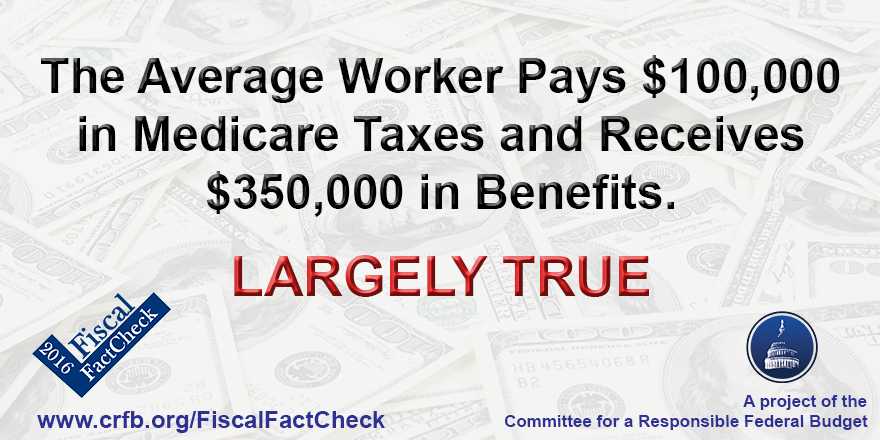

Does the Average Worker Pay $100,000 in Medicare Taxes and Receive $350,000 in Benefits?

Sen. Rand Paul (R-KY) said during the debate that the average worker will pay $100,000 in Medicare taxes and receive $350,000 in benefits. According to Eugene Steuerle and Caleb Quakenbush of the Urban Institute, this will basically be true for a person retiring in 2040; an average male earner would pay $100,000 in taxes and receive $367,000 in benefits, and an average female earner would pay $100K in taxes and receive $417,000 in benefits.

The ratios are similar, though the numbers are smaller, for people turning 65 today. The average male earner pays $70,000 in taxes and receives $195,000 in benefits, while the average female earner pays $70K in taxes and and receives $227,000 in benefits.