No Games With the Debt Limit

When Congress ended the government shutdown last October, they also suspended the debt ceiling through February 7th, which is now only a week away. After that date, the debt limit will be reinstated at about $17.3 trillion, according to estimates from the Bipartisan Policy Center (BPC). After that date, Treasury can still use "extraordinary measures" to continue paying the nation's bills for a limited amount of time. However, even with such measures, the Treasury Department estimates that they will only be able to continue paying the nation’s bills until late February, unless the debt ceiling is raised.

In advance of the reinstatement of the federal debt limit next week, the co-chairs of our partner Fix the Debt — Sen. Judd Gregg, Gov. Edward Rendell, and Mayor Michael Bloomberg — released a statement urging Congress to raise the debt limit. They also noted that the nation’s rising long-term debt remains a serious problem.

Next week, the suspension of the federal debt limit will end, requiring an increase in the federal borrowing limit as soon as late February. Our leaders cannot afford to play games with the full faith and credit of the U.S. Government. Congress should work with the president to raise the debt ceiling in a responsible and timely manner.

At the same time, we must recognize that our long-term debt problems are still far from solved, and the debt ceiling vote should be viewed as a reminder that we still need to take steps to improve the country’s fiscal outlook. Congress and the president should embark on this process as quickly as possible.

Certainly, the debt ceiling should not be accompanied by measures that would worsen the national debt by increasing spending or cutting taxes, without offsets.

Fix the Debt calls upon Congress and President Obama to act swiftly in raising the debt ceiling and to pursue the tax and entitlement reforms needed to grow the economy and put our debt on a sustainable long-term path.

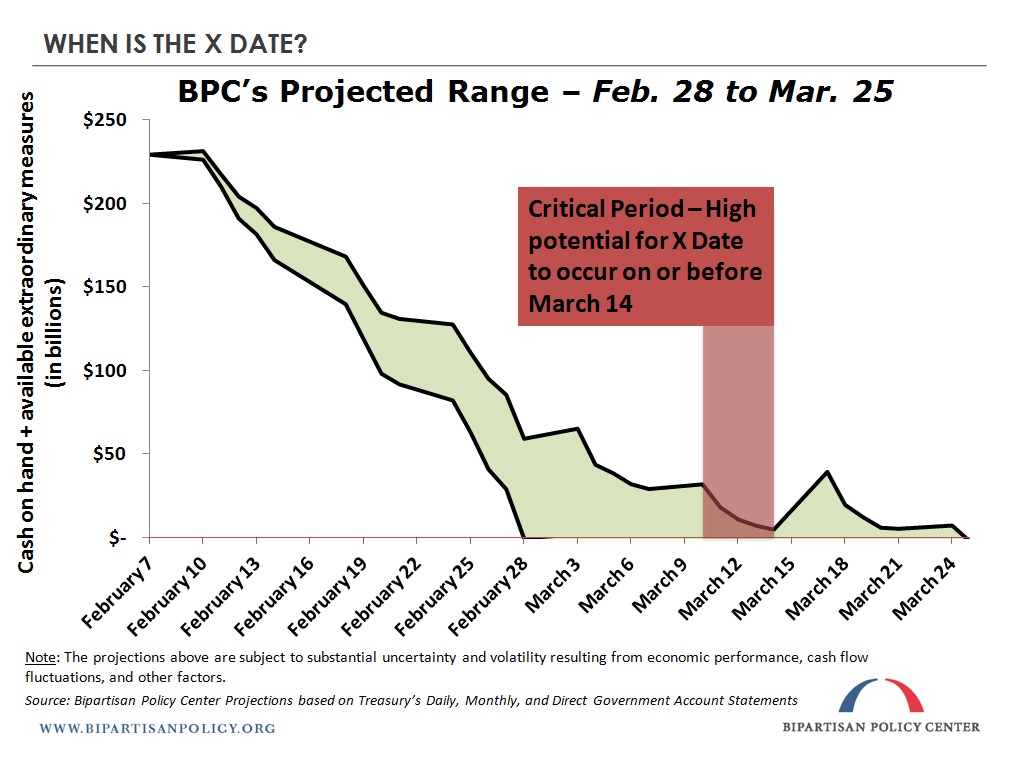

The approaching debt ceiling deadline is critical. Largely due to high numbers of tax refunds going out near the beginning of the tax filing period, The Treasury estimates it can only pay the nation's bills through late February. The Bipartisan Policy Center released a similar estimate today, that the government would be unable to pay its full obligations sometime between February 28 and March 25. In addition to defaulting on many obligations to Americans, BPC highlights that Treasury would also have to conduct major debt rollovers during this window and attempt to pay interest to bondholders.

BPC explains the gravity of failing to raise the debt limit.

“Absent an increase in the debt ceiling, there will come a day when Treasury exhausts its borrowing authority and runs out of cash on hand to pay the nation’s bills. Starting on that day – which the Bipartisan Policy Center (BPC) refers to as the X Date – daily revenues will be the only means by which Treasury can cover the payments that come due. Since the federal government is running a large deficit, these cash flows will be insufficient to meet all obligations.”

Want more information? Read our short Q&A: Everything You Should Know About the Debt Ceiling.