Donald Trump Releases Huge Tax Plan

Republican presidential candidate Donald Trump announced his tax reform plan yesterday to lower tax rates and simplify the tax code with the goal of promoting economic growth. It cuts taxes for both individuals and businesses, lowering tax rates across the board and eliminating the income tax for some people while scaling back or eliminating some tax preferences and changing international taxation to offset some of that cost. The campaign has stated that the plan will be revenue-neutral, though three outside organizations have provided estimates of the plan, which could cost as much as $12 trillion.

Individual Income Tax Reform

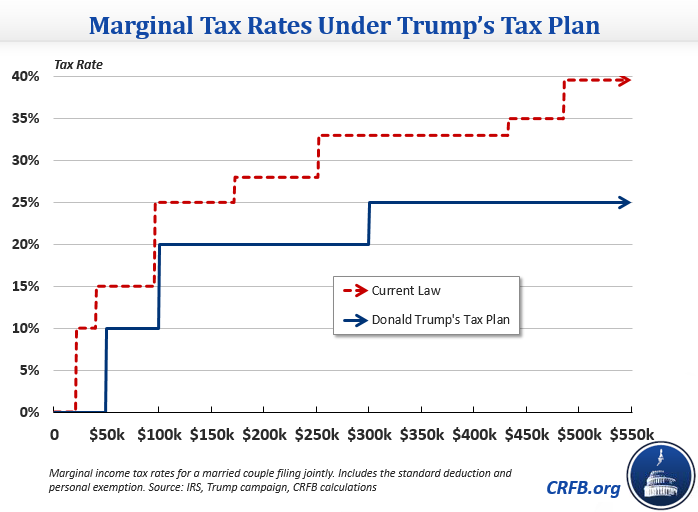

On the individual tax side, Trump's plan would reduce the number of tax brackets from seven rates ranging from 10 percent to 39.6 percent down to three rates of 10, 20, and 25 percent so that nearly every taxpayer would face a lower marginal tax rate. This is similar to but more aggressive than Gov. Bush's plan to reduce rates to 10, 25, and 28 percent.

In addition to the lower rates, the plan includes several other tax cuts, including:

- Repeal of the Alternative Minimum Tax (AMT)

- Repeal of the estate tax

- Elimination of the Medicare surtax, reducing the top rate on capital gains from 23.8 to 20 percent

- Taxing pass-through businesses (which currently pay at individual tax rates) at 15 percent

- Elimination of income tax liability for single people making below $25,000 and couples below $50,000

- Elimination of the marriage penalty (and increasing marriage bonuses)

To offset these tax cuts, the plan relies on mostly unspecified reductions in "deductions and loopholes available to the very rich." It does specify two tax breaks to pare back – carried interest and the tax exemption for life insurance interest. The plan also discusses one way to reduce preferences – by expanding the Personal Exemption Phase-out (PEP) and the Pease limitation on itemized deductions. Although other details are unspecified, the plan says that those in the 10 percent bracket will keep "all or most" of their deductions, those in the 20 percent bracket will keep "more than half" of their current deductions, and those at the top rate will keep "fewer" deductions. The plan also says that the mortgage interest and charitable deductions will remain unchanged.

Eliminating those two breaks and even dramatically scaling back deductions for those in the top two tax brackets would not raise nearly enough to pay for the trillions in lost revenue from the rate reductions.

Corporate Income Tax Reform

On the corporate side, the plan would cut the top corporate rate from 35 percent to 15 percent, a rate that would apply to both corporations and small "pass-through" businesses.

To help finance these costs, the proposal calls for several changes. First, it would shift to a "worldwide" system of taxation, where American companies would owe tax on their overseas earnings that were taxed at less than 15 percent in the year earned, instead of the current system where earnings generally defer U.S. taxes until they are brought back to the U.S.

The plan would also reduce or eliminate unspecified "corporate loopholes that cater to special interests." However, it's worth noting that even repealing all corporate tax expenditures cannot pay for reducing the rate that much. Using the numbers from our Corporate Tax Simulator, even repealing all corporate tax deductions is only enough to reduce the rate to about 27 percent. Next, the plan would also introduce a "reasonable cap" on the current deduction for interest expenses. Although this deduction is not a tax expenditure, limiting it can reduce incentives for companies to over-leverage.

Finally, during the transition to a worldwide system, the plan would include a one-time deemed repatriation tax of 10 percent on these companies' existing overseas earnings. The international changes of a 15-percent worldwide tax and 10-percent repatriation are similar, though with a lower rate, to President Obama's budget, which proposed a 19-percent minimum tax and 14-percent repatriation tax.

Revenue Impact

The plan states clearly that it is revenue-neutral and doesn't add to our debt and deficits. However, this assertion seems highly unlikely given the details provided. Although not all details are available, two different organizations made estimates using available information and concluded the plan would cost between $10 and $12 trillion in lost revenue over ten years.

The right-leaning Tax Foundation found the plan would reduce federal revenues by almost $12 trillion on a static basis, and $10.1 trillion after they account for a (very generous) projected 11 percent increase in Gross Domestic Product (GDP). (Note: this increase assumes the tax reductions would be fully paid for so would not add to the debt). In a separate estimate which excludes the possible economic impact, the left-leaning Citizens for Tax Justice found the plan would reduce revenues by $12 trillion. A third estimate from the the Tax Policy Center found that the plan would cost $9.5 trillion over ten years.

| Economic and Revenue Analysis of Trump's "Tax Reform That Will Make America Great Again" | |||

| Tax Foundation | Citizens for Tax Justice | Tax Policy Center | |

| Revenue Impact | Ten-Year Cost | ||

| Conventional Score (no economic growth) | $11.98 trillion | $12 trillion | $9.5 trillion |

| Dynamic Score | $10.14 trillion | N/A | N/A |

| Economic Growth from Tax Reform Alone | |||

| Increase in GDP by the 10th Year | 11.5% | N/A | N/A |

| Average Increase in GDP over the next 10 years | 5.75% | N/A | N/A |

Source: Citizens for Tax Justice, Tax Foundation, Tax Policy Center, CRFB calculations for average growth

Importantly, these estimates might overstate the cost of the plan since they may not account for many of the unspecified revenue-raisers alluded to in existing material. However, even if the plan were extraordinarily aggressive with regards to unnamed tax preferences, it would likely still increase deficits tremendously – probably well more than Gov. Bush's plan, which would lose between $1.2 to $7.1 trillion over a decade.

Conclusion

It is encouraging to see a prominent presidential candidate endorsing tax reform and acknowledging on paper that a plan should not add to deficits and debt, but the details so far released suggest the plan would instead hugely increase the debt. Indeed, assuming an $11 trillion cost (before interest) and no other changes, debt would grow from 74 percent of GDP today to somewhere around 125 percent by 2025– well above current projections of 77 percent.

Hopefully the campaign will revise the plan and provide more details to ensure it meets their stated goals of deficit-neutrality and then will couple this revised plan with serious spending cuts and/or other revenue to put the debt on a downward path relative to the economy.

Update: This blog was updated to reflect a new static score of $12 trillion from the Citizens for Tax Justice, revised upward from their previous score of $10.8 trillion to include the Trump plan's 15 percent pass through rate. This blog was updated again to reflect a new $9.5 trillion static score from the Tax Policy Center.