GAO Recommends Actions to Reduce Tax Gap

The Government Accountability Office (GAO) recently released revised recommendations for the Treasury Department and the Internal Revenue Service (IRS) to narrow the “tax gap” – the difference between taxes owed to the federal government each year and the amount actually collected.

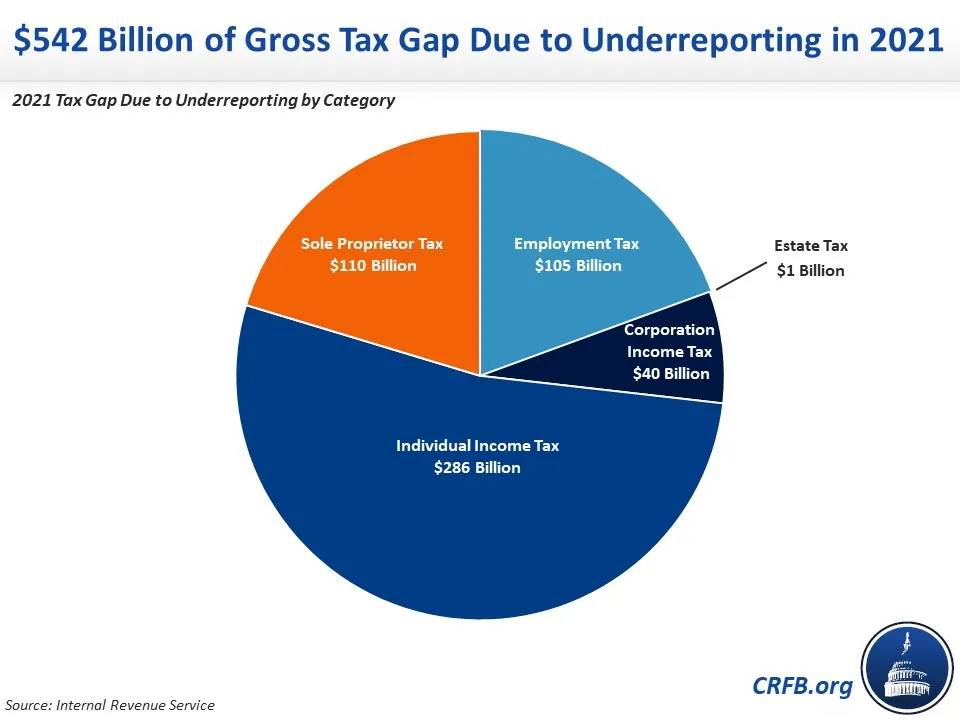

The report focuses on underreported income by sole proprietors, someone who owns an unincorporated business and is exclusively entitled to all profits and responsible for all losses. Using IRS data, GAO shows that underreporting from sole proprietorships accounted for 16 percent of the total $496 billion average gross tax gap between 2014 and 2016. Most recently, for tax year 2021, the IRS estimates a net tax gap of $625 billion, or $688 billion gross tax gap, with sole proprietor underreporting still accounting for 16 percent of the gap and a similar breakdown of other contributing factors compared to the 2014-2016 tax years referenced by GAO. GAO projects that $542 billion of the gross tax gap in 2021 was due to underreporting.

GAO offers various options to improve sole proprietor tax compliance, falling into four categories:

- Education and Outreach: Use modern channels for education, aid first-time filers, increase the number of informational notices, and clarify worker classification criteria to enhance compliance through proactive communication.

- Administrative Actions: Require separate business accounts, redesign forms, include more direct questions about cash transactions, implement voluntary tax withholding, and offer a standard business deduction to simplify reporting and encourage accuracy.

- Leverage Data: Enhance reporting mechanisms, access third-party transaction data, and improve IRS access to state-level data to increase transparency and accuracy.

- Improve Technology: Optimize deduction matching, expand the Return Review Program, and use technology to enhance costumer service to streamline processes, enhance accuracy, and provide better support.

Importantly, GAO specifies that these options should be considered as part of a comprehensive strategy to narrow the tax gap – though GAO notes IRS has yet to take steps on previous recommendations and that Treasury has no current plans to develop a strategy.

Reducing the tax gap remains one of the most effective means of boosting revenue without increasing tax rates, and it has a long history of bipartisan support. Congress should maintain the IRS’s funding to further reduce the tax gap and work with the executive branch on a comprehensive strategy to do so – including measures that improve compliance from sole proprietorships.