The President's Approach to the Sequester

October 1 of this year marks the beginning of fiscal year (FY) 2016 and the return of the sequester on discretionary (appropriated) spending. No longer does the sequester require across-the-board cuts to such spending, but it does mandate lower topline levels for both defense and non-defense discretionary spending, under which appropriators determine exactly where to spend money.

The sequester will reduce discretionary appropriations by $91 billion in FY 2016 and result in the spending caps rising by only $2 billion from this year (FY 2015). If lawmakers adhere to the sequester caps, discretionary spending will reach a modern-era low as a share of GDP in just two years and continue to decline after that.

President Obama, as he has in every budget since the failure of the Super Committee, would repeal part of the sequester. While the budget does not identify specific savings to pay for the sequester, it includes enough cuts to mandatory spending and new revenue to offset the sequester, and indicates that it would be offset "by cutting inefficient spending, and closing tax loopholes." Lawmakers should follow a similar approach in any efforts to roll back sequestration this year, replacing all resulting costs with other cuts to mandatory spending and/or new revenues. Replacing the cuts mandated by sequestration with savings from specific changes in mandatory spending programs and revenues, particularly policies which result in savings that grow over time, is consistent with the original purpose of sequestration and would represent sound economic and fiscal policy.

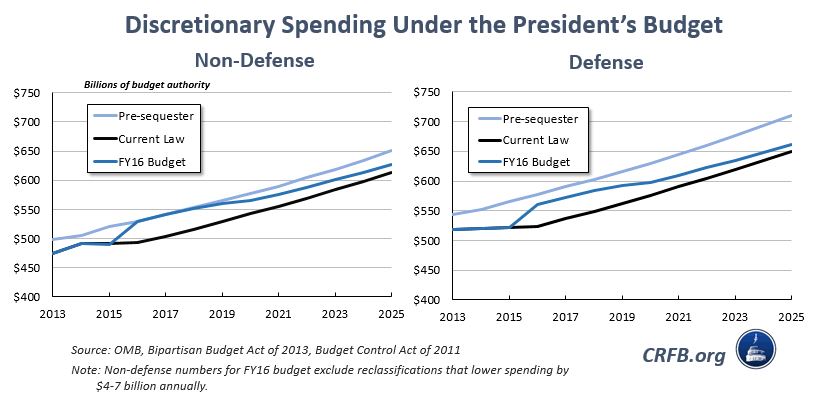

Like last year, the budget repeals the entire non-defense sequester in 2016 and provides the same dollar amount of relief to defense, which would roll back about 70 percent of the defense cuts. The 2016 relief would total about $75 billion. After that, the budget would replace less and less of the sequester over time, with the relief falling to $40 billion in 2021, the last year the discretionary sequester is technically in effect.

After 2021, the budget would extend the caps through 2025, holding discretionary spending increases to about 2 percent per year. This would provide about $80 billion of extra spending above the sequester levels extrapolated (the method that the Congressional Budget Office uses in its baseline). However, these levels would be $230 billion below the Administration's budget baseline, which assumes the caps grow from pre-sequester levels after 2021 by 2.5 percent annually. It appears to use these post-2021 savings to offset pre-2021 sequester relief, although those savings just reflect how much those levels are below pre-sequester spending.

In addition to the discretionary sequester relief, the budget would fully repeal the across-the-board sequester on mandatory spending that has been in effect continuously since 2013 (and has in fact been extended three years from its original expiration date through 2024). This would remove cuts to programs like Medicare and farm subsidies, costing $185 billion through 2025.

| Components of the President's Sequester Changes | |

| Cost Through 2025 |

|

| Reduce discretionary sequester through 2021 | $325 billion |

| Grow discretionary spending by 2% after 2021 | $80 billion |

| Repeal mandatory sequester | $185 billion |

| Total Sequester Relief | $590 billion |

Source: OMB, CRFB calculations

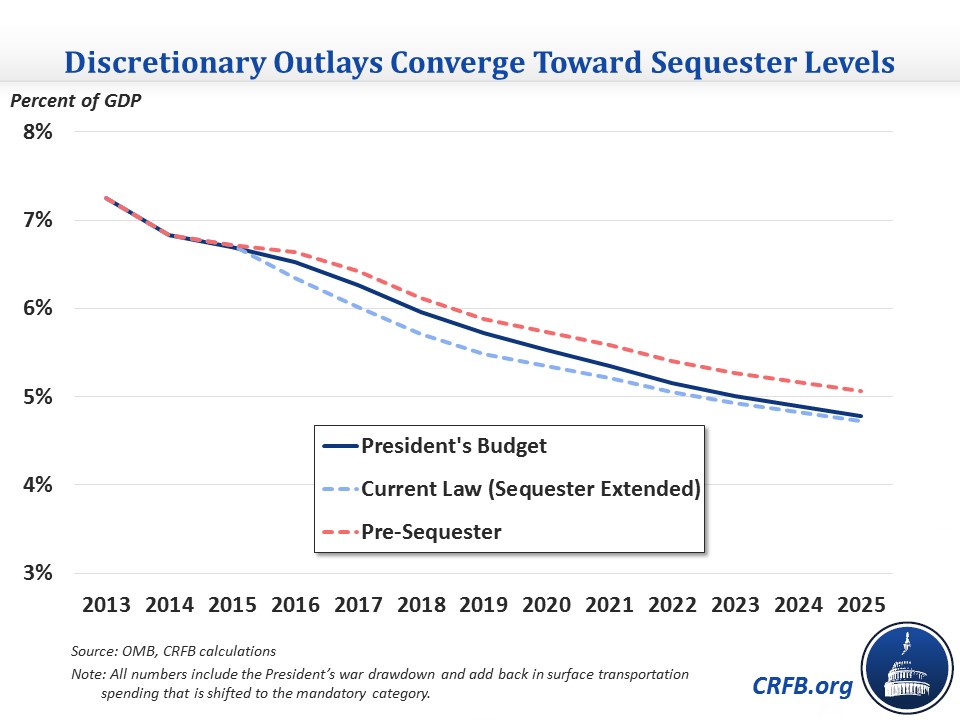

Even after the President's sequester relief, discretionary spending caps would still grow slower than the economy, leaving such spending declining as a share of GDP over time. Excluding the shifting of surface transportation to mandatory spending, this category would fall from 6.8 percent in 2014 to a modern-era low of 6 percent in 2018 and fall further to 4.8 percent of GDP by 2025. Granted, some of this decline is due to a rapid drawdown of war spending that was expected to occur, but the low level of discretionary spending could put increasing pressure on appropriators over time. By 2025, discretionary spending would be only 0.1 percentage points of GDP higher than the sequester levels extended.

Nonetheless, the budget proposes significant sequester relief and most importantly provides enough savings to pay for those changes. Even if the policies may differ, lawmakers should take the same approach and pay for any rollbacks of the sequester cuts they make this year.