A New Approach to Federal Lending Program Accounting

A new paper by Donald Marron of the Urban Institute brings a new idea to the table in the debate over accounting methods for federal lending programs. The paper proposes an approach Marron argues corrects the downsides he describes in both current Federal Credit Reform Act (FCRA) budget accounting standards and fair-value accounting. His approach is called "expected returns," and it is a third way that maintains some of the benefits of both approaches.

Simply put, expected returns accounting calculates a yearly expected value on a loan by comparing the government's returns net of defaults to its borrowing costs (interest on the new federal debt that funds the loan). This method, the paper argues, is a more accurate picture of the actual fiscal effects of the loan over many years in contrast to showing the lifetime effect of a loan in one year as FCRA and fair-value do. This presentation allows for the accounting of any taxpayer subsidies over market rates, an important point made by fair-value. Expected returns accounting departs from both approaches by spreading the score over time when net returns or losses are expected.

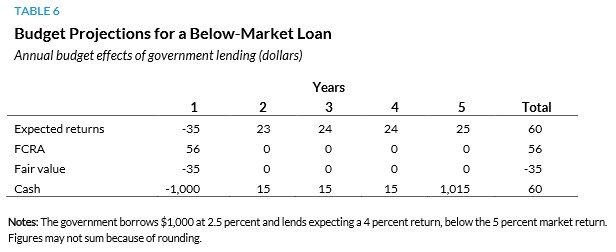

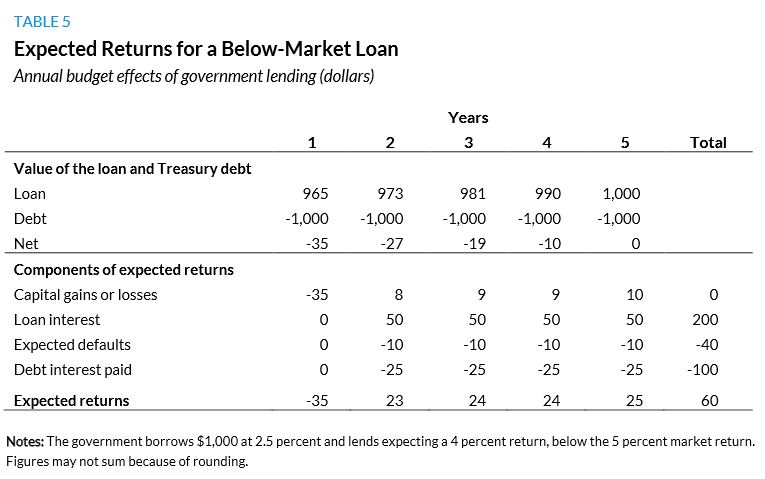

Below is an example of a $1,000 dollar loan at below market interest rates from the paper. The government loses $35 in the first year because the loan is below market rates, but it gains money in later years as its returns exceed borrowing costs.

We have previously written on the differences in the FCRA and fair-value methods and the implications for the federal budget. Because FCRA accounting can show immediate government savings when actual returns may not materialize for many years, that method may help justify new or expanded credit programs which on average are self-financing but riskier, instead of grant programs or other safer alternatives. Fair-value scoring accurately reflects the cost of the subsidy that credit programs create for the recipient, but it has been criticized for being less connected to the actual budgetary effects.

By allowing the loan to appreciate as an asset in the out years as payments become more certain and risk shrinks, expected returns accounting corrects some of the arguable flaws that exist in fair-value accounting. By making sure that the payments back to the government are appropriately accounted over time, it may allow government policy makers to actually value the loan program based on expected monetary flows without resorting to the more wildly fluctuating cash accounting. The breakout of expected returns accounting in this example is reproduced below.

This all being said, Marron's method, while clever, may still result in policymakers making judgments based on a quick glance at a final score of a proposal without considering what will surely result in increased lending by the federal government in year one. The government's assumption of risk deserves some evaluation by policy makers separate from fiscal considerations, a point Marron concurs with:

Policymakers should also devote more attention to the financial risks facing the government. Those risks cannot be shoe-horned into budget projections, and thus they warrant separate attention. It is perfectly reasonable for you to hope that the higher expected returns of investing your 401(k) in corporate debt may allow you to keep your home in retirement. But you should also consider the downside: there is a chance that you will do worse than if you had kept your investments in the money-market fund. Good decision-making requires you to assess that risk and revisit your financial position over time to make course corrections. Federal policymakers should do the same.

An accounting innovation like expected returns could be very valuable for properly accounting for both the subsidy and expected benefits of loan programs. While more research is needed to determine how expected returns accounting would compare to FCRA or fair-value accounting for federal credit programs, Donald Marron’s thoughtful contribution to the ongoing discussion of loan program accounting is welcome.

Related Posts and Additional Reading:

- Is Fair-Value Accounting Fairer?

- Understanding Fair-Value Accounting

- Reassessing a View on Federal Accounting

- The Case for Fair-Value Accounting

- Can Social Security Privatization Guarantee You More Benefits at a Lower Cost?

For additional budget process resources including specific options for reform, visit our Better Budget Process Initiative home page.