How Much Would the Wyden-Smith Tax Deal Cost?

Senate Finance Committee Chairman Ron Wyden (D-OR) and House Ways & Means Committee Chairman Jason Smith (R-MO) recently put forward a bipartisan plan to expand the Child Tax Credit and revive various business tax breaks through 2025, among other changes.

Based on estimates from the Joint Committee on Taxation the tax breaks and cuts in the plan would have a gross cost of $79 billion over a decade and be fully paid for by limiting excessive payments from the pandemic-era Employee Retention Credit (ERC). We recently praised the decision to offset the tax bill’s costs, abiding by and helping to “codify the principle that all policies – including tax cut extensions – must be paid for to avoid adding to the debt.”

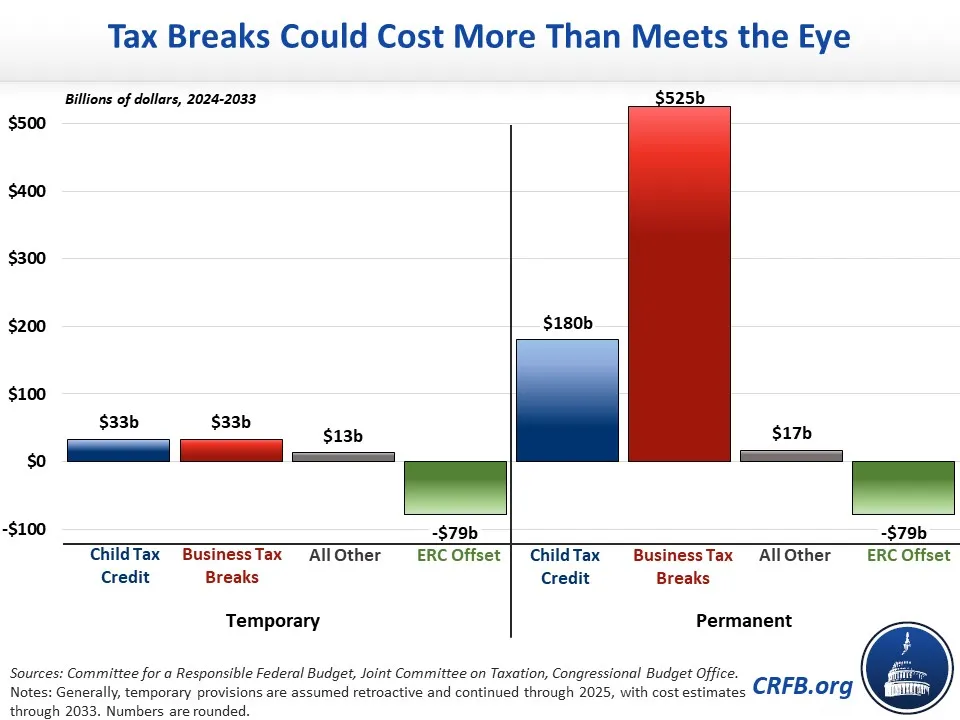

However, the timing-based nature of the corporate tax breaks and inflation indexing of the Child Tax Credit means that the cost of the package is likely understated. Based on our understanding of the package from press reports, the Wyden-Smith package could cost roughly $650 billion over a decade if arbitrary sunsets are abandoned and the policies are made permanent without further offsets. This estimate is rough and is likely to change as further information is made available.

Possible Cost of Announced Tax Package (2024-2033)

| Policy | Through 2025 | Permanent |

|---|---|---|

| Expand Child Tax Credit | $33 billion | $180 billion* |

| Reinstate R&E expensing | $8 billion | $150 billion^ |

| Extend 100% bonus depreciation (full expensing) | $3 billion | $325 billion |

| Delay tighter limit on interest deductibility | $19 billion | $50 billion |

| Increase limitations on expensing of depreciable assets | $2 billion | $2 billion |

| Other tax cuts | $13 billion | $17 billion |

| Subtotal | $79 billion | $725 billion |

| Restrict ERC collection and overpayments | -$79 billion | -$79 billion |

| Total | $0 billion | $645 billion |

Sources: Joint Committee on Taxation, Congressional Budget Office, and Committee for a Responsible Federal Budget estimates. Figures are rough, rounded, and subject to change. Numbers may not add due to rounding. *Cost assumes the TCJA Child Tax Credit expansion is extended separately. ^There is no available estimate for the cost of permanent R&E expensing for domestic investment alone. Assuming proportionality to full R&E expensing could mean costs anywhere between $100 and $200 billion, depending on how proportionality is defined. For this analysis, we assume the halfway point. However, this figure is highly uncertain and subject to change.

The piece below is in part an update to our prior analysis of rumored details of the package.

The Wyden-Smith plan would expand the Child Tax Credit in several ways, including by gradually increasing the cap on how much can be refundable (in excess of taxes paid), by changing the income phase-in to be concurrent rather than consecutive for those with multiple children who are eligible for multiple credits, to allow eligibility based on prior year income, and to index the $2,000 credit to inflation. While the inflation indexing of the base credit and lookback provisions apply only to tax years 2024 and 2025, the other changes would begin retroactively in 2023 and continue through 2025.

Based on the Joint Committee on Taxation’s (JCT) score of the bill, the Child Tax Credit expansion would cost about $33 billion as written. Using our Build Your Own Child Tax Credit tool, we estimate this expansion would cost roughly $180 billion through 2033 if made permanent. Importantly, this estimate assumes the current credit is extended beyond its 2025 expiration but does not account for the cost of that extension.

On the business side, the Wyden-Smith plan would revive three business tax breaks, specifically 100 percent bonus depreciation for business equipment purchases, a looser limit on interest deductibility, and full expensing of research and experimentation costs – though, unlike prior law, only for domestic spending. These provisions would all be continued through 2025. The deal would also permanently increase the limitations on expensing depreciable assets. Again based on JCT’s score, these provisions would cost about $33 billion as written. Because these provisions rely in part on changing the timing of tax payments, costs would be far higher on a permanent basis – we estimate more than $525 billion over a decade.

The deal also includes provisions that improve access to housing, provide more favorable tax treatment to Taiwan, grant assistance to disaster-impacted communities, and increase the threshold for reporting certain income from online payment platforms. These provisions cost an estimated $13 billion over a decade and would likely cost a bit more if made permanent.

To offset the $79 billion cost of the package, the plan would reduce payments from the pandemic-era Employee Retention Credit – a tax credit originally offered to certain businesses who held onto workers during the early parts COVID-19 pandemic, which has recently seen its costs explode due in part to a cottage industry of “COVID-ERC promoters” encouraging taxpayers to apply. Specifically, the legislation would cut off applications for the credit on January 31st of this year as opposed to April 15th of 2025. It would also work to reduce fraudulent payments by increasing penalties on COVID-ERC promoters and lengthening the time the government has to review and assess any claims related to the ERC.

In terms of the tax cuts, the Child Tax Credit expansion and business tax breaks would have similar ten-year costs if truly enacted on a temporary basis. However, the business tax provisions would cost nearly 3 times as much if enacted on a permanent basis. And without further offsets (ERC savings could not be meaningfully ‘extended’), an extension of either or both would add significantly to the already massive federal debt.

It is extremely encouraging that the announced tax deal is paid for to avoid adding to the debt, and that the policy changes are thoughtful and targeted. Hopefully, this package helps to codify the practice that all spending increases and tax cuts – including extensions of Tax Cuts and Jobs Act (TCJA) provisions – are fully paid for. However, there is also a risk that this package will set the stage for future deficit increases by expanding the cost of any TCJA extension.

As CRFB president Maya MacGuineas recently noted:

We need to stop the practice of passing temporary tax and spending policies with arbitrary sunsets that exist only to hide the true costs. Policymakers already face nearly $4 trillion of policy expirations at the end of 2025, and this package would lead this cost to grow massively.

It’s important that policymakers hold onto the mantle of fiscal responsibility, ensuring that any new spending or tax cuts are paid for and pursuing meaningful deficit reduction to address our mounting debt.