Medicare Trustees' Report Shows The Importance of Cost Control Vigilance

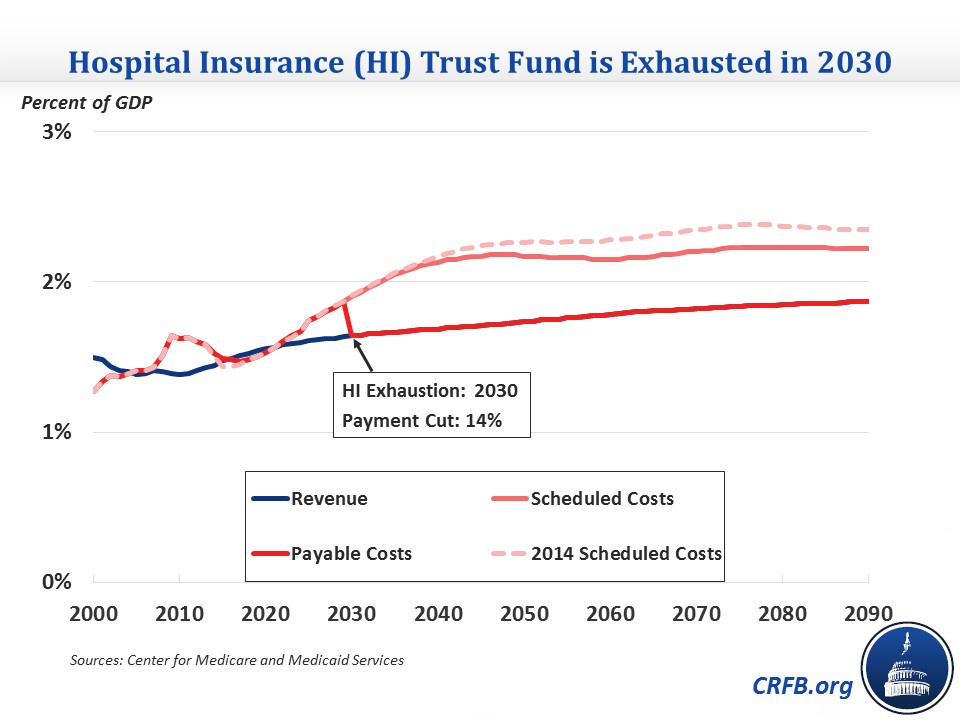

There was plenty of focus on the Social Security Trustees' report yesterday, but the Medicare report, released at the same time, contains very important information and projections as well. The report shows some improvement from last year, despite the incorporation of this year’s “doc fix” legislation for the first time. The Hospital Insurance (HI) Trust Fund for Medicare Part A remains scheduled to become exhausted in 2030, although the shortfall within HI is smaller. Over the longer term, Medicare spending is down due to lower cost growth assumptions.

Hospital Insurance Trust Fund

The HI Trust Fund was projected to become exhausted by 2024 as recently as 2012 and by 2017 in the 2009 report before enactment of the Affordable Care Act (ACA). The improvement in the Trust Fund’s finances since 2009 stems from the combination of the ACA’s Medicare cuts and HI payroll tax increases, the impressive recent slowdown in Medicare spending growth, and a general shift in the health care system from inpatient (covered by the HI Trust Fund) to outpatient care.

While the Trust Fund’s exhaustion date is unchanged, the 75-year actuarial shortfall shrank again this year to 0.68 percent of taxable payroll, down from the 0.87 percent projected in last year’s report, and from 1.11 percent the year before that. This year’s decline stems almost entirely from lower predicted long-range Medicare cost growth, somewhat offset by higher projected enrollment in Medicare Advantage (MA) plans.

Total Medicare Spending

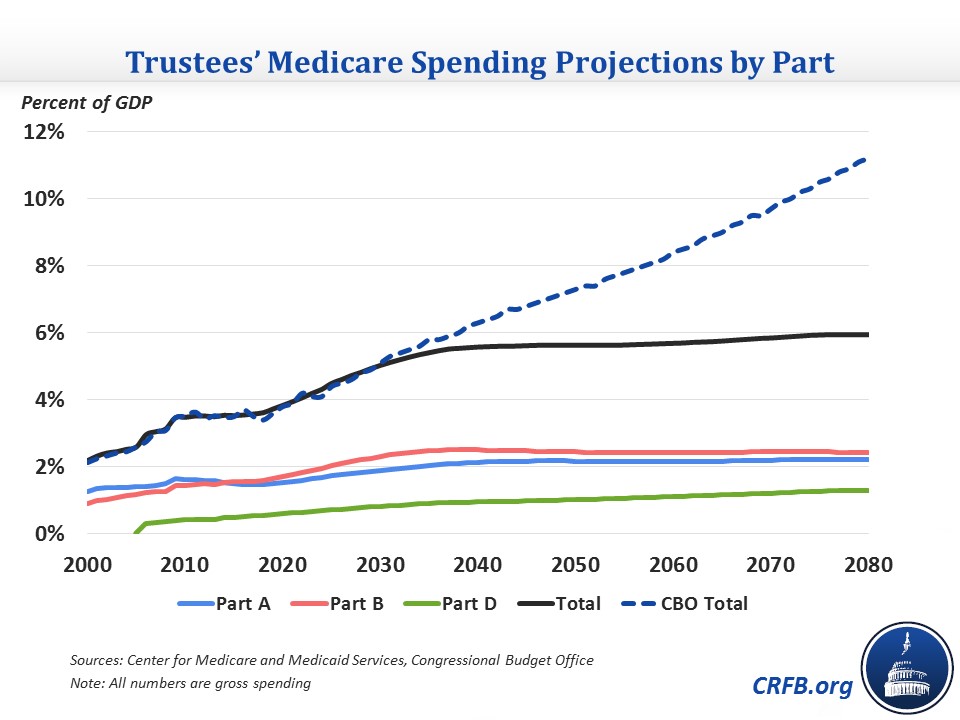

In spite of the recent slowdown, Medicare spending is still projected to grow significantly over the coming decades as a share of GDP, from 3.5 percent of GDP this year to 4.5 percent in 2025, and 5.6 percent by 2040. These totals are similar to CBO's numbers in the short term, although it has higher 2040 spending of 6.3 percent of GDP. That gap continues to widen over the long term due to different assumptions about health care cost growth.

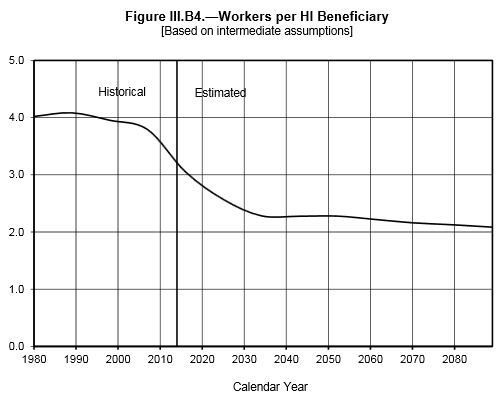

Much of Medicare’s growth over the next 25 years is driven by the retirement and aging of the baby boom generation, adding roughly 10,000 new beneficiaries per day and dropping the ratio of workers to HI beneficiaries from nearly 4:1 in 2000 to 2.4:1 in 2030.

The Part D Slowdown Reverses

As could be expected with the rise of specialty drugs like the new expensive remedies for Hepatitis C, the recent slowdown in Medicare Part D (prescription drug) spending growth came to an abrupt halt in 2014 as per beneficiary costs soared by 10.9 percent.

One interesting takeaway from the report, in part as a result of the projected relatively fast growth in Part D spending, is how the distribution of Medicare spending between its component parts is expected to shift over time.

Part A spending will grow more slowly than Medicare overall, dropping its share of spending from 42 percent this year to 38 percent by 2040. Part B spending, which covers outpatient and physician care, exceeded Part A for the first time last year and will account for about 45 percent of spending over the next 25 years. Part D, though, will grow noticeably from 14 percent to 17 percent of total Medicare spending by 2040 and take up a growing share of spending beyond then.

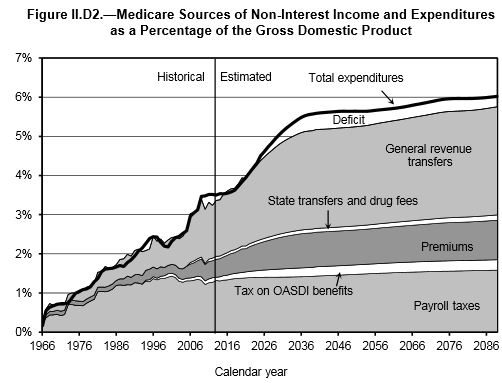

As Part B and D spending makes up a larger portion of Medicare, the payroll tax that finances Part A will become a less important financing source. Medicare as a whole will begin relying more and more on the premiums and general revenue that support Parts B and D.

IPAB Could be Triggered in 2017

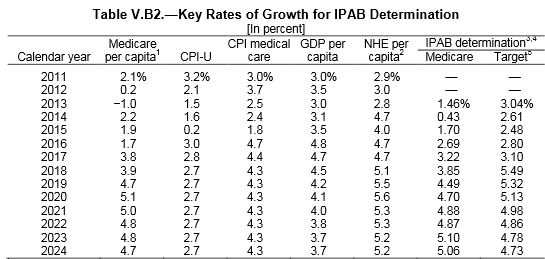

As Medicare spending growth returns toward more normal levels in the coming years, the Independent Payment Advisory Board (IPAB) created by the ACA to control Medicare spending could actually be triggered as early as 2017 (and thus be required to make recommendations in 2018 that would take effect in 2019).

Through 2017, IPAB is triggered if the five-year rolling average (consisting of two years prior, the current year, and the two following years) of per-beneficiary Medicare spending growth exceeds the average of economy-wide inflation (CPI-U) and medical inflation over that same five-year period. After 2017, IPAB’s determination target shifts to the growth rate of GDP plus one percent (GDP+1%), which is generally higher.

Therefore, the Medicare Trustees project IPAB to be triggered in 2017 but not again until 2022. Overall, the Trustees project that IPAB will have to make cuts of about 0.1 percent in 5 of the next 25 years.

The Importance of Remaining Vigilant

While the recent Medicare slowdown and downward revisions to future spending growth have greatly improved America’s fiscal trajectory, lawmakers must still remain vigilant in controlling Medicare’s costs. The program still represents the fastest growing portion of the non-interest budget, projected to increase by 2 percent of GDP over the next 25 years, and many reforms underway may require a watchful eye to ensure their success. As the Trustees note:

The other important factor is that the relatively smaller size of Medicare’s financing gap depends in large part on sustaining ambitious cost-containment provisions under current law whose effectiveness has yet to be fully tested over the long term. Irrespective of whether one supported or opposed the enactment of these provisions, Medicare participants and those with insurance obtained through employers, unions and exchanges share a common stake in their success. If these provisions were to be scaled back or repealed, other more aggressive savings measures would need to be enacted in their place. Because even under current projections Medicare faces a substantial financing gap, we will need all of current law’s cost containment and more to ensure that it remains on a financially secure footing.