The Economic Outlook in CBO's New Budget Baseline

CBO's new budget baseline released yesterday relies on its own economic projections over the next decade. After comparing their economic projections to their August projections, we can clearly see the effects of avoiding the fiscal cliff. We and most others predicted that going over the cliff would result in a huge hit to economic performance, one that would send us back into a recession in 2013 with a great deal of deficit reduction implemented much too quickly.

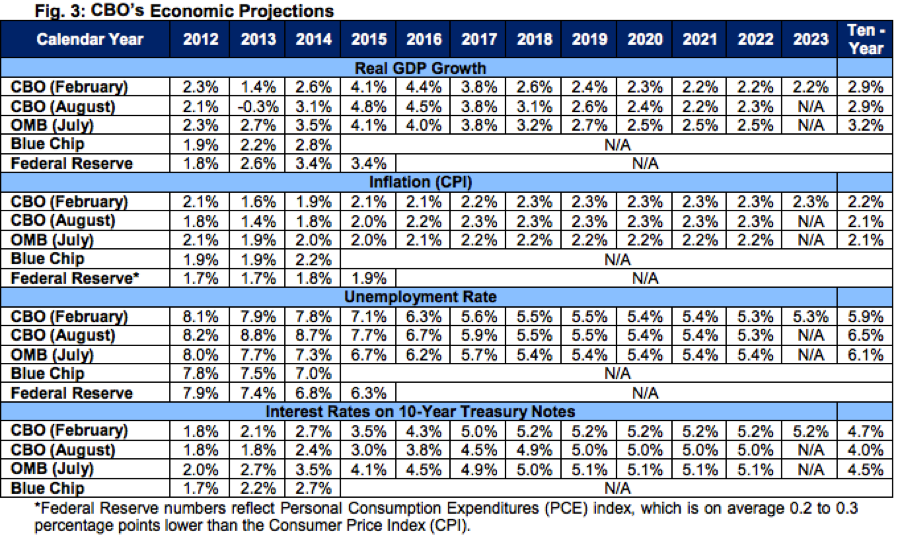

This new baseline, coming shortly after the enactment of the American Taxpayer Relief Act (ATRA), projects that in the short-term the economy will perform better than previously projected, but will grow slightly slower at the end of the decade as a result of higher debt levels. Highlights in the economic projections included:

- Economic growth (measured by real GDP) is expected to be better than projected in August, at 1.4 percent in 2013 compared to a 0.3 percent decline under the August projections. Note that these projections assume the sequester goes off, which holds growth in the first half of the year to under one percent. However, if the sequester were replaced, growth could be 2 percent for the year, according to CBO multipliers. After that, CBO projects that economic growth will pick up and will fully close the output gap by 2017, a year earlier than they estimated in August.

- By 2023, economic growth is projected to be 0.1 percent lower than the August projection, at 2.2 percent, with higher debt levels likely crowding out investment.

- Unemployment rate estimates in the near term are better than August. For 2013, it went down to 7.9 percent compared to 8.8 percent in August. It will however remain relatively high in the short and medium term, not getting much below 8 percent through 2014, until it steadily declines to 5.6 percent by 2017.

- Inflation will remain generally low around 2 percent, leveling out at 2.3 percent per year at the end of the decade.

- Interest rates on 10-year Treasury bonds will rise from about 2 percent today to 5.2 percent later in the decade, higher than August's estimates, possibly showing the impact of the additional debt resulting from ATRA.

The summary table below from our paper on the report compares CBO's newest economic forecast to its August forecast and other projections.

It is important to note that current projections are based on current law, meaning they incorporate the assumption that sequestration would begin in March. Sequestration would involve sharp and untargeted cuts to domestic and security spending, causing greater economic harm than a phased-in, deliberative debt reduction plan.

CBO's economic projections remind us that lawmakers need to consider minimizing any negative impact on the economy when they look to bring our federal budget under control. Timing is important, lawmakers can delay much of the savings until later in the decade when the economy has had more time to recover. In the short term, even announcing a plan would provide certainty and confidence for businesses to invest, spurring needed economic growth. If a comprehensive plan enacts pro-growth reforms, the effect could be even greater. But the cost of doing nothing is too great for lawmakers to wait any longer.

Click here to read our analysis of the CBO report.