Pension Gimmick Rises Again

In yesterday's State of the Union address, the President called for extending unemployment benefits that expired in December, which would affect roughly 1.6 million long-term unemployed people. Lawmakers were unable to agree upon an extension last December, when the emergency unemployment compensation program—originally passed in 2008—expired. In the wake of the President's speech, lawmakers are still debating whether to extend unemployment compensation, and how to pay for it.

A full one-year extension of the program would cost $25 billion, but many Democrats have set their sights on a lower hurdle: extending the benefits for three months, at a cost of $6.4 billion. If lawmakers extend unemployment insurance, they should abide by "pay-as-you go" principles and find savings or revenues elsewhere in the budget to prevent increasing deficits. However, news reports indicate that lawmakers are considering using a budget gimmick to "pay for" the extension (as we've explained before, as have other groups on the left and right).

Democrats are reportedly considering extending the "pension smoothing" gimmick from the 2012 transportation bill as a way to offset unemployment insurance costs. That provision raised money by temporarily reducing the amount that companies are required to pay into their pension funds. While pension smoothing saves the government money in the short term, it increases future deficits by more than it saves. This occurs because in the near term, companies have higher profits (or employees have higher wages) subject to taxes, since companies take fewer deductions for employee compensation (or employees have more taxable income). However, contributing less to pension plans now means that companies must make greater contributions in later years, thus increasing their deductions, reducing revenue, and increasing the deficit. In addition, underfunding pensions makes it more likely that a company will need a bailout from the federally funded Pension Benefit Guaranty Corporation.

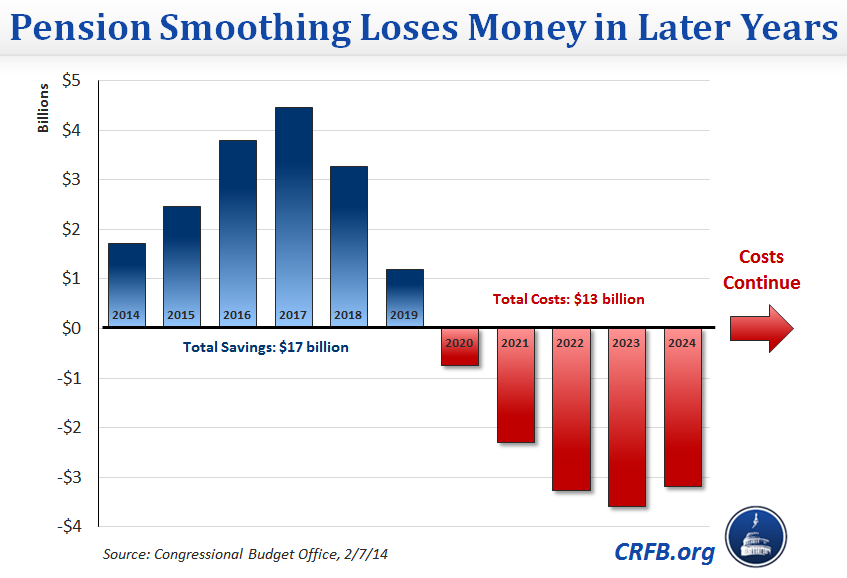

On February 7, CBO estimated that the provision would raise $17 billion over the first six years, but lost money afterward. The losses in the next five years reduce the net savings to $4 billion. However, the provision continues to lose money outside the 10-year projection window. If lawmakers extend the pension smoothing gimmick to "raise" $4 billion, it will save $4 billion over the next ten years only, but lose money over the long term.

Lawmakers should abide by PAYGO and find savings to pay for the cost of extending unemployment insurance. But they should avoid budget gimmicks like pension smoothing that only appear to save money, while actually driving up our deficits.

Related Posts:

- Don't Use a Gimmick to Fund Our Highways, talking about the July 2014 plan to fund the Highway Trust Fund with pension smoothing

- Heritage and CBPP Agree: Pension Smoothing is a Gimmick

- Gimmick Chartbook: Policies Which Save Now and Cost Later Don't Really Save At All

Update 2/7/14: This post has been updated to reflect the Congressional Budget Office score for the actual pension smoothing provision used in the unemployment insurance legislation, released on February 7. The original version cited pension smoothing legislation from 2012.