How Much COVID Relief Has Been Spent So Far?

Our brand new, state-of-the-art interactive COVID Money Tracker tool follows every dollar authorized and spent by Congress, the Federal Reserve, and the Administration in response to the coronavirus public health and economic crisis.

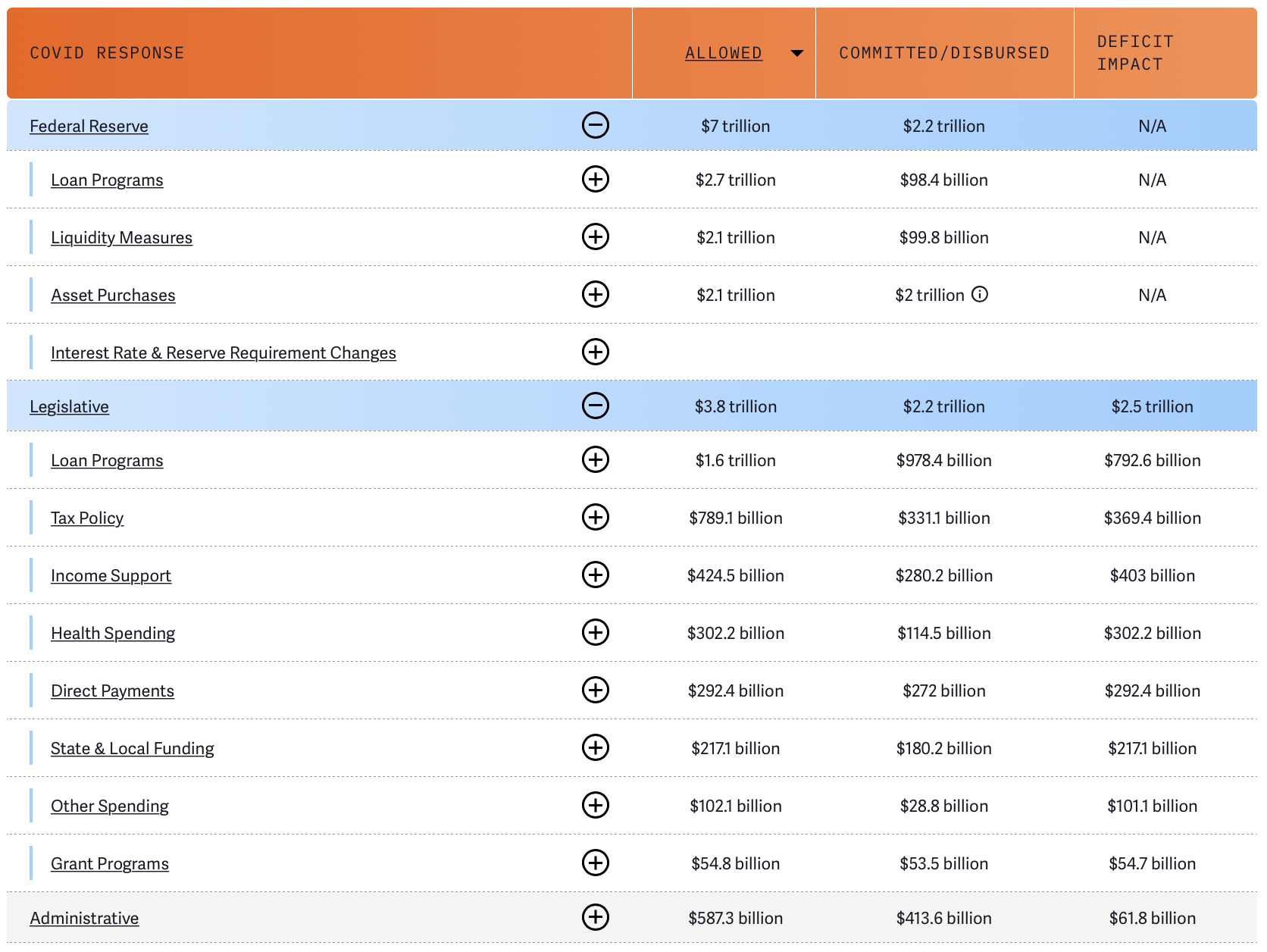

To date, we estimate policymakers have committed trillions of financial support — including $587 billion through administrative actions, $3.8 trillion through legislative actions, and $7.0 trillion through Federal Reserve actions. Approximately $414 billion (70 percent) of administrative support has been committed or disbursed, along with $2.2 trillion (almost 60 percent) of legislative support and $2.2 trillion (over 30 percent) of Federal Reserve support. On net, we estimate these measures will increase ten-year deficits by $2.6 trillion.

The $2.2 trillion of legislative support already committed or disbursed includes, by our estimates, $532 billion in forgivable loans and related bank fees from the Paycheck Protection Program (PPP), $272 billion in Economic Impact Payments, $242 billion in unemployment benefits, $195 billion to support Federal Reserve loan facilities, $180 billion in state and local funding, $164 billion in Economic Injury Disaster Loans, $159 billion in temporary relief from allowing employers to defer payroll tax payments, $114 billion in health-related spending, $113 billion in payroll tax credits for paid leave and employee retention, and roughly $270 billion in other spending, loans, and tax breaks.

Of the $1.6 trillion of uncommitted legislative funds, approximately $637 billion comes from loan programs. So far, the Federal Reserve has only tapped $195 billion out of $454 billion available to establish emergency lending facilities. Meanwhile, small businesses claimed only $532 billion of the $670 billion made available in forgivable loans through the Paycheck Protection Program – which is now closed – and $164 billion out of $366 billion available through the Economic Injury Disaster Loans (EIDL) program – which continues to offer loans.

Another $458 billion of undisbursed funds can be attributed to tax policies. Most of these tax breaks and deferrals began in April and will last through the end of the year. Therefore, we anticipate funds will continue to be disbursed gradually as taxpayers file taxes and claim refunds. However, data limitations make it difficult to track disbursements from certain business tax cuts in real time.

Similarly, expanded unemployment benefits (apart from the $600 supplement) and other income support programs are set to continue through the end of the year or beyond — which explains why $145 billion of income support has not yet been disbursed. About $188 billion set aside for health provider grant programs and health spending also appears to be uncommitted — either because policymakers have yet to distribute it or the data is not yet available.

You can track these and other programs and policies through our new interactive COVID Money tracker tool, which will be updated regularly.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.