GAO Releases Long-Term Budget Outlook

The Government Accountability Office (GAO) recently published its latest report on the nation’s long-term fiscal outlook. Once again, GAO warns that the nation’s fiscal path is unsustainable and stresses the need for policymakers to refocus on implementing reforms that would place the nation on a sustainable fiscal path once the pandemic recedes and the economy recovers.

As GAO explains, the federal government’s response to the COVID-19 pandemic added significantly to what was already a high and rising national debt. Last year, debt held by the public surpassed the size of the economy for the first time since the period following World War II.

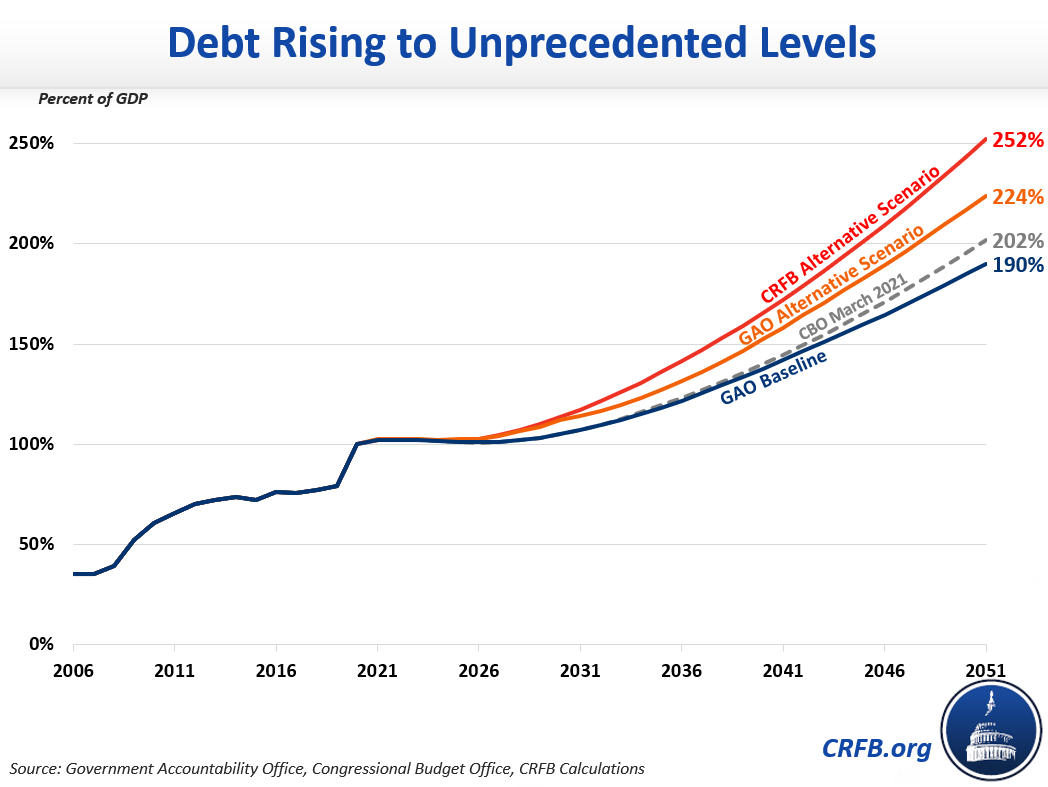

Over the next ten years, under its baseline scenario, GAO projects debt will grow at the same rate as projected by the Congressional Budget Office (CBO) under its comparable current law baseline, reaching 107 percent of Gross Domestic Product (GDP) by 2031. From there, GAO estimates debt will grow at a slightly lower rate relative to CBO’s projections, reaching 190 percent of GDP by 2051. This is 12 percentage points lower than projected by CBO in its latest long-term budget outlook.

Under GAO’s more realistic “alternative scenario” – which assumes higher Medicare spending levels, extension of certain temporary tax cuts, and a return to historic average levels for revenue, discretionary, and other mandatory spending – GAO projects debt will reach 224 percent of GDP by 2051. Our alternative scenario – which has assumptions that differ significantly from GAO’s – projects that debt will reach 252 percent of GDP by 2051.1

Importantly, none of these estimates incorporate the recently enacted American Rescue Plan (ARP), which is projected to cost $1.9 trillion over the next ten years. Our most recent projections show that the ARP would increase debt-to-GDP by 5.6% in 2031 and similar amounts thereafter.

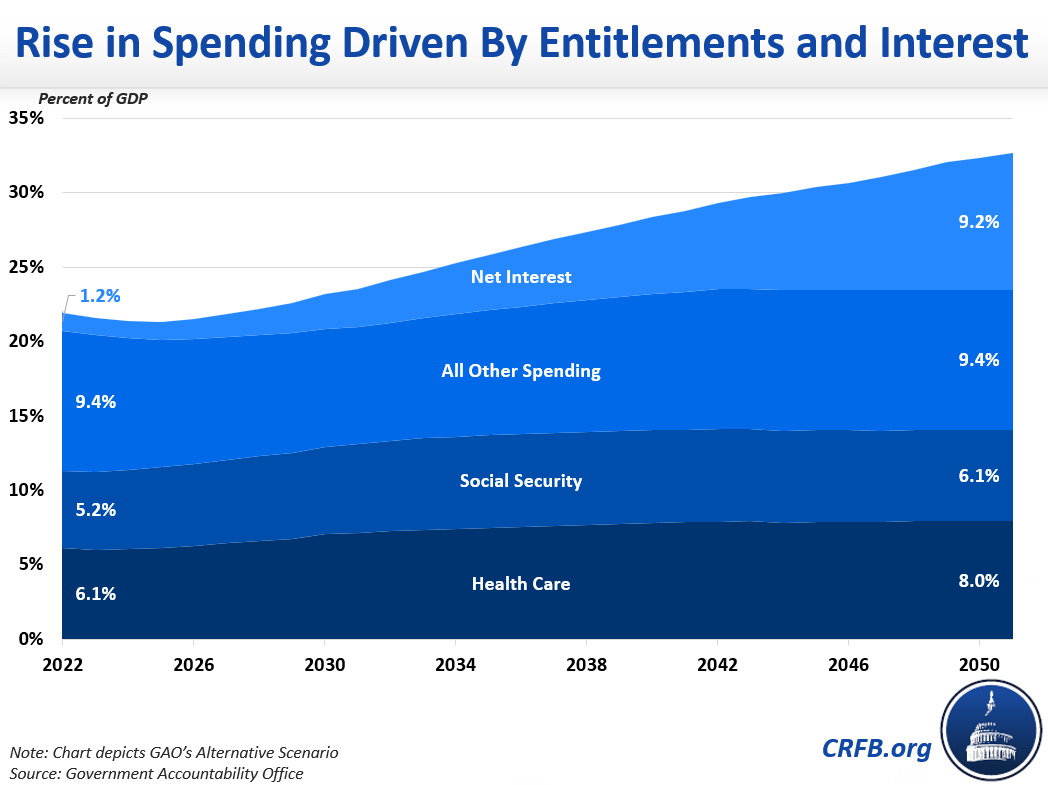

GAO notes that growth in spending on major health care programs and Social Security will account for all of the growth in non-interest spending over the long term, as a percentage of GDP. Under its alternative scenario, health care spending is projected to increase from 6.1 percent of GDP in 2022 to 8.0 percent in 2051, while Social Security would grow from 5.2 percent of GDP to 6.1 percent over the same time period. Meanwhile, all other non-interest spending would decrease from 9.4 percent of GDP in 2022 to a low of 7.8 percent in 2031, before rising back again to 9.4 percent by 2051.

As debt increases, interest costs will also grow. GAO estimates that spending on net interest will increase from 1.2 percent of GDP in 2022 to 9.2 percent in 2051. After 2043, interest is projected to overtake Social Security, becoming the largest category of spending in the federal budget.

Absent any action, GAO warns that rising debt could restrain policymakers’ capacity to respond to future economic downturns and unforeseen emergencies. In addition, high and rising federal debt increases the likelihood of a fiscal crisis.

As the rate of vaccinations accelerates and the economy rebounds, GAO urges Congress and the administration to focus on implementing a long-term strategy to return the nation to a sustainable fiscal path. Helpfully, the report includes some recommended policy options and process reforms for policymakers to consider.

For instance, GAO strongly suggests that Congress and the Internal Revenue Service (IRS) take action on multiple fronts to address the tax gap – the annual gap between federal taxes owed and taxes collected – which has remained on GAO’s “High-Risk List” since its inception in 1990.

GAO identifies several other ways that executive agencies can contribute to improved fiscal health, including reducing improper payments, reducing program overlap and duplication, and improving information on agency finances.

Besides reforms to policy, GAO argues that existing fiscal rules, such as statutory Pay-As-You-GO (PAYGO) or discretionary spending caps, are insufficient and that stronger ones may ultimately be needed to achieve lasting fiscal sustainability. GAO suggests several process reforms that were previously identified in its September 2020 report, The Nation's Fiscal Health: Effective Use of Fiscal Rules and Targets. These rules and targets include concepts such as balanced budget requirements, spending ceilings, revenue floors, and debt-to-GDP ratio targets.

GAO concludes its report by emphasizing that its recommendations should not be viewed as stand-alone solutions that would put the United States back on a sustainable fiscal path if implemented alone, but rather as steps in a process that will eventually make federal spending programs more efficient and revenue collection more effective. To truly address our fiscal challenges, policymakers will ultimately have to make difficult decisions about how to reduce deficits.

1 CRFB’s alternative budget scenario assumes that all individual tax cuts in the 2017 Tax Cuts and Jobs Act are extended, that all temporary tax extenders are extended, and that discretionary spending grows with GDP. Unlike in GAO’s alternative scenario, we do not assume that certain categories of mandatory spending, discretionary spending, and revenue revert to historical average levels after the initial ten-year budget window, nor do we assume a change in the trajectory of Medicare spending. These differences in underlying assumptions explain the significant difference between our alternative scenario estimate for debt in 2051 and GAO’s.