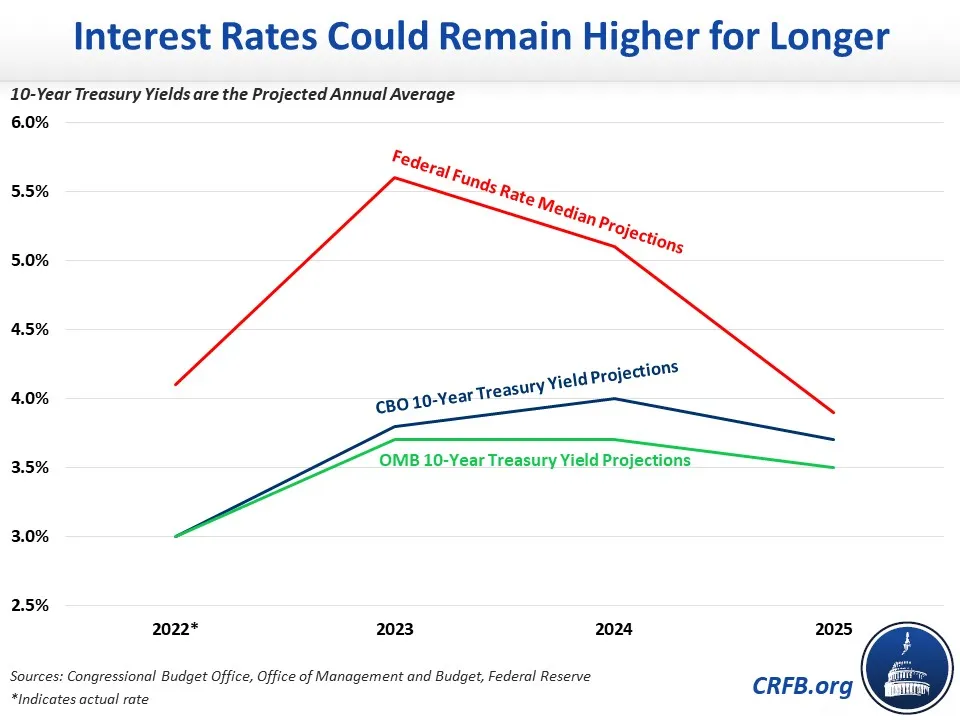

Interest rates on the ten-year Treasury note have been climbing and recently reached a 16-year high of 4.6 percent. Interest rates, on average, have been roughly 75 basis points above the CBO’s projection for 2023 of 3.8 percent. CBO expects rates to average 4.0 percent in 2024 before falling to 3.7 percent in 2025. OMB expects an average rate of 3.6 percent through 2025. CBO also estimates the average interest rate on three-month Treasury bills – which more than doubled from 2.5 percent to 5.6 percent over the past year - to be 5.1 percent in 2023 and 4.7 percent in 2024, falling to 3.6 percent by 2025. Projections have been revised up from earlier this year, and with recent yields spiking, rates could remain even higher for longer. Members of the Federal Reserve also revised the median federal funds rate over the next three years, expecting higher rates than both its June and March projections.

The latest projections show a growing economy, a strong labor market, and slowing inflation even in the face of higher-than-normal interest rates. The Fed, OMB, and CBO have all improved projections from earlier this year and suggest that a near-term recession is unlikely. However, if higher-than-expected interest rates persist, debt as a share of the economy will continue to grow and put the U.S. at risk of a debt spiral. Policymakers should pass responsible fiscal reforms to keep inflation trending down, unemployment low, and the economy strong.