IRA Would Lower Medicare Costs, NOT Cut Benefits

Several political advertisements have made misleading attacks that the Inflation Reduction Act (IRA) would cut Medicare spending by $300 billion. In reality, the bill's prescription drug savings would save the federal government nearly $300 billion through 2031 without cutting benefits – and while actually reducing premiums and out-of-pocket costs by nearly $300 billion more. Unfortunately, attacking cost-reduction policies as benefit cuts is a bipartisan tradition; similar misleading attacks were made against President Trump’s sensible Medicare proposals, and these false and misleading attacks make it more difficult to bring health care costs under control.

What’s in the Inflation Reduction Act?

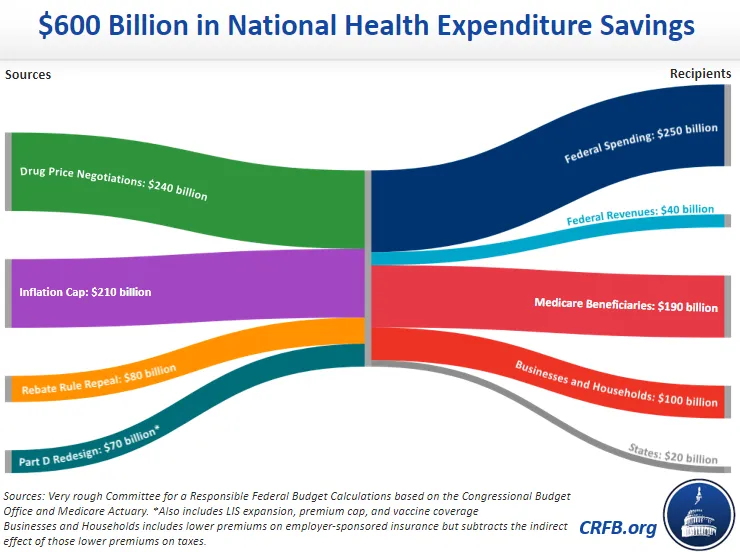

The IRA includes three major policies to lower prescription drug costs, including allowing Medicare to negotiate select prescription drug prices, limiting drug price growth to inflation, and repealing the Trump-era drug rebate rule. These policies would save the federal government roughly $320 billion, with $35 billion of those savings recycled into higher drug spending elsewhere and the remaining $290 billion for deficit reduction and offsets.

While these policies do reduce the cost of Medicare, they do so by lowering prescription drug costs, not by cutting benefits. In fact, we estimate the policies as a whole would improve benefits by lowering premiums and out-of-pocket costs -- including through a $2,000 annual cap on out-of-pocket costs. In addition to saving the government nearly $300 billion, the IRA would save American families nearly $300 billion more. This includes nearly $200 billion of lower premiums and cost sharing for Medicare beneficiaries and another $100 billion in savings for other households and employers. Overall, we estimate the bill would reduce national health expenditures (NHEs) by roughly $600 billion through 2031.1

A Long History of Misleading Medicare Claims

Unfortunately, the claim that lowering Medicare costs amounts to a benefit cut is not new. During the last Administration, President Trump put forward $600 billion of policies to reduce Medicare costs through lower prescription drug and provider costs. Although these common-sense policies would have lowered costs for Medicare beneficiaries, they were attacked and described by political operatives, politicians, and some members of the media as slashing Medicare. While we and other fact-checkers refuted these claims, they, unfortunately, became part of the narrative.

Similar claims were made against President Obama during the debate over the Affordable Care Act and against the late Senator John McCain (R-AZ) during the 2008 election, after each had put forward proposals to reduce Medicare costs without cutting benefits.

Lowering Medicare costs is not the same as reducing benefits. Quite the opposite – many measures to reduce costs for the government would reduce costs for individuals as well.

The Inflation Reduction Act would save Medicare $300 billion and reduce premiums and out-of-pocket costs by another $300 billion. Congress should pass and then build on these common-sense proposals, which can reduce deficits and help the Fed to fight inflation.

1 We estimate these savings primarily by reviewing CBO and CMS actuary analyses of similar policies and assuming a similar distribution of NHE savings for each policy area. Our prior analysis describes these sources in more detail.