The President's Housing Reform Proposals

Yesterday in Phoenix, one of the hardest hit areas by the housing bust, President Obama gave a speech that laid out his plan to strengthen the housing market. This was the second speech in a series President Obama plans to give laying out his principles and proposals to improve the economy. While yesterday's speech covered a broad range of issues within housing, some had substantial fiscal implications, especially the decisions that need to be made on the Freddie Mae and Fannie Mac, the two largest government-sponsored enterprises (GSE) which were explicitly brought under conservatorship in 2008.

As the housing market is beginning to slowly make its recovery, President Obama stressed the importance of preventing a future housing bubble, while also continuing to provide support for the sector in the short term. The President proposed allowing more homeowners to refinance mortgages under the current lower rates, simplifying mortgage forms, assisting renters, and implementing the $15 billion "Project Rebuild" stimulus program, among other policies.

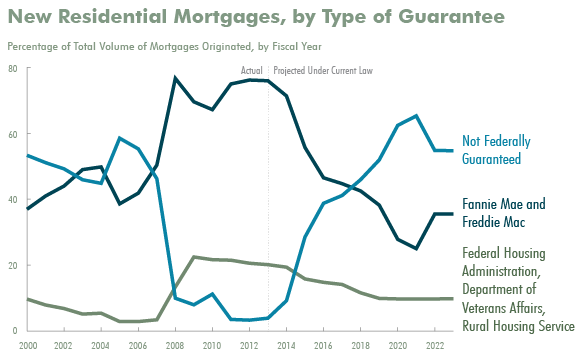

But most significant from a budgetary aspect may be the President's plans for winding down Fannie and Freddie. The White House has proposed to wind-down their investment portfolios by a mimimum of 15 percent per year. Replacing the two would be an institution similar to the FDIC, which would only provide government backing after all private capital is wiped out. The federal government would be paid a premium for its catastrophic guarantee. The proposal is similar to the approach that is being led by Senators Mark Warner (D-VA) and Bob Corker (R-TN) and the plan put forward by University of Maryland's Phillip Swagel as part of the Hamilton Project's series on the federal budget.

Source: CBO

The collapse of the housing market was met with a major effort startto prop up the sector, such as the federal takeover of Freddie and Fannie, the First-Time Home Buyers Credit, and smaller stimulus provisions. Back in 2009, when CBO reviewed the federal commitment to housing, we noticed that much of the support for housing was not temporary, but part of the regular budget. Not surprisingly, even after many of the stimulus provisions have expired or wound down, federal support is still significant.

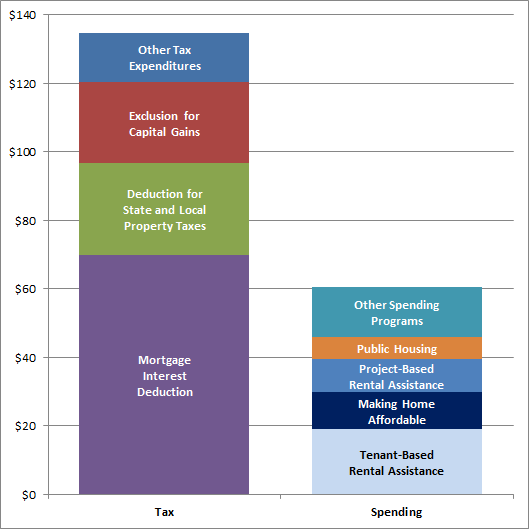

As was the case four year ago, much of the support is provided through the tax code. Tax expenditures that back housing will result in nearly $135 billion in forgone revenues, with nearly half of that from the mortgage interest deduction (estimated a $70 billion in 2013), according to the Joint Committee on Taxation. While popular, the mortgage interest deduction, like many other itemized deductions, disproportionately benefits higher earners. We've examined many different options that could reduce the mortgage interest deduction's cost, including turning it into a credit, putting a cap on its value, disallowing it for second-homes and home equity loans, or eliminate it all together.

Federal Support for Housing in 2013

Source: JCT, Departments of Housing and Urban Development and Agriculture

Spending programs for housing will roughly total more than $60 billion in 2013. The majority is provided through tenant-based (Section 8) and project-based rental assistance, and federal construction and maintenance of public housing. The Making Home Affordable program was created in 2009 as part of the financial crisis response and is slowly being phased down. Smaller programs exist to serve vulnerable populations. Beyond those spending programs, the Federal Housing Administration (FHA) and the Department of Agriculture also make loans, whose totals are not accounted for in the graph below.

We will continue to follow the White House's economic speeches and provide analysis of budgetary implications in the coming weeks.