Event Recap: Gene Steuerle Explains How the Budget Offices Can Reframe Our Long-Term Budget Problems

At the Savings and Retirement Foundation’s December meeting, Gene Steuerle, Urban Institute Fellow and CRFB Board Member, presented his recent paper, “How Budget Offices Should Reframe Our Long-Term Budget Problems.” Steuerle advocated for the Congressional Budget Office (CBO) and Office of Management and Budget (OMB) to creatively reframe budgetary information in order to improve how policymakers view the impact of their decisions. Rather than viewing their numbers in terms of changes from a baseline, Steuerle expressed hope that his proposals might bring a long-term perspective into budgetary decision-making.

Steuerle drew from his book, Dead Men Ruling, to begin his presentation, arguing that poor budgetary policy and political brinkmanship have led to a situation where spending exceeds revenue on a long-term basis. From the pre-WWII-era to the 1970s, spending was usually lower than revenue over the long term. From the 1980s onward, however, actual and projected government spending began to exceed revenue, thus causing the structural debt problem we see today.

The growth of automatic spending programs, specifically Social Security and Medicare, are the cause of the long-term imbalance in the budget going forward. Steuerle cited his recent paper with CRFB President Maya MacGuineas, noting that 150 percent of new revenue in 2026 is already committed to scheduled spending growth in automatic programs under current law. While that paper diagnosed the problem of the “lame duck presidency” assuming office in 2017, Steuerle used this discussion to outline a solution that uses a long-term perspective to provide a picture of the incremental steps made while budgeting.

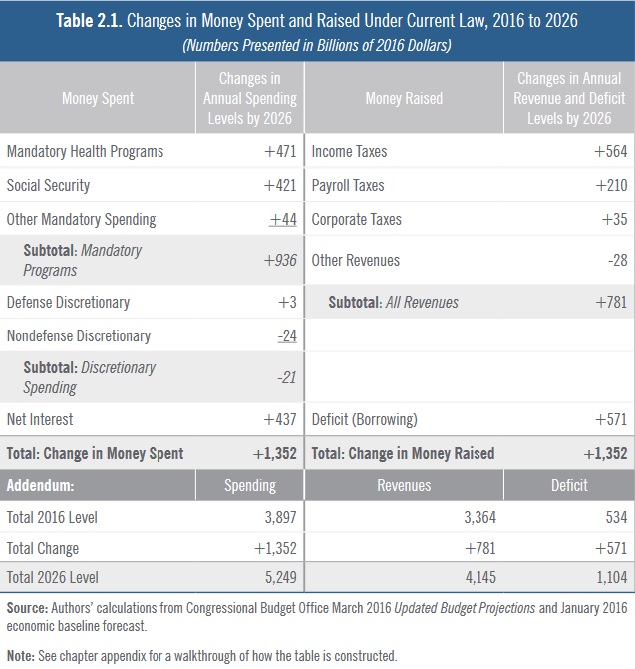

In addition to the way information is currently presented, Steuerle proposed that the CBO and OMB develop a table that presents the entire balance sheet by highlighting changes in the current levels of spending and the inflation-adjusted impact of those changes. Steuerle presented the table below in order to show what this table might look like.

Source: Bipartisan Policy Center, “How Budget Offices Should Reframe Our Long-Term Budget Problems,” 25.

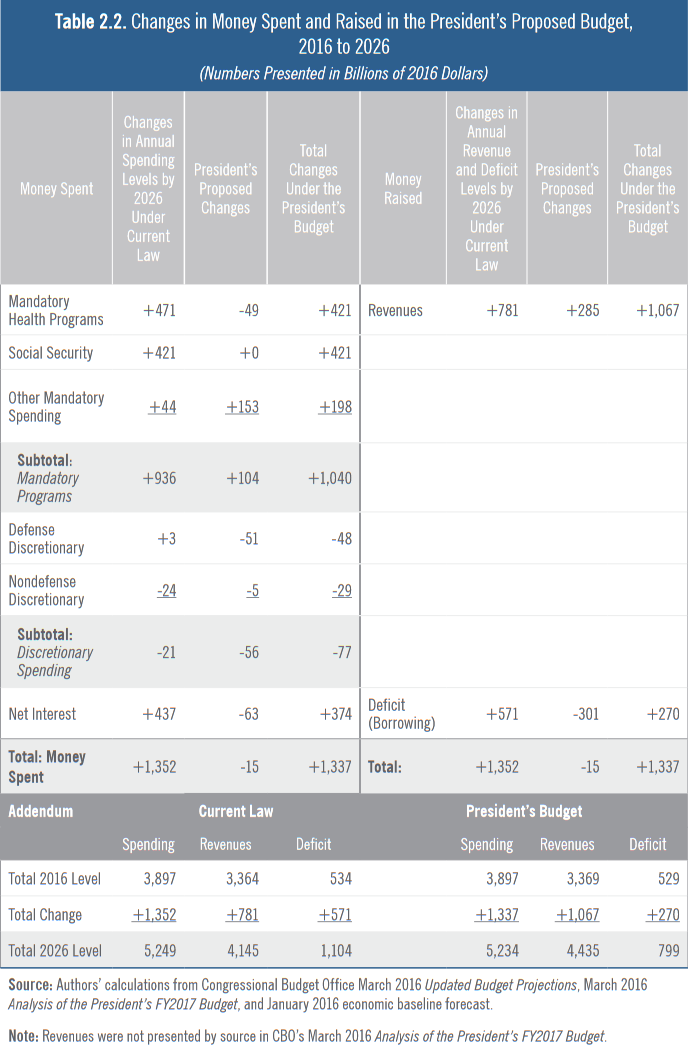

This type of presentation can be used to analyze major budget proposals, like the President's budget in the example below.

Source: Bipartisan Policy Center, “How Budget Offices Should Reframe Our Long-Term Budget Problems,” 30.

The table above shows how the President’s proposed budget relates to the spending and revenue that is already being built into the system. Steuerle expressed hope that this table's information would force Congress and the President to be accountable for their spending and revenue decisions by clearly highlighting where budget priorities lie.

Steuerle argued that the CBO and OMB need to use different accounting measures in order to develop these tables and bring the long-term budget into policy deliberation. First, Steuerle emphasized that decision-makers should use a universal price index to make their budgeting decisions, not an index that benefits their favorite programs. Second, Steuerle emphasized the need for the CBO to stop accounting in nominal terms and start using real increments. Third, Steuerle argued that there should be no on- or off-budget programs. Instead, automatic spending programs should be lumped into the budget’s baseline, because off-budget, automatic programs often have on-budget consequences or face similar economic and demographic trends as on-budget programs.

Steuerle’s paper included other recommendations, such as creating a table that shows the growth of real spending from tax expenditures and creating a health budget to track health spending. Steuerle briefly mentioned these proposals before opening the floor for discussion.

Audience members asked Steuerle why this proposal has not yet been implemented and whether his proposal was a type of incremental, zero-based budgeting. Steuerle commented that he thinks many policymakers do not have access to this specific information, and he hopes that someone at the CBO or OMB might begin to implement his proposal. He also noted that his proposal is an incremental change and not an example of zero-based budgeting, because it sets a base and then looks at the incremental changes from that base.

While some audience members voiced concerns that this way of presenting the data does not adequately separate programmatic spending from general spending, Steuerle commented that Social Security does not have any way to adjust for demographic changes. The problems facing Social Security result from demographic and workforce changes, and these problems require more holistic solutions that will address the challenges facing Social Security. Steuerle concluded by expressing hope that his proposal will highlight the structural problems facing Social Security and the budget and spark interest in reform.

***

We commend Steuerle for his thoughtful and timely contribution to the budget debate. For more information on reforming the budget process and the presentation budget data, please see our Better Budget Process Initiative.